Achieving long-term financial freedom is not merely a dream; it’s a tangible goal attainable through disciplined planning and strategic action. It involves a synergistic approach that tackles your finances from multiple angles: gaining control over your spending, systematically eliminating debt, and wisely growing your wealth through investments. This article will guide you through the essential steps to transform your financial future.

The Foundation: Optimizing Your Budget

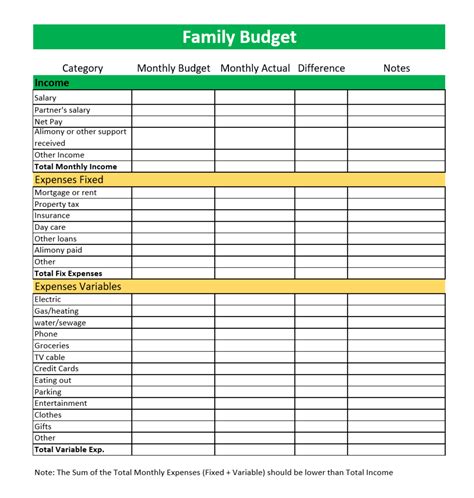

Your budget is the bedrock of your financial strategy. Without a clear understanding of your income and expenditures, it’s impossible to make informed decisions. Start by meticulously tracking every dollar that comes in and goes out for at least a month. This audit will reveal your true spending habits, often uncovering areas where money is leaking unnecessarily.

Once you have a clear picture, create a realistic budget that allocates funds to necessities, savings, debt repayment, and discretionary spending. Popular methods like the 50/30/20 rule (50% for needs, 30% for wants, 20% for savings and debt repayment) can provide a good starting point, but customize it to fit your unique circumstances and goals. Identifying and cutting non-essential expenses is crucial; every dollar saved from impulse purchases or subscriptions you don’t use can be redirected towards debt reduction or investment.

Crushing Debt: Strategies for Freedom

Debt acts as an anchor, holding back your financial progress. High-interest debt, in particular, can erode your income and prevent you from building wealth. Developing a clear strategy to eliminate it is paramount for achieving financial freedom.

Two popular methods for tackling debt are the debt snowball and the debt avalanche. The debt snowball involves paying off your smallest debts first, gaining psychological momentum, while the debt avalanche prioritizes debts with the highest interest rates, saving you more money in the long run. Choose the method that best suits your motivation and financial situation. Consider consolidating high-interest debts into a single, lower-interest loan if possible, but be cautious of new fees or extended repayment periods.

Beyond active repayment, focus on preventing new debt. Live within your means, build an emergency fund to avoid relying on credit cards for unexpected expenses, and be mindful of lifestyle creep. Every dollar freed from debt payments becomes a dollar you can invest in your future.

Investing Smartly: Building Wealth for Tomorrow

Once your budget is optimized and your debt strategy is in motion, the next critical step is to make your money work for you through smart investing. Investing isn’t just for the wealthy; it’s a powerful tool for anyone seeking long-term financial growth, harnessing the power of compound interest.

Start by understanding your risk tolerance and financial goals. Are you saving for retirement, a down payment, or simply general wealth accumulation? This will influence your investment choices. Diversification is key: don’t put all your eggs in one basket. Spread your investments across different asset classes like stocks, bonds, mutual funds, and exchange-traded funds (ETFs) to mitigate risk.

Begin investing early, even with small amounts. Thanks to compound interest, time is your greatest asset. Tools like employer-sponsored 401(k)s, IRAs, and robo-advisors make investing accessible to everyone. Consider dollar-cost averaging, which involves investing a fixed amount regularly, regardless of market fluctuations, reducing the risk of buying high.

Synergy for Long-Term Financial Freedom

True financial freedom is achieved when budgeting, debt management, and smart investing work in harmony. Your optimized budget creates surplus funds, which are then used to crush debt. As debt diminishes, more funds become available for investing, accelerating your wealth accumulation. This virtuous cycle builds momentum, propelling you towards your goals.

Regularly review your financial plan. Life circumstances change, and your budget and investment strategy should adapt accordingly. Stay informed about market trends, but avoid impulsive decisions based on short-term fluctuations. Discipline, patience, and continuous learning are your allies on this journey.

Taking control of your finances through strategic budgeting, aggressive debt reduction, and intelligent investing is a marathon, not a sprint. It requires commitment and consistency, but the reward — long-term financial freedom and peace of mind — is immeasurable. Start today, and empower yourself to build the secure and prosperous future you deserve.