The eternal financial question for many individuals is whether to aggressively tackle debt or funnel extra cash into retirement accounts. Both strategies offer significant benefits, but choosing the right path depends heavily on your unique financial situation, risk tolerance, and long-term goals. There’s no one-size-fits-all answer, but by understanding the merits of each approach, you can make an informed decision.

The Case for Aggressive Debt Repayment

For many, the idea of being debt-free is incredibly appealing. Aggressive debt repayment, especially for high-interest debts like credit cards or personal loans, can provide immediate and tangible benefits. Each payment reduces your principal, lowering the total interest you’ll pay over time and freeing up future cash flow.

Emotionally, shedding debt can be a huge relief, reducing financial stress and opening the door to greater financial freedom. Mathematically, paying off debt with an 18-25% interest rate is often a guaranteed return on investment that’s hard to beat in the market.

- Guaranteed Return: The interest rate on your debt is essentially the “return” you get by paying it off. Eliminating a 20% interest rate is like earning a guaranteed 20% on your money.

- Reduced Financial Stress: Less debt often means less anxiety and a stronger sense of security.

- Improved Cash Flow: Once debt payments are gone, that money becomes available for other goals, including investments.

The Case for Maximizing Retirement Investments

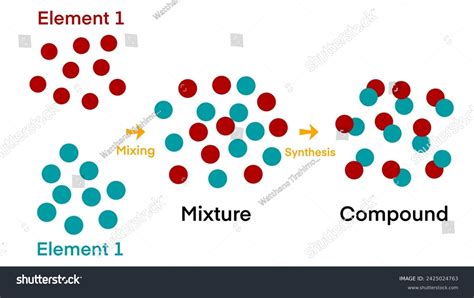

On the other side of the coin is the powerful allure of compound interest and long-term wealth accumulation through retirement investments. Time is an investor’s greatest asset, and starting early allows your money to grow exponentially over decades.

Employer-sponsored retirement plans, such as a 401(k), often come with an employer match—essentially free money that you shouldn’t leave on the table. These accounts also offer significant tax advantages, either through tax-deferred growth (traditional 401k/IRA) or tax-free withdrawals in retirement (Roth 401k/IRA).

- Compound Interest: The earlier you invest, the more time your money has to grow and compound, potentially leading to substantial wealth.

- Employer Match: Don’t miss out on “free money” by at least contributing enough to get your full employer match.

- Tax Advantages: Retirement accounts offer various tax benefits that can accelerate your savings.

Finding Your Personalized Financial Strategy

Instead of viewing this as an either/or dilemma, many financial experts recommend a hybrid approach. The optimal strategy often involves a few key steps:

- Build an Emergency Fund: Before tackling debt or investing heavily, ensure you have 3-6 months of living expenses saved in an easily accessible account. This prevents new debt in a crisis.

- Secure Your Employer Match: Always contribute enough to your 401(k) or similar plan to get the full employer match. This is a 100% immediate return on your investment.

- Address High-Interest Debt: After securing your match, aggressively pay down any debt with interest rates exceeding what you can reasonably expect to earn from investments (typically anything above 7-8%). This includes most credit card debt, payday loans, and often personal loans.

- Increase Retirement Contributions: Once high-interest debt is eliminated, shift your focus to maximizing your retirement contributions, aiming to hit the annual limits if possible.

- Consider Medium-Interest Debt: For debts like student loans or mortgages with lower interest rates (e.g., 3-6%), you might choose to make minimum payments while also investing, especially if your investments are projected to yield higher returns.

Your risk tolerance also plays a role. If the psychological burden of debt is significant, even if the interest rate is lower, paying it off might bring more peace of mind, which has its own value.

Conclusion

The decision to prioritize aggressive debt repayment or maximizing retirement investments is deeply personal. By understanding the financial and emotional implications of both strategies, building an emergency fund, securing your employer match, and then systematically addressing high-interest debt before fully ramping up investments, you can build a robust financial plan tailored to your specific situation. Regularly review your progress and adjust your strategy as your life circumstances and financial landscape evolve.