In today’s fast-paced world, many men find themselves juggling demanding careers, family responsibilities, and personal commitments, leaving little room for complex financial analysis. The idea of investing can seem daunting, leading to procrastination or analysis paralysis. However, building wealth doesn’t require hours of stock picking or market timing. For the busy man, the most effective investment plan is often the simplest and most automated.

Why Simplicity is Key for Busy Men

Time is a precious commodity. Attempting to outperform the market or engage in active trading requires significant research, monitoring, and emotional resilience – resources that busy men simply don’t have in abundance. A complex strategy can quickly become overwhelming, leading to abandonment or poor decisions driven by market noise. A simple plan, on the other hand, minimizes decision fatigue, reduces stress, and maximizes the power of consistency and compounding over time.

The Core Pillars of Your Simple Plan

An effective, low-effort investment strategy for busy individuals rests on four fundamental principles:

- Automation: Set it and forget it. Automate your contributions to ensure consistency.

- Low Cost: High fees erode your returns over the long run. Choose investments with minimal expense ratios.

- Diversification: Don’t put all your eggs in one basket. Spread your investments across many companies and asset classes.

- Long-Term Focus: Resist the urge to react to short-term market fluctuations. Investing is a marathon, not a sprint.

Step-by-Step Action Plan

Here’s how to implement a straightforward, actionable investment plan:

- Open the Right Accounts: Start with tax-advantaged accounts like a 401(k) through your employer (especially if there’s a company match – free money!) or a Roth IRA/Traditional IRA. Once those are maxed out, consider a taxable brokerage account.

- Automate Your Contributions: Set up an automatic transfer from your checking account to your investment account on payday. Even small, regular contributions add up significantly over decades.

- Choose Broad Market Index Funds or ETFs: These are baskets of hundreds or thousands of stocks or bonds that track a specific market index (e.g., S&P 500, total U.S. stock market, total international stock market). They offer instant diversification and typically have very low fees.

Recommended Vehicles: Index Funds & ETFs

For the ultimate in simplicity and effectiveness, consider these options:

- Total Stock Market Index Fund/ETF: Invests in virtually every publicly traded U.S. company. Examples: VTSAX (Vanguard Total Stock Market Index Fund Admiral Shares) or ITOT (iShares Core S&P Total U.S. Stock Market ETF).

- S&P 500 Index Fund/ETF: Tracks the performance of the 500 largest U.S. companies. Examples: VFIAX (Vanguard 500 Index Fund Admiral Shares) or SPY (SPDR S&P 500 ETF Trust).

- Total International Stock Market Index Fund/ETF: Provides exposure to companies outside the U.S. Examples: VTIAX (Vanguard Total International Stock Index Fund Admiral Shares) or IXUS (iShares Core MSCI Total International Stock ETF).

- Target-Date Funds: If you want extreme simplicity, these funds automatically adjust their asset allocation (stocks vs. bonds) as you get closer to a specific retirement year. Be mindful of their expense ratios.

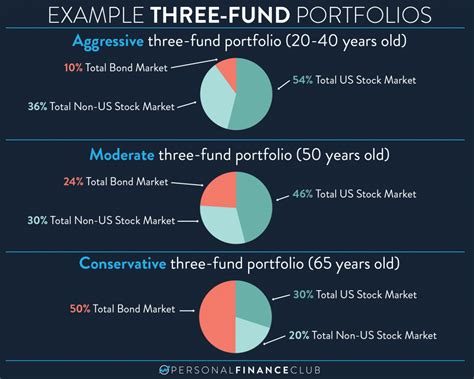

A common, highly effective strategy is to invest in just two or three funds: a U.S. total stock market fund, an international total stock market fund, and perhaps a bond fund as you approach retirement or if you desire less volatility.

Set It and Forget It (Mostly)

Once your automated contributions and fund selections are in place, the primary work is done. Resist the urge to constantly check your portfolio or make frequent changes. Market fluctuations are normal; panic selling is a wealth destroyer. Rebalancing your portfolio once a year or every few years (e.g., selling some overperforming assets to buy more underperforming ones to maintain your target allocation) is usually sufficient. This minimalist approach allows busy men to focus on their lives while their money quietly works for them.

Conclusion: The Power of Consistency

The simplest actionable investment plan for busy men isn’t about finding the next hot stock or timing the market. It’s about consistency, automation, low costs, and a long-term perspective. By setting up automatic contributions into broadly diversified, low-cost index funds within tax-advantaged accounts, you can build substantial wealth over time with minimal effort. This strategy frees up your valuable time and mental energy, allowing you to focus on what truly matters in your life, confident that your financial future is in capable (and automated) hands.