In today’s dynamic economic landscape, financial literacy is not just a desirable skill; it’s a critical component of a fulfilling and secure life. For men, taking control of personal finance goes beyond balancing a checkbook; it’s about building a robust foundation for family, future, and freedom. This guide will walk you through the essential pillars of financial mastery: effective budgeting, aggressive debt reduction, and strategic investing for genuine, lasting wealth.

The Foundation: Mastering Your Budget

A budget isn’t a restriction; it’s a roadmap to your financial goals. The first step is to gain absolute clarity on where your money goes. Start by tracking every dollar in and every dollar out for at least a month. Use spreadsheets, budgeting apps like Mint or YNAB, or even a simple notebook. Once you have a clear picture, categorize your expenses.

Consider popular budgeting methods such as the 50/30/20 rule (50% for needs, 30% for wants, 20% for savings and debt repayment) or a zero-based budget, where every dollar is assigned a job. The key is to find a system that works for you and stick with it. Identify areas where you can cut back without sacrificing your quality of life too much – perhaps eating out less, reviewing subscriptions, or optimizing utility usage.

Regularly review and adjust your budget to reflect changes in income, expenses, or financial goals. This continuous process ensures your financial plan remains relevant and effective.

Systematically Crushing Debt

Debt, especially high-interest consumer debt, can be a heavy chain. Breaking free is paramount for building wealth. Start by listing all your debts, including the creditor, interest rate, and minimum payment. This overview will help you decide on a repayment strategy.

Two popular methods are the debt snowball and the debt avalanche. The debt snowball involves paying off the smallest debt first to build momentum, while the debt avalanche prioritizes debts with the highest interest rates to save money in the long run. Choose the method that best aligns with your psychology and financial situation. Crucially, commit to making more than the minimum payments whenever possible. Consider consolidating high-interest debts, but be wary of transferring debt without addressing the underlying spending habits.

As you pay off each debt, roll the money you were paying into the next one, accelerating your progress. Avoiding new debt is equally important; for large purchases, save up rather than borrowing.

Investing for Long-Term Wealth

Once your budget is stable and debt is under control, the real wealth-building begins: investing. The power of compound interest is your greatest ally here, where your earnings start to earn their own returns. The earlier you start, the more significant the impact.

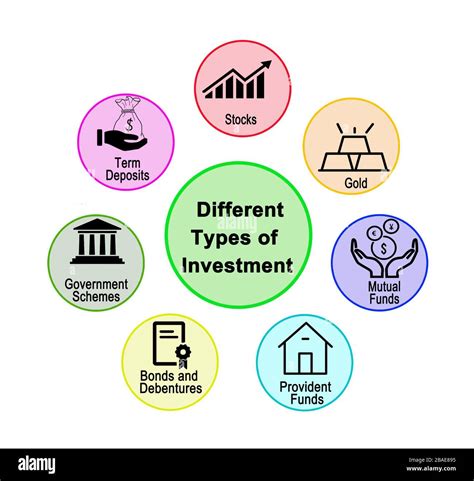

Begin by defining your financial goals – whether it’s retirement, a down payment on a home, or funding your children’s education. This will dictate your investment horizon and risk tolerance. Explore various investment vehicles: stocks, bonds, mutual funds, Exchange Traded Funds (ETFs), and real estate. Diversification is key to managing risk; don’t put all your eggs in one basket. For most men starting out, low-cost index funds or ETFs offer a broad market exposure with minimal effort.

Consider tax-advantaged accounts like 401(k)s, IRAs, or HSAs, which can significantly boost your returns over time. If your employer offers a 401(k) match, contribute at least enough to get the full match – it’s free money!

Protecting Your Future & Building a Legacy

True financial wealth isn’t just about accumulating assets; it’s also about protecting them and planning for the future. An emergency fund, typically 3-6 months of living expenses, should be a non-negotiable part of your financial plan, providing a buffer against unexpected events.

Review your insurance needs: life insurance, disability insurance, and health insurance are crucial safeguards for you and your loved ones. Understanding your risk exposure and mitigating it through proper insurance coverage is a mark of financial responsibility. Furthermore, as your wealth grows, consider basic estate planning like a will and designating beneficiaries to ensure your assets are distributed according to your wishes.

Finally, financial education extends beyond your own journey. Consider how you can educate and empower your family or the next generation with sound financial principles, fostering a legacy of financial wisdom.

Taking Action: Your Path to Financial Freedom

Taking control of your finances is an ongoing journey that requires discipline, education, and adaptability. By effectively budgeting, aggressively tackling debt, and strategically investing, you’re not just managing money; you’re building a future of security, opportunity, and true wealth. Start today, stay consistent, and watch your financial destiny unfold.

Remember, financial wisdom is a continuous pursuit. Stay informed, seek advice from trusted professionals when needed, and consistently work towards your financial goals. Your future self will thank you for the disciplined choices you make today.