Navigating a Common Financial Dilemma

Many individuals face a perennial financial conundrum: whether to aggressively pay down high-interest debt or funnel money into their 401k retirement plan. Both are crucial for financial health, but resources are often limited, forcing a choice. Understanding the benefits and drawbacks of each approach is key to making an informed decision tailored to your personal circumstances.

The Urgency of High-Interest Debt

High-interest debt, typically anything with an interest rate above 7-8% (e.g., credit cards, some personal loans, payday loans), can be a significant drain on your finances. The interest accrues rapidly, making it difficult to pay down the principal and potentially trapping you in a cycle of debt. Prioritizing this debt offers a guaranteed “return” in the form of saved interest, which can often be higher than typical stock market returns.

- Guaranteed Return: Paying down debt with an 18% interest rate is equivalent to an 18% risk-free return on your money.

- Improved Cash Flow: As debt balances decrease, minimum payments reduce, freeing up more money for future savings or investments.

- Psychological Relief: The emotional burden of high-interest debt can be immense; eliminating it provides significant peace of mind.

The Power of 401k Contributions

On the other hand, contributing to a 401k offers substantial long-term benefits, especially when coupled with an employer match. This is often described as “free money” and should be a top priority for most workers.

- Employer Match: Many companies match a percentage of your contributions, immediately boosting your savings. Missing this is leaving money on the table.

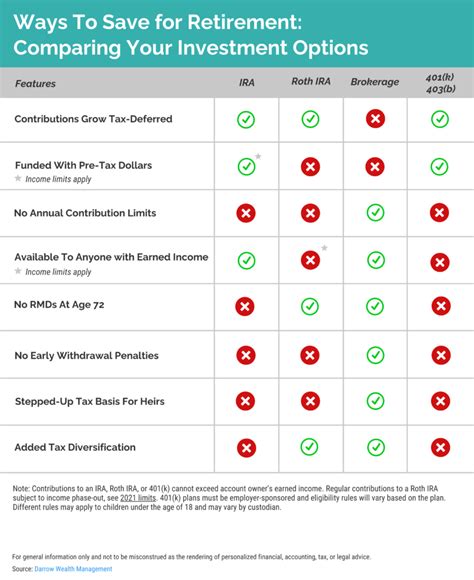

- Tax Advantages: Traditional 401k contributions are pre-tax, reducing your current taxable income. Investments grow tax-deferred until retirement. Roth 401k contributions are after-tax, but qualified withdrawals in retirement are tax-free.

- Compounding Growth: The earlier you start investing, the more time your money has to grow exponentially through the power of compound interest.

![[100+] Roblox Piggy Backgrounds | Wallpapers.com](/images/aHR0cHM6Ly90czIubW0uYmluZy5uZXQvdGg/aWQ9T0lQLkE3dGk3RzdOb0NWNDhWZGlqTDU1R1FIYUZqJnBpZD0xNS4x.webp)

A Strategic Hybrid Approach

For many, the optimal strategy isn’t an either/or but a phased approach that blends the benefits of both. A common recommendation unfolds as follows:

- Emergency Fund First: Establish a foundational emergency fund of 3-6 months’ living expenses in a readily accessible, high-yield savings account. This protects you from unexpected expenses without incurring new debt.

- Capture the 401k Match: Contribute enough to your 401k to receive the full employer match. This is essentially a 100% (or high percentage) return on your money, unmatched by almost any other investment.

- Attack High-Interest Debt: Aggressively pay down any debt with an interest rate above what you realistically expect to earn in the market (e.g., above 7-8%). Use the “debt snowball” or “debt avalanche” method to stay motivated.

- Increase 401k Contributions: Once high-interest debt is eliminated, shift your focus to increasing your 401k contributions, aiming to max it out ($23,000 for 2024, plus catch-up contributions if applicable).

- Address Lower-Interest Debt: If you have lower-interest debt (e.g., mortgages, student loans below 5-6%), you can choose to continue making minimum payments while further investing, or accelerate repayment based on your comfort level and financial goals.

Key Factors to Consider

Your personal financial situation and goals should guide your decision. Consider these factors:

- Interest Rate of Debt: The higher the interest rate, the more pressing the need to eliminate it.

- Employer Match: Always prioritize getting the full match.

- Risk Tolerance: Some prefer the guaranteed “return” of debt repayment over market volatility.

- Financial Discipline: If you struggle with debt, eliminating it completely might be a higher priority for psychological and behavioral reasons.

- Time Horizon: Younger individuals have more time for compound interest to work in their 401k, but also more time to be burdened by debt.

Making Your Informed Decision

There’s no single universal answer to whether to max your 401k or aggressively pay high-interest debt first. The best approach is often a blend, starting with foundational financial security (emergency fund), leveraging free money (employer match), and then systematically tackling financial burdens. By understanding the advantages of each and tailoring a strategy to your unique financial landscape, you can build a robust path towards long-term financial freedom and wealth accumulation.