The Roadmap to Financial Fitness: A Man’s Guide to Wealth Building

Achieving financial fitness isn’t just about accumulating money; it’s about building a robust system that supports your life goals, provides security, and ensures long-term prosperity. For men, this journey often involves navigating unique career paths, family responsibilities, and investment opportunities. This guide provides a comprehensive plan to build substantial wealth and secure your financial future.

1. Establish a Strong Foundation: Mindset and Cash Flow Mastery

Cultivating a Wealth-Oriented Mindset

Your journey to wealth begins with your mindset. Adopt a long-term perspective, understand the power of compound interest, and commit to continuous learning about personal finance. Financial literacy is not a destination but an ongoing pursuit. Embrace discipline, patience, and the willingness to make smart, sometimes difficult, financial choices today for a richer tomorrow.

Master Your Cash Flow: The Power of Budgeting

Understanding where your money goes is paramount. Create a detailed budget that tracks all income and expenses. Utilize tools or apps to categorize spending, identify areas for reduction, and allocate funds towards savings and investments. A clear budget empowers you to make intentional spending decisions, ensuring you live within your means and direct resources towards wealth-building objectives.

2. Eradicate Debt and Supercharge Savings

Conquering High-Interest Debt

High-interest debt, such as credit card balances or personal loans, acts as a significant drag on your wealth-building efforts. Prioritize paying these off aggressively. Consider strategies like the debt snowball or debt avalanche method to systematically eliminate these burdens, freeing up more capital for investment.

Supercharge Your Savings

Beyond paying off debt, focus on building robust savings. Start with an emergency fund covering 3-6 months of living expenses. This provides a crucial safety net against unexpected events, preventing you from incurring new debt. After securing your emergency fund, direct savings towards specific goals like a down payment for a home, education, or significant purchases, always aiming to automate these contributions.

3. Strategic Investing for Long-Term Growth

Start Early, Invest Consistently

The earlier you start investing, the more time your money has to grow through compounding. Even small, consistent contributions over a long period can lead to substantial wealth. Automate your investments into retirement accounts (401k, IRA) and taxable brokerage accounts.

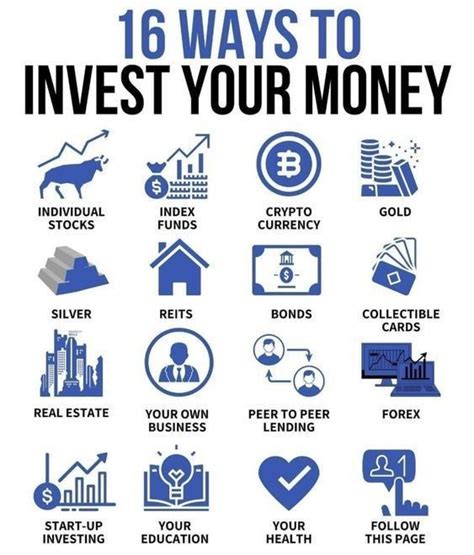

Diversification is Key

Don’t put all your eggs in one basket. Diversify your investments across different asset classes (stocks, bonds, real estate), industries, and geographies. This strategy helps mitigate risk and provides a more stable growth trajectory. Consider low-cost index funds or ETFs for broad market exposure and built-in diversification.

Understanding Risk Tolerance

Your investment strategy should align with your personal risk tolerance and time horizon. Younger investors with a longer time horizon can typically afford to take on more risk for potentially higher returns, while those closer to retirement might opt for more conservative portfolios. Regularly assess and adjust your risk profile as your life circumstances change.

4. Grow Your Income and Protect Your Future

Enhance Your Earning Potential

Your greatest asset is often your ability to earn. Continuously seek opportunities to increase your income through skill development, career advancement, entrepreneurship, or side hustles. Investing in yourself through education, certifications, or networking can lead to significant boosts in earning power, accelerating your wealth accumulation.

Protect Your Assets: Insurance and Estate Planning

Wealth building isn’t just about accumulating; it’s also about protecting what you’ve built. Secure adequate insurance coverage (life, health, disability, property) to shield yourself and your loved ones from unforeseen financial catastrophes. Furthermore, establish an estate plan, including a will, power of attorney, and potentially trusts, to ensure your assets are distributed according to your wishes and to minimize tax implications.

5. The Power of Review and Adaptability

Regular Financial Check-ups

Your financial plan isn’t a static document; it’s a living guide. Schedule annual or semi-annual financial reviews to assess your progress, adjust your budget, rebalance your investment portfolio, and update your goals. Life events such as marriage, children, career changes, or economic shifts will necessitate adjustments to your plan.

Stay Informed and Adapt

The financial landscape is constantly evolving. Stay informed about market trends, economic indicators, and changes in tax laws. This knowledge will enable you to make timely adjustments to your strategy, ensuring your wealth-building plan remains robust and effective.

Conclusion

Building wealth and achieving financial fitness is a marathon, not a sprint. It requires discipline, consistency, ongoing education, and the willingness to adapt. By establishing a solid foundation, managing debt, investing strategically, growing your income, protecting your assets, and regularly reviewing your progress, men can confidently navigate the path to lasting financial independence and a secure future.