The Great Financial Dilemma: Debt vs. Early Retirement

For many aspiring to financial freedom, the crossroads of aggressively paying down debt and investing for an early retirement presents a significant challenge. Both paths offer compelling benefits, but resources are often finite, forcing a strategic decision. Understanding the nuances of each approach is key to forging a financial strategy that aligns with your personal goals and risk tolerance.

The Case for Aggressive Debt Repayment

Prioritizing aggressive debt repayment, especially high-interest debt, can feel like a guaranteed win. Every dollar paid towards a credit card with 18% APR is an 18% return on investment, tax-free. This isn’t theoretical; it’s money saved that you would have otherwise paid in interest. The psychological relief of being debt-free is also invaluable, reducing stress and opening up new financial possibilities.

Benefits of Crushing Debt:

- Guaranteed Return: The interest saved is a risk-free return on your money, often exceeding what you could reliably earn in many investments.

- Improved Cash Flow: As debts are eliminated, your monthly required payments decrease, freeing up more money for investing, saving, or discretionary spending.

- Reduced Financial Stress: The burden of debt can be immense. Eliminating it provides significant peace of mind and financial security.

- Better Credit Score: Lowering debt-to-income ratios and demonstrating responsible repayment can improve your credit score, leading to better rates on future loans.

The Case for Investing for Early Retirement

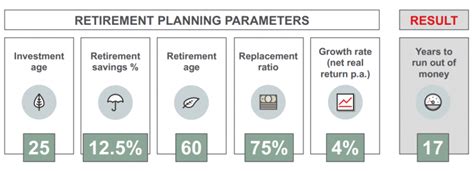

On the other hand, the power of compounding is a formidable force when it comes to investing. Starting early allows your money to grow exponentially over decades, potentially leading to a much larger nest egg for an early retirement. The opportunity cost of not investing early can be substantial, as lost years of growth can never be fully recovered.

Advantages of Early Investing:

- Power of Compounding: Even small, consistent investments can grow significantly over time, thanks to compound interest.

- Inflation Protection: Investments in the market have the potential to outpace inflation, preserving and growing your purchasing power.

- Tax Advantages: Retirement accounts like 401(k)s and IRAs offer tax-deferred or tax-free growth, which can supercharge your returns.

- Achieving Financial Independence: A robust investment portfolio can provide the passive income needed to retire early and live off your assets.

Finding the Balance: A Strategic Approach

The optimal strategy often isn’t an either/or but a carefully balanced approach. Here’s a framework to consider:

- Build an Emergency Fund: Before tackling significant debt or investing heavily, ensure you have 3-6 months of living expenses saved in an easily accessible account. This prevents new debt in times of crisis.

- Address High-Interest Debt: Prioritize any debt with an interest rate higher than what you reasonably expect to earn from investments (typically 7-8% or more). This includes most credit card debt, payday loans, and some personal loans.

- Capture Employer Match: If your employer offers a 401(k) match, contribute at least enough to get the full match. This is essentially free money and an immediate, guaranteed return on your investment.

- Evaluate Medium-Interest Debt: For debts like student loans or car loans with rates between 4-7%, the decision becomes more nuanced. You might aggressively pay these down or make minimum payments while investing, depending on your risk tolerance and confidence in market returns.

- Invest for Long-Term Goals: Once high-interest debt is under control and employer match is secured, prioritize investments in tax-advantaged accounts (IRAs, 401(k)s) and then taxable brokerage accounts.

Strategies for Debt and Investing Simultaneously

It’s possible to do both, albeit at a measured pace. Consider these strategies:

- The Hybrid Approach: Dedicate a portion of your extra funds to debt repayment and another portion to investing. For example, allocate 70% to paying off high-interest debt and 30% to your 401(k) or IRA.

- Debt Avalanche vs. Snowball: The debt avalanche method (paying highest interest first) is mathematically superior, while the debt snowball method (paying smallest balance first) offers psychological wins. Choose the one that motivates you most.

- Refinance Debt: Explore options to refinance high-interest debts like credit cards (via personal loans) or student loans to lower your interest rates, freeing up cash flow for investing.

Ultimately, the decision hinges on your personal financial situation, your comfort with risk, and your long-term goals. There’s no one-size-fits-all answer, but by understanding the benefits and drawbacks of each path, you can make an informed choice that moves you closer to financial freedom and an early, comfortable retirement.