Navigating Your Retirement Savings: Roth IRA vs. 401k

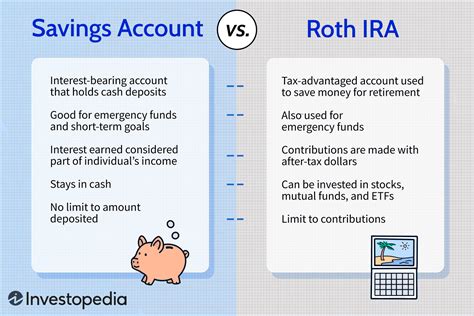

Planning for retirement is a cornerstone of financial security, and two of the most popular vehicles for building a nest egg are the Roth IRA and the 401k. While both are powerful tools for long-term savings, they operate under different rules, particularly concerning taxes, contribution limits, and withdrawal flexibility. Understanding these distinctions is crucial for making an informed decision that aligns with your financial future and current circumstances.

Understanding the Roth IRA

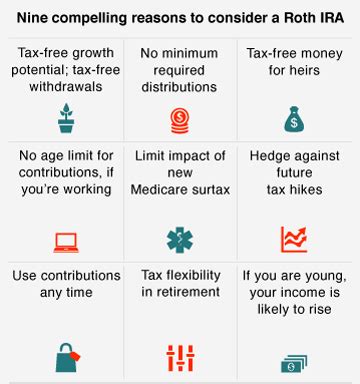

A Roth IRA is an individual retirement account that allows your investments to grow tax-free, and qualified withdrawals in retirement are also tax-free. The key differentiator is that contributions to a Roth IRA are made with after-tax dollars. This means you don’t get an immediate tax deduction, but in exchange, you avoid paying taxes on your withdrawals when you’re retired – a significant advantage if you expect to be in a higher tax bracket in the future.

- After-Tax Contributions: You contribute money that has already been taxed.

- Tax-Free Growth & Withdrawals: Your investments grow tax-free, and qualified withdrawals in retirement are completely tax-free.

- Income Limitations: Eligibility to contribute directly to a Roth IRA is subject to income phase-outs.

- Contribution Flexibility: Contributions can be withdrawn tax-free and penalty-free at any time, as long as they are not earnings.

Understanding the 401k

The 401k is an employer-sponsored retirement plan, meaning you can only contribute to it if your employer offers one. Traditionally, contributions to a 401k are made on a pre-tax basis, which lowers your current taxable income. Your investments grow tax-deferred, and you only pay taxes when you withdraw the money in retirement. A major draw of the 401k is the potential for employer matching contributions, essentially free money towards your retirement.

- Pre-Tax Contributions: Contributions are deducted from your paycheck before taxes, lowering your current taxable income.

- Tax-Deferred Growth: Your investments grow without being taxed annually, but withdrawals in retirement are taxed as ordinary income.

- Employer Match: Many employers offer to match a percentage of your contributions, providing a significant boost to your savings.

- Higher Contribution Limits: 401k plans generally allow for much higher annual contribution limits than IRAs.

Key Differences and Considerations

The choice between a Roth IRA and a 401k largely boils down to your personal financial situation and your outlook on future tax rates.

Tax Treatment: Pay Now or Pay Later?

- Roth IRA: You pay taxes now (on your contributions) and enjoy tax-free withdrawals later. This is ideal if you anticipate being in a higher tax bracket in retirement than you are currently.

- Traditional 401k: You save on taxes now (through pre-tax contributions) and pay taxes later (on your withdrawals). This is often preferred if you expect to be in a lower tax bracket in retirement.

Contribution Limits and Employer Match

401k plans typically have significantly higher annual contribution limits than Roth IRAs. Furthermore, the employer matching contribution often associated with a 401k is a major advantage that cannot be replicated with an IRA. Always contribute enough to your 401k to capture the full employer match – it’s essentially a 100% return on that portion of your investment.

Income Limitations and Access

Roth IRAs have income limitations that can prevent high-earners from contributing directly, though a ‘backdoor Roth’ strategy can sometimes circumvent this. 401ks, conversely, are tied to employment and don’t have income restrictions for contributions, though not everyone has access to an employer-sponsored plan.

Which is Better for You? A Hybrid Approach

Determining whether a Roth IRA or a 401k is “better” isn’t a one-size-fits-all answer. For many, the optimal strategy involves utilizing both.

- Start with Your 401k (at least for the match): If your employer offers a 401k and provides a matching contribution, prioritize contributing enough to get the full match. This is free money and an immediate boost to your retirement savings.

- Max Out Your Roth IRA: After securing your employer match, consider funding your Roth IRA. Its tax-free withdrawals in retirement offer tremendous value, especially for younger individuals or those currently in lower tax brackets.

- Return to Your 401k: If you still have more to save, contribute additional funds to your 401k. Whether you opt for a traditional (pre-tax) 401k or a Roth 401k (if offered by your employer) will depend on your tax outlook.

Ultimately, the “better” option hinges on your current income, your expected income in retirement, and the availability of an employer-sponsored plan. Diversifying your retirement savings with both pre-tax and after-tax accounts can also provide greater flexibility and tax optionality in your golden years.

Conclusion

Both Roth IRAs and 401ks are indispensable tools for building a secure retirement. The Roth IRA offers tax-free growth and withdrawals, ideal for those who anticipate higher tax brackets later. The 401k provides immediate tax deductions and the invaluable benefit of employer matching. By carefully evaluating your personal financial situation and long-term tax expectations, you can strategically leverage one or both of these powerful accounts to achieve your retirement goals.