Unlocking Long-Term Wealth: A Straightforward Approach for Men

In the complex world of finance, it’s easy for men to feel overwhelmed by the sheer volume of advice, products, and market fluctuations. Many aspire to build substantial long-term wealth but get lost in the noise, chasing the latest stock tip or trying to time the market. The truth is, building enduring wealth doesn’t require a finance degree or constant market monitoring. Instead, it often thrives on simplicity, discipline, and a focus on proven principles.

This article cuts through the complexity to offer a simple, actionable investment strategy designed for the modern man – one that prioritizes efficiency, minimizes stress, and maximizes your potential for financial growth over decades.

Why Simplicity Trumps Complexity in Investing

The allure of complex strategies is strong, promising outsized returns if you can just pick the right stock or predict the next market move. However, decades of financial research show that most active investors, including professionals, fail to beat broad market index funds over the long run, especially after accounting for fees and taxes. Over-complicating your investments often leads to more anxiety, more fees, and ultimately, less wealth.

A simple strategy allows you to set a course and stick to it, freeing up your mental energy for your career, family, hobbies, and personal well-being. It leverages the inherent efficiency of the market and the incredible power of compounding interest.

Step 1: Prioritize and Maximize Your Savings Rate

Before you even think about where to invest, focus on how much you can invest. Your savings rate — the percentage of your income you save and invest — is arguably the most critical factor in your wealth-building journey, especially in the early stages. A higher savings rate means more money working for you sooner, allowing compounding to do its magic more effectively.

- Create a Budget: Understand exactly where your money goes. Use apps, spreadsheets, or even pen and paper.

- Identify and Cut Unnecessary Expenses: Small, consistent cuts add up significantly over time.

- Increase Income: Look for opportunities for raises, promotions, or side hustles to boost your earning potential.

Step 2: Embrace Low-Cost Index Funds or ETFs

This is the cornerstone of the simple strategy. Instead of trying to pick individual stocks, which is highly speculative and risky, invest in diversified funds that track entire markets or broad market segments. Low-cost index funds and Exchange Traded Funds (ETFs) offer instant diversification across hundreds or thousands of companies, minimizing individual company risk and capturing overall market growth.

- Total Stock Market Index Funds: Invest in virtually every publicly traded company in the U.S.

- S&P 500 Index Funds: Track the performance of the 500 largest U.S. companies.

- International Stock Index Funds: Diversify globally to capture growth outside the U.S.

These funds have extremely low fees (expense ratios) because they simply track an index rather than paying expensive managers to pick stocks. Over decades, those low fees can save you hundreds of thousands of dollars compared to actively managed funds.

Step 3: Automate Your Investments and Stay Consistent

The best way to stick to an investment plan is to automate it. Set up automatic transfers from your checking account to your investment accounts (e.g., 401(k), IRA, taxable brokerage) on a regular schedule – ideally every payday. This practice is known as dollar-cost averaging.

Dollar-cost averaging removes emotion from investing. You invest a fixed amount regularly, regardless of market highs or lows. When prices are low, your fixed contribution buys more shares; when prices are high, it buys fewer. Over time, this smooths out your average purchase price and prevents you from trying to time the market, which is a losing game for most.

Step 4: Understand Your Asset Allocation (and Rebalance Periodically)

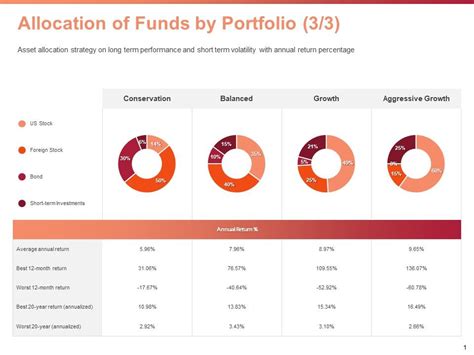

While the focus is on index funds, it’s important to decide on your asset allocation – the mix of stocks and bonds in your portfolio. Stocks offer higher growth potential but also more volatility. Bonds are generally more stable and provide income, acting as a cushion during market downturns.

- Younger Men (Long Time Horizon): Often favor a higher allocation to stocks (e.g., 80-100%) due to their long time horizon to recover from market dips.

- Older Men (Closer to Retirement): May prefer a more conservative mix (e.g., 60% stocks, 40% bonds) to preserve capital.

Periodically (e.g., once a year or when your allocation drifts significantly), you might rebalance your portfolio. This means selling some of your overperforming assets and buying more of your underperforming assets to bring your portfolio back to your target allocation. Don’t overdo it; simplicity is key.

The “Set It and Forget It” Mindset

Once your strategy is in place – you’re saving consistently and investing in low-cost index funds – the most powerful thing you can do is often nothing at all. Resist the urge to constantly check your portfolio, react to daily market news, or tinker with your investments. The market is designed for the long haul, and short-term fluctuations are just noise.

Focus your energy on what you can control: your income, your savings rate, and your long-term commitment to your investment plan. This “set it and forget it” approach, combined with the power of compounding, is the secret weapon for building substantial wealth over 20, 30, or even 40 years.

Conclusion: Your Path to Financial Independence

For men seeking a clear and effective path to long-term wealth, the strategy is remarkably simple: maximize your savings, invest consistently in low-cost, diversified index funds, and let time and compounding do the heavy lifting. Avoid the temptation of complex schemes or market timing. Embrace discipline, patience, and the profound power of simplicity. By following these actionable steps, you’re not just investing; you’re building a foundation for lasting financial security and the freedom to pursue your life’s passions.