The Crucial Conversation: Why Financial Discussions Matter

Money is one of the leading causes of conflict in relationships, yet it’s often the topic partners avoid most. Open and honest financial discussions are not just about budgeting or saving; they are about understanding each other’s values, dreams, fears, and building a shared future. When handled with care, these conversations can significantly strengthen your bond and build profound trust.

Avoiding financial talks can lead to misunderstandings, resentment, and even secret spending, eroding the very foundation of your partnership. Instead of a source of stress, view these discussions as an opportunity to grow together and align your life goals.

Setting the Stage for Productive Money Talks

The environment and timing of your financial discussions are as important as the content itself. Rushing a conversation or bringing it up during a stressful moment is a recipe for conflict. Here’s how to create an optimal setting:

1. Choose the Right Time and Place

- Schedule it: Treat it like an important meeting. Set aside dedicated time when both of you are relaxed, well-rested, and free from distractions. Avoid discussing money when you’re tired, hungry, or stressed.

- Neutral Territory: A quiet coffee shop, your dining room table, or a cozy corner of your home can work, as long as it feels calm and private.

2. Establish Ground Rules

- No Blame, No Shame: Approach the conversation as a team. The goal is to understand, not to criticize or assign blame for past mistakes.

- Listen Actively: Give your partner your full attention. Let them finish speaking before you respond.

- Be Honest and Transparent: Share all financial information, even the uncomfortable parts. Secrecy breeds distrust.

Practical Tips for Engaging in Financial Conversations

Once you’ve set the stage, these practical approaches can guide your discussions:

1. Understand Each Other’s Money Mindset

Everyone has a unique relationship with money shaped by their upbringing, experiences, and personality. One partner might be a natural saver, while the other is a spender. Discuss:

- What did you learn about money growing up?

- What are your biggest financial fears?

- What does financial security mean to you?

Understanding these underlying perspectives can foster empathy and explain differing financial behaviors.

2. Share Your Current Financial Picture

Lay out all the facts on the table, metaphorically speaking:

- Income: Individual and combined.

- Debts: Credit cards, student loans, mortgage, car loans.

- Assets: Savings, investments, property.

- Expenses: Regular bills, discretionary spending.

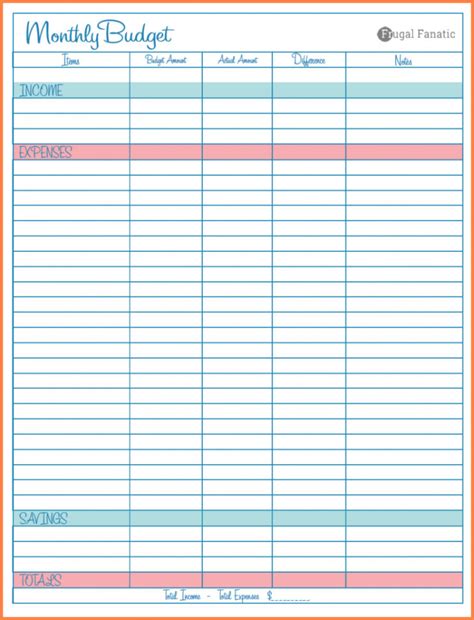

Tools like spreadsheets, budgeting apps, or even a simple pen and paper can help organize this information. Transparency is key here.

3. Define Shared Financial Goals

This is where money becomes a powerful tool for building a shared future. Discuss what you want to achieve together:

- Short-term goals (e.g., a vacation, new appliance).

- Mid-term goals (e.g., buying a home, paying off debt).

- Long-term goals (e.g., retirement, children’s education, legacy planning).

Aligning on these goals provides a common purpose and makes financial sacrifices feel more meaningful.

4. Create a Budget and Spending Plan Together

A budget isn’t about restricting joy; it’s about allocating your resources to achieve your goals while still enjoying life. Work together to create a realistic budget that reflects your shared income and goals. Decide on:

- How much to save each month.

- How much to allocate to fixed expenses (rent, utilities).

- How much discretionary spending each person can have without needing approval.

This joint effort ensures both partners feel ownership and commitment to the plan.

Navigating Disagreements and Building Trust

It’s natural to have different opinions, especially when it comes to money. The key is how you handle these differences.

1. Practice Compromise

Finding a middle ground is essential. If one partner wants to save aggressively and the other wants to spend more on experiences, brainstorm ways to do both. Maybe you save for a big trip, but also allocate a smaller amount for regular fun activities.

2. Seek Professional Help if Needed

If financial discussions consistently lead to arguments, or if you’re struggling to agree on major decisions, consider consulting a financial planner or a relationship counselor. An unbiased third party can facilitate conversations and offer expert advice.

3. Regular Check-ins

Financial situations and goals evolve. Make it a habit to schedule monthly or quarterly financial check-ins. This isn’t about micro-managing; it’s about staying on track, adjusting the budget as needed, and celebrating progress together.

The Reward: A Stronger, More Secure Partnership

Discussing finances with your partner might feel daunting at first, but it’s an investment in your relationship’s health and longevity. By fostering open communication, understanding each other’s perspectives, and working as a team, you not only avoid common conflicts but also build a deeper layer of trust and security that strengthens your bond for years to come. A united front on finances leads to a more harmonious and fulfilling shared life.