Taking Control of Your Financial Future

For many men, taking charge of personal finances can feel like a daunting task. Yet, mastering your money is a cornerstone of true independence, security, and the ability to build the life you want. Whether you’re just starting out, navigating mid-career challenges, or planning for retirement, understanding how to budget effectively, crush debt, and build emergency funds are non-negotiable skills.

This guide cuts through the noise, offering actionable strategies tailored to help you gain control, reduce stress, and set yourself up for lasting financial success. It’s time to stop letting money manage you and start managing your money like a pro.

The Foundation: Budgeting Effectively

Budgeting isn’t about restriction; it’s about control. It’s a roadmap that tells your money where to go instead of wondering where it went. For men, a budget can be a powerful tool to achieve specific goals, from buying a house to funding a passion project.

Step-by-Step Budget Creation:

- Track Your Spending: For one month, meticulously record every dollar you spend. Use apps, spreadsheets, or a simple notebook. This reveals where your money is actually going.

- Categorize Expenses: Group your spending into categories like housing, transportation, food, entertainment, and utilities. Separate needs from wants.

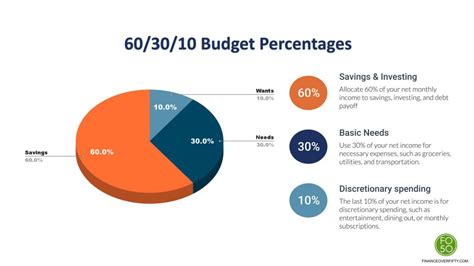

- Set Realistic Limits: Based on your income and tracking data, allocate a specific amount to each category. A popular method is the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

- Choose Your Budgeting Method: Experiment with tools like Mint, YNAB (You Need A Budget), or even a simple Excel sheet. Find one that fits your style and you’ll stick with.

- Review and Adjust: Your budget isn’t set in stone. Life changes, so review your budget monthly and make necessary adjustments.

The key is consistency. Stick with it, and you’ll transform your financial habits and gain clarity on your spending patterns.

Conquering Debt: Strategies for Freedom

Debt can feel like a heavy chain, limiting your choices and adding significant stress. From credit card balances to student loans, understanding and aggressively tackling your debt is crucial for financial freedom.

Two Powerful Debt Reduction Strategies:

- The Debt Snowball Method: List all your debts from smallest balance to largest. Pay the minimum on all debts except the smallest, on which you focus all your extra money. Once the smallest is paid off, take the money you were paying on it and add it to the payment of the next smallest debt. This method provides psychological wins as debts are eliminated quickly.

- The Debt Avalanche Method: List all your debts from highest interest rate to lowest. Pay the minimum on all debts except the one with the highest interest rate, on which you focus all your extra money. This method saves you the most money in interest over time.

Choose the method that motivates you most. Additionally, consider negotiating lower interest rates with creditors or consolidating high-interest debt into a single, lower-interest loan if appropriate. The faster you eliminate debt, the more financial resources you free up for building wealth.

Building Your Financial Shield: The Emergency Fund

Life is unpredictable. A job loss, unexpected medical bill, or car repair can derail your finances if you’re unprepared. An emergency fund acts as your financial shield, protecting you from these unforeseen events without plunging you into debt.

How to Build a Robust Emergency Fund:

- Determine Your Target: Aim for 3-6 months’ worth of essential living expenses. Calculate your monthly needs (rent/mortgage, utilities, food, transportation, insurance).

- Set Up a Separate, Accessible Account: Keep your emergency fund in a separate, high-yield savings account that is easily accessible but not linked to your daily spending. This prevents accidental spending and allows your money to grow a little.

- Automate Your Savings: Treat your emergency fund contribution like a bill. Set up an automatic transfer from your checking account to your emergency savings account each payday. Even small, consistent contributions add up quickly.

- Prioritize It: Before investing heavily or paying off low-interest debt, prioritize building at least a foundational emergency fund (e.g., $1,000). This provides immediate peace of mind.

Sustaining Momentum and Looking Ahead

Achieving financial mastery isn’t a one-time event; it’s an ongoing journey. Once you’ve established effective budgeting, made significant strides in debt reduction, and built a solid emergency fund, the next steps involve maintaining momentum and setting new goals.

- Regular Reviews: Continue to review your budget and financial progress monthly or quarterly. Adjust as your income, expenses, and goals evolve.

- Invest for the Future: With your financial foundation secure, start exploring investment options. Contribute to retirement accounts (401k, IRA), consider brokerage accounts, or save for larger purchases like a down payment on a home.

- Educate Yourself: Continuously learn about personal finance. Read books, listen to podcasts, and stay informed about economic trends. The more you know, the better decisions you can make.

Taking control of your money empowers you to live life on your terms, pursue your ambitions, and secure a prosperous future for yourself and your loved ones. Start today, stay consistent, and watch your financial landscape transform.