Money matters are often a leading cause of stress in relationships, and it’s completely normal for partners to have differing views on spending, saving, and financial priorities. The key to a healthy relationship isn’t avoiding these disagreements, but rather learning how to handle them respectfully and constructively. By approaching financial discussions with empathy and a willingness to understand, you can turn potential conflict into an opportunity for growth and stronger connection.

Acknowledge and Understand Each Other’s Perspectives

Before diving into solutions, take the time to truly understand where your partner is coming from. Everyone develops their financial habits and beliefs based on their upbringing, past experiences, and personal values. One partner might be a natural saver, while the other is more inclined to spend. Neither approach is inherently wrong, but they can clash if not communicated. Listen actively without judgment, allowing your partner to express their concerns, fears, or aspirations related to money.

Ask open-ended questions like, “What are your biggest worries about our finances right now?” or “What does financial security mean to you?” This helps uncover underlying emotions and motivations, moving beyond surface-level arguments about specific purchases or bills. Empathy is your most powerful tool here.

Set the Right Environment for Discussion

Timing and setting are crucial for productive financial conversations. Avoid bringing up sensitive money topics when one or both of you are stressed, tired, or in a rush. Choose a calm, private moment when you can give each other your full attention. This might be over a quiet dinner, during a weekend morning, or scheduled specifically as a ‘money meeting.’

Frame the discussion as ‘us against the problem,’ rather than ‘you against me.’ Use ‘I’ statements to express your feelings and needs, for example, “I feel anxious when we don’t track our expenses,” instead of “You never track our expenses.” Focus on finding solutions that benefit both of you and the relationship as a whole.

Establish Shared Financial Goals

Once you understand each other’s perspectives, work together to define common financial goals. These could be short-term, like saving for a vacation or paying off a credit card, or long-term, such as buying a house, saving for retirement, or funding your children’s education. Having shared objectives provides a powerful motivation to compromise and work together.

When you have a joint vision for the future, current disagreements about spending or saving become easier to navigate because you can evaluate them in the context of your shared aspirations. Regularly revisit these goals to ensure you’re both still on the same page and to make adjustments as life circumstances change.

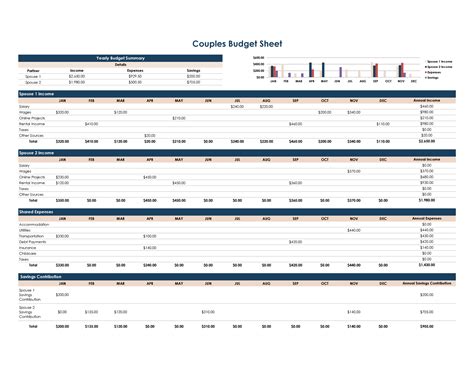

Create a Joint Financial Plan (and Review Regularly)

Translating goals into action requires a concrete plan. This might involve creating a budget, deciding on who handles which financial responsibilities, and agreeing on spending limits. Open a joint account for shared expenses, but consider individual accounts for personal spending to maintain some autonomy and prevent micro-managing each other’s smaller purchases.

A financial plan isn’t a one-time setup; it’s an ongoing process. Schedule regular ‘money dates’ – perhaps once a month – to review your budget, track your progress toward goals, and discuss any new financial decisions. These check-ins keep you both informed and accountable, reducing surprises and fostering transparency.

When to Seek Professional Help

If you find yourselves consistently stuck in financial arguments, unable to find common ground, or if money issues are causing significant strain on your relationship, don’t hesitate to seek external support. A financial advisor can offer objective advice and help you create a sustainable plan. A couples therapist specializing in financial issues can provide tools and strategies for better communication and conflict resolution around money.

Remember, seeking help is a sign of strength and commitment to your relationship, not a failure. It provides a safe space for both partners to express themselves and learn new ways to tackle financial challenges together.

Handling financial disagreements with your partner respectfully is an ongoing process that requires patience, communication, and a shared commitment to the relationship. By understanding each other’s perspectives, setting clear goals, creating a actionable plan, and knowing when to ask for help, you can transform money into a source of strength rather than conflict, paving the way for a more secure and harmonious future together.