The Invisible Chains: Understanding Procrastination

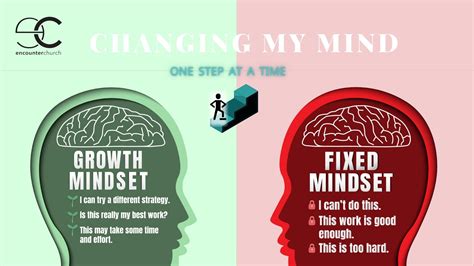

Procrastination is a universal foe, especially when it comes to areas like fitness and finance that demand consistent, often uncomfortable, effort. It’s not merely laziness; it’s a complex psychological phenomenon often rooted in fear, perfectionism, or an inability to manage overwhelming tasks. The good news? You can forge a practical mindset to break free.

The Illusion of the Future Self

One common trap is believing our future self will be more motivated, disciplined, or capable. This leads us to defer crucial workouts or financial planning to a mythical future date. The reality is, your future self is shaped by the actions of your present self. Recognize this illusion and understand that action, however small, must start now.

Overwhelm and Analysis Paralysis

When tasks seem too large or complex – like overhauling a diet, starting an investment portfolio, or training for a marathon – our brains can shut down. The sheer scope can trigger analysis paralysis, where we get stuck in planning rather than doing. A practical mindset involves breaking down these gargantuan tasks into manageable, bite-sized steps.

Shifting Your Mindset for Fitness

Focus on Process, Not Just Outcome

Instead of fixating on a distant weight goal or an unachieved physique, shift your focus to the process itself. Celebrate showing up for your workout, the effort you put in, or simply choosing a healthier meal. This makes the journey more enjoyable and sustainable.

Embrace Imperfection and Small Wins

Perfectionism can be a silent killer of fitness goals. Don’t wait for the ‘perfect’ workout plan or the ‘perfect’ day. A 15-minute walk is better than no walk. A single healthy meal is better than giving up entirely because you ‘ruined’ your diet. Acknowledge and appreciate these small victories.

Leverage the Power of Habit Stacking

Integrate new fitness habits into existing routines. For example, if you always make coffee in the morning, do 10 squats while the water boils. If you always watch TV in the evening, do some stretching during commercials. This technique reduces the friction of starting something new.

Building Financial Fortitude

Demystify Your Finances

Many procrastinate on financial tasks because they seem intimidating or complicated. Instead of avoiding, commit to spending a specific, short amount of time each week (e.g., 15 minutes) simply reviewing your bank statements, credit card bills, or investment accounts. Familiarity reduces fear.

Automate and Simplify

One of the most powerful anti-procrastination tools in finance is automation. Set up automatic transfers to your savings or investment accounts, automate bill payments, and even automate debt repayments. This removes the need for daily decision-making and ensures progress even when your motivation wanes.

Visualize Future Rewards (and Risks)

Clearly visualize the future you’re building by taking control of your finances: a comfortable retirement, a down payment on a house, or financial freedom. Conversely, visualize the potential negative consequences of continued financial procrastination, such as debt accumulation or missed opportunities. This clarity can be a powerful motivator.

Universal Mindset Pillars

The “Two-Minute Rule”

Popularized by productivity expert James Clear, if a task takes less than two minutes, do it immediately. This applies perfectly to fitness (e.g., lay out workout clothes) and finance (e.g., check account balances, pay a small bill). These tiny actions build momentum and reduce the mental barrier to starting larger tasks.

Cultivate Self-Compassion

Be kind to yourself when you slip up. Procrastination often involves a cycle of guilt and shame, which only fuels more procrastination. Acknowledge the setback, learn from it, and gently redirect yourself back on track without harsh self-criticism. Every day is a new opportunity to start afresh.

Accountability and Support

Share your goals with a trusted friend, family member, or mentor. Having someone to report to, whether informally or formally, can significantly boost your commitment. For fitness, this might be a workout buddy; for finance, a financial advisor or a budgeting partner.

Actionable Steps to Get Started

- For Fitness:

- Schedule your workouts like non-negotiable appointments.

- Find an activity you genuinely enjoy.

- Prepare healthy meals in advance.

- Invest in comfortable workout attire.

- For Finance:

- Create a simple budget you can stick to.

- Set up one automatic savings transfer, however small.

- Open a separate savings account for a specific goal.

- Review one financial statement per week.

Conquering procrastination in fitness and finance isn’t about finding a magic bullet; it’s about consistently applying practical mindset shifts and actionable strategies. By breaking down goals, focusing on process, and cultivating self-compassion, you can build unstoppable momentum towards a healthier, wealthier future. Start small, stay consistent, and celebrate every step of the journey.