Why Investing is a Non-Negotiable for Men’s Future

In today’s dynamic economic landscape, securing your financial future is more critical than ever, especially for men who often shoulder significant responsibilities. Building long-term wealth isn’t just about accumulating money; it’s about creating security, achieving independence, and ensuring a comfortable future for yourself and your loved ones. While the idea of investing might seem daunting or exclusive to those with large sums, the truth is that anyone, regardless of their current income, can start investing wisely and effectively. The key lies in understanding the fundamentals, leveraging smart strategies, and most importantly, starting early.

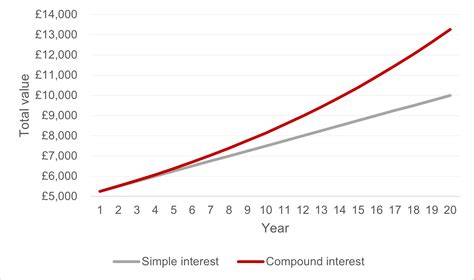

Many men are conditioned to focus on immediate financial needs or traditional career progression. However, neglecting the power of compound interest and consistent investing is a missed opportunity for exponential growth. This guide is designed to break down the barriers, offering clear, actionable steps for men to embark on their investment journey, even when resources feel scarce.

Step One: Master Your Budget and Find Your Investment Capital

Before you can invest, you need to know what you can afford to invest. This starts with a thorough understanding of your personal finances. Create a detailed budget by tracking all your income and expenses for at least a month. Categorize your spending to identify where your money is actually going. This exercise often reveals surprising insights and highlights areas where you can trim unnecessary costs.

Look for opportunities to reduce discretionary spending. Can you cut down on eating out, subscription services you barely use, or expensive hobbies temporarily? Even saving $20-$50 a week can translate into significant investment capital over time. Remember, the goal isn’t deprivation, but rather strategic reallocation of funds towards your long-term financial goals. Once you’ve identified a consistent amount, however small, commit to setting it aside specifically for investing.

Getting Started: Simple, Low-Cost Investment Options

You don’t need to be a Wall Street guru to start investing. For beginners, especially those on a budget, simplicity and low costs are paramount. Here are excellent entry points:

- Robo-Advisors: Services like Betterment or Wealthfront automate your investments based on your risk tolerance and financial goals. They build diversified portfolios of low-cost ETFs and rebalance them automatically. Minimums can be as low as $0-$500, making them highly accessible.

- Index Funds and ETFs: These are funds that hold a collection of stocks or bonds, often tracking a specific market index (like the S&P 500). They offer instant diversification at a very low cost. Many brokerages offer commission-free ETFs, and you can often buy fractional shares, allowing you to invest with as little as $10-$25.

- Employer-Sponsored Retirement Plans (401k/403b): If your workplace offers a retirement plan, especially one with an employer match, contribute at least enough to get the full match. This is essentially free money and one of the best returns on investment you’ll ever find.

Core Principles for Wise Long-Term Investing

Successful long-term investing isn’t about timing the market; it’s about time in the market and adhering to sound principles:

- Compounding: This is the eighth wonder of the world. It means earning returns not only on your initial investment but also on the accumulated interest from previous periods. The earlier you start, the more time compounding has to work its magic.

- Diversification: Don’t put all your eggs in one basket. By investing in a variety of assets (different companies, industries, and asset classes), you reduce risk. If one investment performs poorly, others may perform well, balancing out your portfolio.

- Dollar-Cost Averaging: Instead of trying to guess the best time to invest, commit to investing a fixed amount regularly (e.g., $100 every month). This strategy averages out your purchase price over time, reducing the risk of buying everything at a market peak.

- Long-Term Mindset: Stock market fluctuations are normal. Resist the urge to panic sell during downturns. True wealth is built over decades, not days. Focus on your long-term goals and stay consistent with your strategy.

Practical Steps to Launch Your Investment Journey

- Set Clear Goals: What are you investing for? Retirement, a house down payment, financial independence? Specific goals provide motivation and help you determine appropriate risk levels.

- Open a Brokerage Account: Choose a reputable online brokerage (e.g., Fidelity, Vanguard, Charles Schwab, M1 Finance) that offers low fees and access to the investment vehicles you prefer.

- Start Small, Stay Consistent: Begin with whatever you can afford, even if it’s just $25 or $50 a month. The habit of investing regularly is more important than the initial amount.

- Automate Your Investments: Set up automatic transfers from your checking account to your investment account. This ensures you’re consistently investing and removes the temptation to spend the money elsewhere.

- Educate Yourself Continuously: The world of finance evolves. Read books, listen to podcasts, and follow reputable financial news sources. The more you learn, the more confident and capable you’ll become.

Conclusion: The Power of Starting Small and Staying Consistent

Building long-term wealth as a man on a budget is not a pipe dream; it’s an achievable reality. The most critical step is simply to start. Don’t wait until you have a large sum of money or feel like an expert. Begin with what you have, automate your contributions, and commit to a long-term perspective. Embrace the power of compounding, diversify your portfolio, and stay disciplined through market ups and downs. By taking these smart, consistent steps, you’ll not only build significant wealth over time but also gain invaluable financial confidence and control over your future. Your future self will thank you for taking action today.