In a world of unpredictable expenses and economic shifts, financial security isn’t just a goal—it’s a necessity. For many men, the pressure to provide, protect, and remain steadfast can be immense. Building an emergency fund is one of the most fundamental and empowering steps you can take to safeguard your future and alleviate financial stress. This isn’t about hoarding cash; it’s about creating a safety net that protects you, your family, and your aspirations from life’s inevitable curveballs. And the good news? You can build it faster than you think.

Why an Emergency Fund is Non-Negotiable for Every Man

Think of an emergency fund as your financial fortress. It’s a dedicated pool of money specifically designed to cover unexpected costs without derailing your long-term financial goals or forcing you into debt. Life throws a lot at us: a sudden job loss, an unexpected car repair, a medical emergency, or even home repairs. Without this fund, these events can quickly snowball into major financial crises, leading to high-interest debt and significant stress. Having readily available cash means you can face these challenges head-on, without compromising your current lifestyle or future investments.

Setting Your Target: How Much Do You Really Need?

The standard advice for an emergency fund is to save three to six months’ worth of essential living expenses. For men with dependents or less stable income, aiming for six to twelve months might be a wiser choice. Start by calculating your monthly essential expenses: rent/mortgage, utilities, groceries, transportation, insurance, and minimum debt payments. Exclude discretionary spending like dining out or entertainment for this calculation. Once you have this number, multiply it by your target number of months to arrive at your ultimate savings goal.

Rapid Accumulation Strategies: Build Your Fund Faster

1. Ruthless Budgeting and Expense Slicing

This is where the rubber meets the road. Go through every single expense item by item. Where can you cut back, even temporarily? Cancel unused subscriptions, pack your lunch instead of buying, reduce discretionary spending on entertainment, or temporarily pause non-essential purchases. Every dollar saved from your regular budget can be redirected to your emergency fund.

2. Boost Your Income: Side Hustles and Overtime

If cutting expenses isn’t enough, or if you want to accelerate your savings, look for ways to earn more. Can you pick up extra shifts at work? Start a freelance gig related to your skills (web design, writing, consulting)? Drive for a ride-sharing service, deliver food, or offer handyman services on weekends? Every extra dollar earned should go straight into your emergency fund, not into lifestyle inflation.

3. Automate Your Savings

Set up an automatic transfer from your checking account to your dedicated emergency savings account immediately after each paycheck. Start small if you need to, but aim to increase the amount regularly. Automation removes the need for willpower and ensures consistent progress, making saving feel less like a chore and more like an effortless habit.

4. Sell Unused Items

Declutter your home and convert forgotten assets into cash. Old electronics, tools you no longer use, sports equipment, or even clothes can be sold on online marketplaces, at garage sales, or consignment shops. Not only does this clear space, but it also provides a quick influx of cash for your fund.

5. Channel Windfalls and Bonuses

Tax refunds, work bonuses, gifts, or any unexpected money should be treated as prime candidates for your emergency fund. Resist the urge to spend these windfalls. Directing them entirely to your savings goal can significantly reduce the time it takes to reach your target.

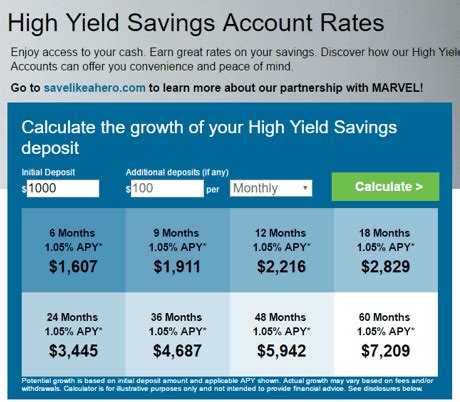

Where to Keep Your Emergency Fund

Your emergency fund needs to be liquid (easily accessible) but separate from your everyday checking account to avoid accidental spending. A high-yield online savings account is an ideal choice. It offers better interest rates than traditional banks, is FDIC-insured, and typically keeps the money slightly out of immediate reach, reducing the temptation to dip into it for non-emergencies. Avoid investing this money in the stock market; while it offers higher returns, it also comes with volatility that makes it unsuitable for funds you might need instantly.

The Path to Unshakeable Financial Security

Building an emergency fund is more than just accumulating money; it’s about building resilience, confidence, and true financial security. It frees you from the anxiety of unexpected expenses, allowing you to focus on larger financial goals like investments, homeownership, or retirement. Embrace these strategies, stay disciplined, and watch as your financial fortress rapidly takes shape. The peace of mind you gain will be immeasurable, providing a solid foundation for every aspect of your life.