Conquering High-Interest Credit Card Debt

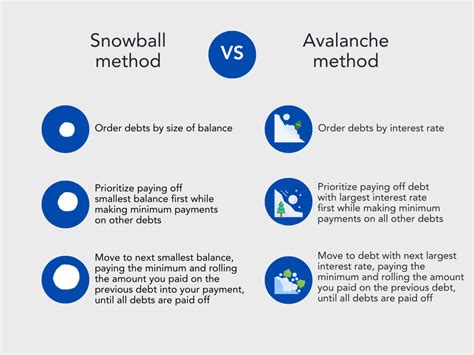

High-interest credit card debt can feel like a heavy burden, constantly eroding your financial progress. Many individuals find themselves overwhelmed by the sheer number of balances and the seemingly endless interest payments. Fortunately, there are proven strategies to help you tackle this challenge head-on: the debt snowball and the debt avalanche methods. Understanding the nuances of each can empower you to make an informed decision and accelerate your path to becoming debt-free.

The Debt Avalanche Method: Prioritizing Interest Savings

The debt avalanche method is a mathematically superior strategy for paying off debt. It involves listing all your debts from the highest interest rate to the lowest. You then make minimum payments on all debts except for the one with the highest interest rate. Any extra money you have is directed towards that highest-interest debt. Once that debt is paid off, you take the money you were paying on it (minimum payment + extra) and apply it to the debt with the next highest interest rate. This process continues until all your debts are eliminated.

Pros of the Debt Avalanche:

- Saves the Most Money: By attacking the highest interest rates first, you reduce the total amount of interest paid over the life of your debt.

- Faster Debt Freedom (Mathematically): Because less money goes to interest, more goes to principal, allowing you to pay off debt faster overall.

Cons of the Debt Avalanche:

- Less Immediate Psychological Boost: If your highest-interest debt is also a large one, it might take longer to see the first debt completely paid off, which can be discouraging for some.

The Debt Snowball Method: Building Momentum and Motivation

In contrast, the debt snowball method focuses on psychological wins and building momentum. With this approach, you list all your debts from the smallest balance to the largest, regardless of their interest rates. You make minimum payments on all debts except for the one with the smallest balance. All your extra funds are then directed towards paying off that smallest debt. Once it’s gone, you take the money you were paying on it (minimum payment + extra) and apply it to the next smallest debt. This continues until all debts are paid off.

Pros of the Debt Snowball:

- Motivational Boosts: Paying off smaller debts quickly provides frequent psychological wins, which can be incredibly motivating and help you stick to your plan.

- Simplicity: It’s easy to understand and implement, making it appealing for those who feel overwhelmed by complex financial calculations.

Cons of the Debt Snowball:

- Costs More in Interest: Because you’re not prioritizing higher interest rates, you will likely pay more in total interest over time compared to the avalanche method.

- Slower Debt Freedom (Mathematically): The higher interest payments mean it can take longer to become completely debt-free.

Which Method is Right for Your High-Interest Credit Cards?

When dealing specifically with high-interest credit card debt, the choice between snowball and avalanche becomes crucial. Credit card interest rates are often among the highest, making the interest-saving aspect of the debt avalanche particularly appealing.

If you are disciplined and highly motivated by financial efficiency, the debt avalanche is generally the optimal choice for high-interest credit cards. It will save you the most money and get you debt-free faster in terms of actual time spent paying down principal, because you’re minimizing the impact of compounding interest.

However, if you find yourself easily discouraged, struggle with sticking to financial plans, or need immediate wins to stay on track, the debt snowball might be more effective for you. The psychological boost from quickly eliminating a small balance can be powerful enough to keep you committed, even if it means paying a bit more in interest in the long run. The best plan is the one you’ll actually stick to.

Making Your Decision and Staying on Track

Regardless of the method you choose, consistency is key. Here are some additional tips:

- Create a Budget: Understand where your money is going to free up extra funds for debt payments.

- Automate Payments: Set up automatic payments to ensure you don’t miss deadlines and incur late fees.

- Avoid New Debt: While paying down existing debt, resist the urge to take on new credit card balances.

- Consider Balance Transfers: If you have good credit, a 0% APR balance transfer offer could give you a temporary reprieve from high interest rates, allowing you to pay down principal faster. Be mindful of transfer fees and the promotional period end date.

Ultimately, both the debt snowball and debt avalanche are effective strategies. The most optimal choice for you will depend on your personal financial psychology and your ability to stay motivated. Weigh the mathematical benefits against your personal need for encouragement, and choose the path that will lead you to financial freedom.