The Modern Man’s Financial Fitness Challenge

For many men, the drive to maintain physical fitness is as strong as the desire to build a secure financial future. However, these two crucial aspects of life often feel like they’re competing for the same resources: time and money. Juggling gym memberships, quality nutrition, and the latest gear with savings goals, debt reduction, and investment portfolios can seem like an impossible feat. The good news is, it’s not. With strategic planning and discipline, you can sculpt both your physique and your financial well-being simultaneously.

Smart Spending on Your Physical Prime

Investing in your health is non-negotiable, but smart investing is key. Before signing up for the most expensive gym or buying every supplement under the sun, assess your actual needs and budget. A high-end gym with all the bells and whistles might be great, but a more affordable option or even a well-equipped home gym could offer similar benefits without draining your wallet. Consider the long-term value of your fitness choices.

- Budget for Fitness: Allocate a specific amount for gym fees, sports activities, or home equipment. Treat it like a non-negotiable bill.

- Evaluate Subscriptions: Are you using that online fitness app or class subscription enough to justify the cost? Be honest with yourself.

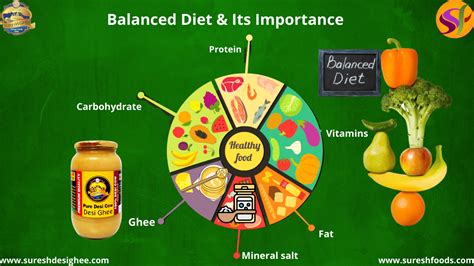

- Cost-Effective Nutrition: Prioritize whole foods over expensive pre-packaged diet meals or excessive supplements. Meal prepping can save significant money and ensure better nutritional control.

- Utilize Free Resources: Running outdoors, bodyweight exercises, and free online workout videos are powerful tools that cost nothing.

Laying the Foundation for Future Wealth

While your body benefits from immediate investments, your financial future demands consistent, disciplined attention. The core principles of wealth building remain steadfast, regardless of your fitness aspirations.

Start with a robust emergency fund – typically 3-6 months of living expenses – to cushion against unexpected life events. Next, tackle high-interest debt aggressively; the money saved on interest can be redirected towards your fitness goals or investments. Then, prioritize retirement savings, ideally contributing enough to max out employer matches in a 401(k) or similar plan, and explore Roth IRAs or traditional IRAs. These foundational steps ensure that your long-term financial health isn’t compromised by short-term spending.

Strategies for Financial-Fitness Synergy

The trick isn’t choosing between fitness and finance, but making them work in harmony. Here’s how to create a synergistic approach:

1. Prioritize & Automate

Decide what truly matters. Is that new pair of sneakers a critical need, or would that money be better allocated to your investment portfolio this month? Set up automatic transfers for your savings, investments, and even your gym membership. This “set it and forget it” approach ensures consistency and reduces the temptation to overspend on either front.

2. Find Affordable Fitness Solutions

Look for fitness options that align with your budget. Community centers often offer affordable memberships. Consider group fitness challenges that motivate without breaking the bank. Sometimes, a running club or a home workout routine can be just as effective as a premium gym membership.

3. Leverage Health for Wealth

Good physical health can translate directly into financial savings. Regular exercise and a healthy lifestyle can reduce healthcare costs in the long run, lower insurance premiums, and even improve productivity at work, potentially leading to higher earnings. View your fitness spending as an investment in preventing future, more significant medical expenses.

4. Set Clear, Measurable Goals

Just as you set fitness goals (e.g., “lose 10 pounds,” “run a marathon”), set clear financial goals (e.g., “save $5,000 for a down payment,” “increase retirement contributions by 2%”). Break them down into smaller, achievable steps. Tracking progress in both areas provides motivation and a sense of accomplishment.

Conclusion: The Path to Holistic Well-being

Balancing fitness goals with future wealth creation isn’t about deprivation; it’s about smart choices and strategic planning. By understanding your priorities, budgeting effectively, and finding synergies between your health and financial habits, you can build a robust foundation for a life of strength, vitality, and financial security. It’s an ongoing journey, but one where consistency and commitment will pay dividends in every aspect of your life.