Building long-term wealth is a critical aspect of financial security and personal freedom for men. While the concept of investing might seem complex, starting early and making informed decisions can significantly impact your financial future. This guide outlines practical steps for men to effectively begin their investment journey, focusing on sustainable growth and achieving long-term financial goals.

Define Your Financial Goals and Timeline

Before you commit a single dollar, it’s essential to clearly define what you’re investing for. Are you saving for retirement, a down payment on a house, your children’s education, or simply general wealth accumulation? Each goal will have a different time horizon and may require a distinct investment strategy.

- Short-term goals (under 5 years): Often better suited for less volatile investments or high-yield savings accounts.

- Mid-term goals (5-10 years): A balanced approach with a mix of growth and stability may be appropriate.

- Long-term goals (10+ years): This is where equities (stocks) often shine due to their higher potential for growth over extended periods.

Having clear objectives will help you determine the appropriate level of risk and the types of investments to consider.

Assess Your Risk Tolerance

Understanding your comfort level with risk is paramount. A high-risk investment might offer greater potential returns but also carries a higher chance of significant losses. Conversely, low-risk investments provide stability but typically yield lower returns. Your risk tolerance is influenced by factors like your age, income stability, financial obligations, and emotional response to market fluctuations.

Men often feel pressured to take on more risk, but it’s crucial to be honest with yourself. An investment strategy that keeps you up at night is not sustainable. Use online risk assessment questionnaires or discuss with a financial advisor to get an objective view of your risk profile.

Build a Foundational Investment Portfolio

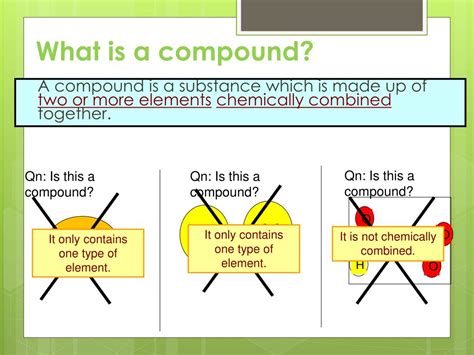

For long-term wealth growth, diversification is key. Don’t put all your eggs in one basket. A well-diversified portfolio typically includes a mix of different asset classes:

- Stocks (Equities): Represent ownership in companies and offer potential for significant growth, but also higher volatility.

- Bonds (Fixed Income): Essentially loans to governments or corporations, offering lower returns but greater stability.

- Mutual Funds & Exchange-Traded Funds (ETFs): Professionally managed portfolios of stocks, bonds, or other assets, providing instant diversification across many securities. These are excellent starting points for new investors.

- Real Estate: Can be a powerful wealth builder, either through direct ownership or Real Estate Investment Trusts (REITs).

Start with broad market index funds or ETFs to get exposure to a wide range of companies without needing to pick individual stocks. As you gain knowledge and confidence, you can gradually explore more specific investments.

The Power of Starting Early and Consistency

The single most powerful advantage an investor has is time, thanks to the magic of compound interest. Compound interest means your earnings also earn returns, leading to exponential growth over time. Even small, consistent contributions made early can outperform larger, later contributions.

Commit to a regular investment schedule, even if it’s a modest amount to start. Automate your contributions if possible, so you’re consistently investing without needing to make a conscious decision each month. This strategy, known as dollar-cost averaging, also helps mitigate risk by spreading your purchases over time, averaging out market fluctuations.

Automate Your Investments and Rebalance Regularly

Once you’ve set up your initial investments, automate contributions from your paycheck or bank account. This ‘set it and forget it’ approach ensures consistency and leverages the power of compound interest without requiring constant attention.

However, ‘set it and forget it’ doesn’t mean never looking at it. Periodically, typically once a year, review your portfolio to ensure it still aligns with your goals and risk tolerance. Market movements can cause your asset allocation to drift. Rebalancing involves selling some of your outperforming assets and buying more of your underperforming ones to bring your portfolio back to its original target allocation. This helps manage risk and can even enhance returns over the long run.

Avoid Common Pitfalls and Seek Expert Advice

Men often fall prey to common investing mistakes, such as:

- Emotional Investing: Making impulsive decisions based on fear or greed, often leading to buying high and selling low.

- Chasing Hot Trends: Investing in speculative assets or sectors solely because they’re currently popular, ignoring fundamentals.

- Lack of Diversification: Concentrating too much wealth in a single stock or industry.

- Impatience: Expecting quick riches and getting discouraged by short-term market downturns.

If you feel overwhelmed or unsure, consider seeking advice from a qualified financial advisor. A professional can help you define goals, assess risk, build a suitable portfolio, and keep you accountable, especially during volatile market conditions. This is an investment in itself that can pay significant dividends over your financial lifetime.

Conclusion

Starting your investment journey for long-term wealth growth is a marathon, not a sprint. It requires patience, discipline, and a commitment to continuous learning. By setting clear goals, understanding your risk profile, diversifying your portfolio, starting early, and automating your contributions, men can lay a solid foundation for financial independence and achieve their long-term aspirations. The most crucial step is to simply begin.