The Dual Pursuit: Fitness and Finances

Both physical well-being and financial stability are pillars of a fulfilling life. While seemingly disparate, achieving consistent progress in either domain demands a common, often elusive, ingredient: mental discipline. It’s not about sudden bursts of motivation, but the sustained effort to make choices aligned with your long-term goals, even when immediate gratification beckons.

Many embark on fitness journeys or financial planning with enthusiasm, only to find their resolve falter. The key to unlocking enduring success in both lies in cultivating a robust mental framework that champions consistency, resilience, and delayed gratification.

Understanding the Core of Mental Discipline

Mental discipline is the ability to control your thoughts, emotions, and actions to stay focused on a goal, especially when faced with distractions, discomfort, or temptation. It’s the inner strength that allows you to adhere to a plan, maintain routines, and resist impulses that undermine your progress. In essence, it’s about making conscious, rational decisions over instinctive, emotional ones.

For fitness, this means showing up for workouts when you’re tired, choosing healthy meals over junk food, and pushing through discomfort. For finances, it translates to sticking to a budget, saving diligently, and resisting unnecessary purchases.

Strategies for Consistent Fitness

Developing mental discipline for fitness starts with clear, realistic goals. Don’t aim for perfection overnight; instead, focus on sustainable habits. Start small: a 15-minute walk daily, swapping one sugary drink for water. Gradually increase the intensity and duration as your discipline strengthens.

1. Set SMART Goals

Define Specific, Measurable, Achievable, Relevant, and Time-bound fitness goals. Instead of “I want to get fit,” try “I will run 5k in under 30 minutes by next quarter by training three times a week.”

2. Build Unbreakable Habits

Utilize habit stacking (linking a new habit to an existing one, e.g., “After I brush my teeth, I will do 10 push-ups”) and environment design (e.g., lay out your workout clothes the night before). Consistency trumps intensity in the long run.

3. Embrace Discomfort and Track Progress

Understand that fitness involves pushing past comfort zones. Celebrate small victories – a new personal best, a week of consistent workouts. Visualizing your progress reinforces positive behavior and strengthens your resolve.

Building Mental Fortitude for Financial Growth

Financial discipline, much like fitness, is a marathon, not a sprint. It requires foresight, patience, and the ability to delay gratification for greater future rewards. The temptations of consumerism are ever-present, making mental resilience crucial.

1. Create a Realistic Budget and Stick to It

A budget isn’t restrictive; it’s a roadmap. Understand where your money goes. Categorize expenses, set limits, and regularly review your spending. The discipline comes from adhering to these limits, even when something shiny catches your eye.

2. Prioritize Saving and Investing

Automate your savings and investments. “Pay yourself first” ensures a portion of your income goes towards your future before you have a chance to spend it. This removes the decision-making process, making discipline easier.

3. Differentiate Needs vs. Wants

Cultivate awareness around your spending triggers. Before making a non-essential purchase, implement a waiting period (e.g., 24-48 hours). This pause allows rational thought to override impulsive desires.

Shared Principles: The Bedrock of Dual Success

The mental muscles you build in one area often transfer to the other. Both fitness and financial growth thrive on several common principles:

1. Consistency is King

Small, consistent actions yield massive results over time. One skipped workout or one overspending spree won’t ruin everything, but a pattern of inconsistency will.

2. Delayed Gratification

Sacrificing immediate pleasure for long-term benefit is the hallmark of mental discipline. Enduring a tough workout for a healthier body, or saving money instead of buying a gadget for financial security, are prime examples.

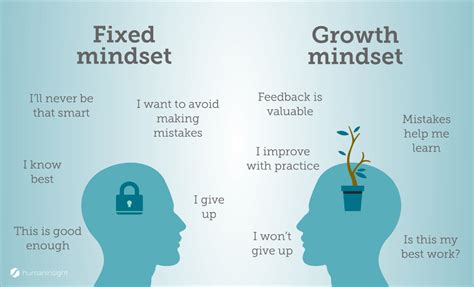

3. Resilience and Learning from Setbacks

There will be days you miss a workout or overspend. The discipline isn’t about never failing, but about how quickly you recover, learn from the setback, and get back on track. View failures as data points, not defeat.

4. Mindful Awareness

Being present and aware of your choices, whether it’s what you’re eating, how you’re moving, or where your money is going, empowers you to make disciplined decisions rather than operating on autopilot.

Forge Your Discipline, Transform Your Life

Developing mental discipline for consistent fitness and financial growth isn’t about being perfect; it’s about being persistent. It’s a skill, honed through practice, self-awareness, and a commitment to your future self. By implementing clear goals, building strong habits, embracing delayed gratification, and learning from every step, you can cultivate the unwavering mental fortitude needed to build the healthy, financially secure life you envision. Start small, stay consistent, and watch your discipline grow, transforming both your body and your bank account.