Laying the Foundation: Why a Strong Financial Strategy Matters

For many men, navigating the complexities of personal finance can feel like a daunting challenge. From the immediate pressure of existing debt to the long-term vision of financial independence, having a clear, actionable strategy is not just beneficial—it’s essential. This guide will outline an optimal strategy tailored to help men not only crush their debt but also systematically build lasting wealth, ensuring a secure and prosperous future.

The Debt Dilemma: Understanding and Conquering It

Debt often feels like an insurmountable obstacle, but understanding its nature is the first step toward conquering it. High-interest debts, such as credit card balances, personal loans, or even student loans, can significantly hinder wealth-building efforts. The goal is to eliminate these financial anchors as quickly and efficiently as possible.

Creating Your Debt Elimination Blueprint

The cornerstone of any debt-crushing strategy is a meticulous budget. Begin by tracking every dollar in and out. Identify where your money is going and pinpoint areas where you can cut unnecessary expenses. This isn’t about deprivation, but about intentional spending aligned with your financial goals.

Once you have a clear picture, choose a debt repayment method. The Debt Snowball Method suggests paying off the smallest debt first to gain psychological momentum, while the Debt Avalanche Method prioritizes debts with the highest interest rates, saving you more money in the long run. Choose the method that best suits your personality and stick to it rigorously.

Consider ways to increase your income, even temporarily. A side hustle, overtime at work, or selling unused items can accelerate your debt repayment. Every extra dollar directed towards principal repayment reduces interest paid and shortens your debt-free timeline.

From Debt-Free to Wealth-Bound: Building Lasting Prosperity

Once significant debt is under control, the focus shifts to building wealth. This phase requires discipline, foresight, and a commitment to long-term financial health.

Establishing Your Financial Safety Net

Before diving into investments, build an emergency fund. This fund should cover 3-6 months of living expenses, held in an easily accessible, high-yield savings account. It acts as a buffer against unforeseen events like job loss, medical emergencies, or unexpected home repairs, preventing you from falling back into debt.

Strategic Investing for Long-Term Growth

Investing is where your money truly starts to work for you. Begin by understanding the basics of different investment vehicles:

- Retirement Accounts: Maximize contributions to tax-advantaged accounts like a 401(k) (especially if there’s an employer match, which is free money) and a Roth IRA or Traditional IRA.

- Stocks and Bonds: Understand the balance between growth (stocks) and stability (bonds). Diversifying across various asset classes is crucial to mitigate risk.

- Real Estate: Consider real estate as an investment for long-term appreciation and potential passive income, though it requires significant capital and commitment.

Regular, consistent contributions, even small ones, combined with the power of compound interest, can lead to substantial wealth over decades. Educate yourself continuously about market trends and investment strategies, or consider consulting a trusted financial advisor.

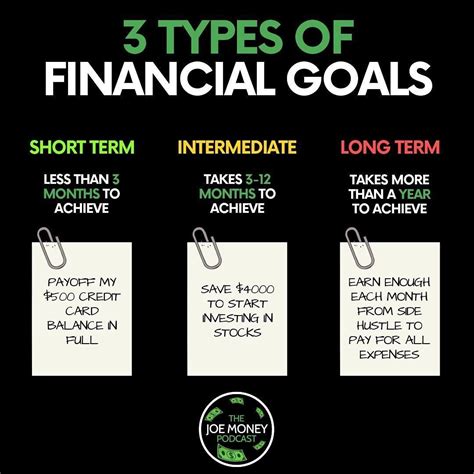

The Power of Financial Planning and Goal Setting

Wealth building isn’t just about accumulating money; it’s about achieving your life goals. Define what lasting wealth means to you: early retirement, buying a home, funding your children’s education, or leaving a legacy. Set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial goals and create a roadmap to reach them.

Regularly review your financial plan—at least annually. Life circumstances change, and your strategy should adapt accordingly. This ongoing assessment ensures you stay on track and make necessary adjustments to optimize your path to wealth.

The Mindset of a Wealth Builder

Beyond strategies and numbers, building lasting wealth requires a specific mindset: discipline, patience, and a long-term perspective. Resist the urge for instant gratification and understand that financial success is a marathon, not a sprint. Celebrate small victories, learn from setbacks, and maintain a consistent approach to saving, investing, and debt management.

Conclusion: Your Path to Financial Freedom

Crushing debt and building lasting wealth is a journey that demands commitment and a well-defined strategy. By understanding your debt, implementing a rigorous repayment plan, establishing an emergency fund, and investing strategically for the long haul, men can lay a robust foundation for financial freedom. Embrace continuous learning, maintain a disciplined approach, and watch as your financial security grows, paving the way for a prosperous future.