Why Automation is Your Financial Superpower

For many men, the pursuit of financial security and future freedom is a significant life goal. However, daily demands can often push long-term planning to the back burner. The solution? Automation. By setting up systems that automatically direct your money towards savings and investments, you remove the need for constant vigilance and willpower, making financial progress inevitable. This isn’t just about convenience; it’s about building consistent habits that compound into substantial wealth over time, particularly crucial for a robust retirement.

Embracing automation means transforming your financial journey from reactive to proactive, ensuring your money works harder for you without you having to think about it every day. It’s a fundamental shift that empowers you to reach your financial goals faster and with greater certainty.

Step 1: Laying the Foundation with Automated Savings

The first practical step is to ensure a portion of every paycheck goes directly into a savings account, ideally one that’s separate from your primary checking account. This makes it ‘out of sight, out of mind’ and less likely to be spent.

Split Your Direct Deposit

- Set it and Forget it: Work with your employer’s HR or payroll department to split your direct deposit. You can direct a fixed amount or a percentage of each paycheck into a dedicated savings account or even directly into an investment account (if your employer supports it).

- Emergency Fund First: Prioritize building an emergency fund of 3-6 months’ worth of living expenses. This is your financial safety net, preventing you from dipping into retirement savings when unexpected costs arise.

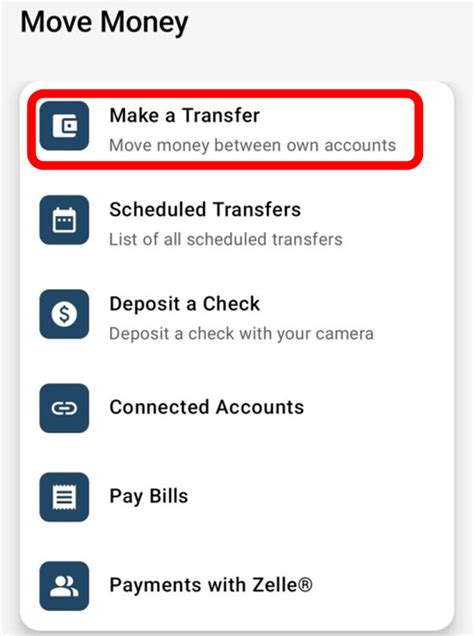

Automate Transfers from Checking to Savings/Investments

- Regular Transfers: If direct deposit splitting isn’t an option, set up automatic transfers from your checking account to your savings and investment accounts on a specific date after you get paid. For example, transfer $X to savings and $Y to investments every pay cycle.

- Microsavings Apps: Consider apps that round up your purchases to the nearest dollar and invest the difference, or allow you to set small, recurring transfers. While not primary wealth builders, they can add up and foster a savings mindset.

Step 2: Turbocharging Your Retirement Investing

Once your basic savings automation is in place, the next crucial step is to supercharge your retirement accounts. These accounts offer significant tax advantages and are designed for long-term growth.

Maximize Employer-Sponsored Plans (401(k), 403(b))

- Get the Match: This is non-negotiable. If your employer offers a matching contribution, contribute at least enough to get the full match. It’s essentially free money and an immediate 100% return on your investment.

- Increase Contributions Annually: Aim to increase your contribution percentage by 1% or 2% each year, especially when you get a raise. You’ll barely notice the difference, but it will significantly boost your retirement nest egg over decades. The maximum contribution limits often increase, so keep an eye on those.

Leverage Individual Retirement Accounts (IRAs)

- Traditional vs. Roth: Understand the difference. Traditional IRAs offer tax-deductible contributions now, with taxes paid in retirement. Roth IRAs are funded with after-tax dollars, but qualified withdrawals in retirement are tax-free. Choose based on your current income and expected future tax bracket.

- Automate IRA Contributions: Set up monthly or bi-weekly automatic transfers from your checking account directly to your chosen IRA. This ensures you consistently contribute and reach the annual maximum contribution limit without a last-minute scramble.

![[100+] Retirement Backgrounds | Wallpapers.com](/images/aHR0cHM6Ly90czMubW0uYmluZy5uZXQvdGg/aWQ9T0lQLjBNT2Rmd2tfbFJyVGFJaGlMUTZpSXdIYUU4JnBpZD0xNS4x.webp)

Step 3: Advanced Strategies for Accelerated Growth

Once the foundational automation is in place, consider these advanced moves to further boost your retirement investing.

Utilize Robo-Advisors for Diversification

- Low-Cost Investing: Robo-advisors (e.g., Betterment, Wealthfront) offer automated, diversified portfolios tailored to your risk tolerance, typically with very low fees. They rebalance your portfolio automatically, saving you time and effort.

- Set and Forget: Link your bank account and set up recurring deposits. The robo-advisor handles the investment decisions based on your profile, ensuring your money is always working efficiently.

Explore Health Savings Accounts (HSAs)

- Triple Tax Advantage: If you have a high-deductible health plan (HDHP), an HSA is a powerful tool. Contributions are tax-deductible, investments grow tax-free, and qualified withdrawals for medical expenses are tax-free. Many consider it a stealth retirement account.

- Invest the Funds: Don’t just let the money sit as cash. Once you have a sufficient amount for immediate medical needs, invest the excess funds within the HSA to maximize its growth potential over the long term.

Step 4: Regular Review and Adjustment

Automation doesn’t mean setting it and forgetting it forever. It means setting it and occasionally reviewing it. At least once a year, preferably during tax season or around a significant life event (promotion, marriage, new child), review your automated financial plan.

- Increase Contributions: As your income grows, increase your automated savings and investment contributions.

- Rebalance Portfolio: Ensure your investment allocation still aligns with your risk tolerance and goals. Robo-advisors often do this automatically.

- Consolidate Accounts: If you’ve changed jobs, consider rolling over old 401(k)s into an IRA or your new employer’s plan for simplicity.

By regularly reviewing and making minor adjustments, you ensure your automated system remains optimized for your evolving financial situation and retirement goals.

Conclusion: Your Path to Financial Freedom

Automating your savings and supercharging your retirement investments are not just practical steps; they are foundational pillars for achieving long-term financial security and ultimate freedom. By removing the decision-making friction and relying on consistent, automated actions, men can build substantial wealth over time without feeling overwhelmed. Start small, stay consistent, and let the power of automation and compounding interest work tirelessly for your future. Your retired self will thank you.