Confronting the Debt Beast: A Man’s Guide to Financial Liberation

For many men, the drive to build, provide, and secure the future is paramount. Yet, insidious credit card debt can silently undermine these ambitions, creating a heavy burden that siphons off potential. The good news? There’s a direct, no-nonsense path to not only crushing that debt but also swiftly pivoting towards smart, strategic investing. It’s about tactical choices, discipline, and a clear vision for financial freedom.

Phase 1: Annihilating Credit Card Debt – The High-Interest Blitz

Forget the ‘snowball’ for now. When time is money and interest is enemy, the ‘debt avalanche’ is your most potent weapon. This strategy focuses on paying down your highest-interest credit card first, while making minimum payments on all others. Once that first card is paid off, you take the money you were paying on it and apply it to the next highest-interest card. This method minimizes the total interest you pay over time, accelerating your debt-free date.

To execute this effectively, you need a clear inventory:

- List all credit cards, their balances, and their interest rates.

- Prioritize them from highest interest rate to lowest.

- Commit every available extra dollar to the top card on your list.

Unleashing More Funds: The Income & Expense Offensive

To truly crush debt quickly, you need to free up capital. This means a two-pronged attack on your finances:

Maximize Your Income:

- Side Hustles: Can you drive for a ride-share, freelance your skills, or pick up extra shifts? Even a few hundred extra dollars a month can drastically shorten your debt repayment timeline.

- Negotiate: If you’re employed, consider negotiating a raise. Present your value and make a compelling case.

Minimize Your Expenses:

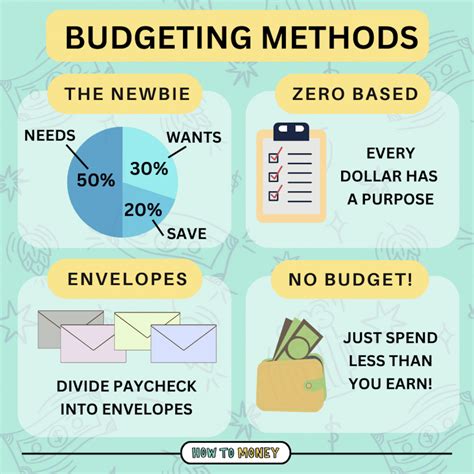

- Aggressive Budgeting: Scrutinize every line item. Cut discretionary spending ruthlessly for a defined period. Cancel unused subscriptions, limit dining out, and seek cheaper alternatives for essentials.

- Temporary Lifestyle Adjustments: Think of this as a temporary financial bootcamp. It’s not forever, but it’s crucial for rapid progress.

Phase 2: Pivoting to Smart Investing – Building Real Wealth

Once the credit card debt is vanquished, the financial power you’ve cultivated shifts gears from defense to offense. It’s time to build a robust financial future.

Step 1: The Emergency Fund – Your Financial Fortification

Before any serious investing, establish an emergency fund. Aim for 3-6 months’ worth of essential living expenses stored in a high-yield savings account. This acts as a buffer against unexpected life events, preventing you from falling back into debt.

Step 2: Maximize Retirement Accounts – The Tax-Advantaged Power Play

This is where real wealth accumulation begins. Leverage tax-advantaged accounts:

- Employer-Sponsored Plans (401(k), 403(b)): If your employer offers a match, contribute enough to get the full match – it’s free money!

- Individual Retirement Accounts (IRAs – Roth or Traditional): These offer significant tax benefits and broad investment choices.

Step 3: Diversified Investing – Spreading Your Bets Wisely

Beyond retirement accounts, consider a diversified investment portfolio. For many, low-cost index funds or Exchange Traded Funds (ETFs) that track broad market indices (like the S&P 500) are an excellent choice. They offer diversification, professional management, and typically lower fees than actively managed funds. Avoid chasing individual stocks unless you’re well-versed and understand the inherent risks.

Automation: Your Path to Consistency

The secret to sustained financial success, both in debt repayment and investing, is automation. Set up automatic transfers for your debt payments and, once debt-free, for your emergency fund contributions and investment accounts. This removes emotion from the equation and ensures consistent progress, month after month, year after year.

The Long Game: Discipline & Financial Freedom

Crushing debt and building wealth aren’t one-time events; they are ongoing journeys of discipline and smart choices. Regularly review your budget, monitor your investments, and adjust your strategy as life changes. The satisfaction of financial control and the freedom it affords are powerful motivators. By taking decisive action now, you’re not just paying off debt; you’re building a legacy of financial strength for yourself and your future.