For many men, the quest for financial security often feels like a two-front war: battling the burdens of existing debt while striving to build a legacy of lasting wealth. The common wisdom often suggests tackling one before the other, but what if you could strategically advance on both fronts simultaneously? This article outlines a powerful, integrated approach designed for men to aggressively crush debt and cultivate enduring prosperity without delay.

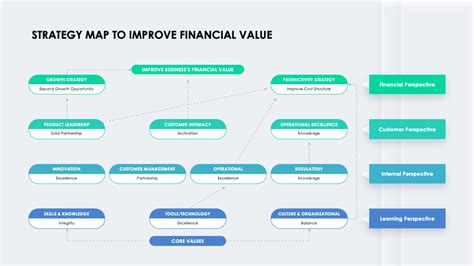

Understand Your Financial Battlefield

Before you can conquer, you must survey your territory. The first step in this dual strategy is a comprehensive audit of your current financial situation. List all your debts—credit cards, student loans, car payments, mortgage—along with their interest rates and minimum payments. Simultaneously, get a clear picture of your income, expenses, and existing assets. This meticulous overview isn’t just about numbers; it’s about gaining clarity and control.

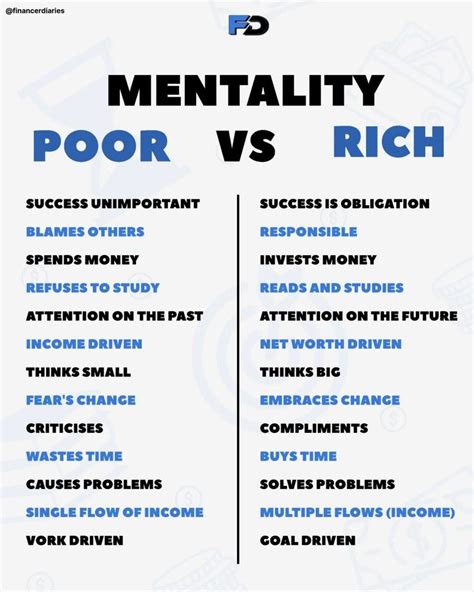

Many men are driven by a desire for control and efficiency. Applying this mindset to your finances means categorizing debts by interest rate (highest first for the avalanche method) or by balance (smallest first for the snowball method). Understanding your cash flow will reveal where funds can be redirected to accelerate your progress.

The Debt Avalanche & Snowball: Your Tactical Weapons

To crush debt, you need a disciplined attack plan. While the Debt Snowball (paying off smallest debts first for motivational wins) and Debt Avalanche (paying off highest interest debts first to save money) are often presented as alternatives, you can adapt them for maximum impact:

- Aggressive Repayment: Commit to paying significantly more than the minimum on your target debt. Free up extra cash by scrutinizing every expense, negotiating bills, and exploring side hustles.

- Strategic Prioritization: If you’re disciplined and analytically driven, the avalanche method is financially superior. If you need quick wins to stay motivated, the snowball can be a powerful psychological tool. Choose the one that best aligns with your personality and stick with it fiercely.

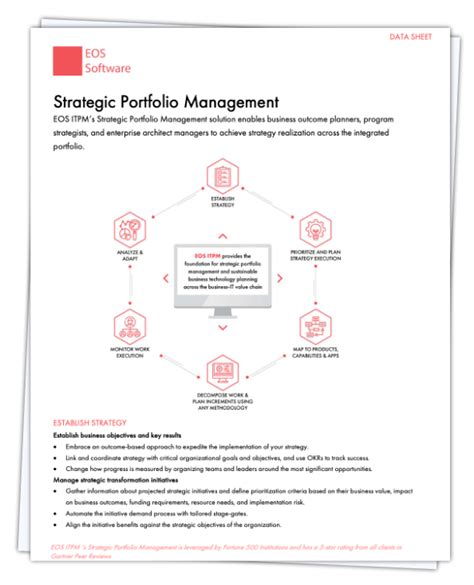

Simultaneously Building Your Wealth Fortress

The crucial differentiator in this strategy is not waiting until debt is gone to start building wealth. Even with significant debt, you can and should allocate resources to wealth creation. This is about establishing multiple pillars of financial strength.

Pillar 1: Emergency Fund – Your First Line of Defense

Before any serious investing, aim for a starter emergency fund of $1,000-$2,000. This fund prevents new debt from accumulating when unexpected expenses arise. Once debt is significantly reduced, expand this to 3-6 months of living expenses.

Pillar 2: Maximize Retirement Contributions (Especially with Employer Match)

This is non-negotiable. If your employer offers a 401(k) or similar plan with a match, contribute at least enough to get the full match. This is free money and an immediate, guaranteed return on investment. Even if you have debt, foregoing this match is leaving money on the table that could be compounding for decades.

Pillar 3: Strategic Investing Beyond Retirement Accounts

Once you’re receiving the employer match and making progress on high-interest debt, consider opening a Roth IRA or a brokerage account. Even small, consistent contributions can grow significantly over time due to compound interest. Focus on low-cost index funds or ETFs for diversified growth.

The key here is balance: don’t divert so much to investing that your debt repayment grinds to a halt. It’s about finding that sweet spot where you’re aggressively reducing debt while consistently planting seeds for future wealth.

Cultivating the Wealth-Builder’s Mindset

This journey isn’t just about numbers; it’s about mindset. Embrace patience, discipline, and a long-term perspective. View money not as a tool for immediate gratification, but as a resource for building security, freedom, and a legacy. Educate yourself continually on personal finance, investment strategies, and economic trends. The more you learn, the more empowered you become.

Advanced Tactics for Acceleration

- Debt Consolidation (Carefully): If you have high-interest consumer debt, a personal loan with a lower fixed rate can simplify payments and reduce interest, but only if you don’t incur more debt.

- Income Optimization: Continuously seek ways to increase your income—negotiate raises, develop new skills, explore entrepreneurship, or leverage passive income streams. More income means more fuel for both debt repayment and wealth building.

- Automate Everything: Set up automatic transfers for debt payments and investment contributions. This removes the decision-making friction and ensures consistency.

Conclusion: Your Path to Financial Domination

Crushing debt and building lasting wealth simultaneously isn’t just possible; it’s a powerful strategy for men who are ready to take full command of their financial future. By understanding your situation, executing a dual-pronged attack on debt and wealth creation, and cultivating a disciplined mindset, you can accelerate your journey to financial independence. Start today, stay consistent, and watch as you build a robust financial fortress that will serve you and your legacy for decades to come.