Unlocking Your Potential Through Inner Resolve

In a world brimming with distractions and instant gratification, the ability to maintain unwavering discipline stands as a cornerstone for success, particularly in crucial areas like fitness and finance. It’s not merely about having willpower; it’s about cultivating a deep-seated mindset that propels you forward, even when motivation wanes. This article explores how to forge that powerful inner resolve, transforming aspirations into tangible achievements.

The Mindset: The True Engine of Discipline

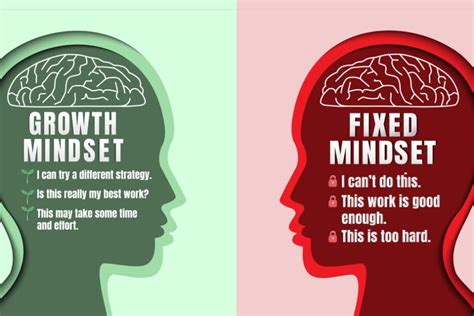

Many equate discipline with punishment or restriction, but at its core, it’s a conscious commitment to long-term goals over short-term desires. This commitment originates in the mind. A disciplined mindset is one that understands delayed gratification, embraces process over outcome, and views setbacks as feedback rather than failures. It’s about making a consistent choice, day after day, that aligns with your ultimate vision for a healthier body and a secure financial future.

Pillars of a Disciplined Mindset

1. Clarity of Vision and Purpose

Before you can be disciplined, you must know what you’re being disciplined for. Clearly define your fitness goals (e.g., run a marathon, lose X pounds, build strength) and financial goals (e.g., save for a down payment, retire by age X, pay off debt). Visualize the outcome vividly. This clear purpose acts as your North Star, guiding your decisions when temptations arise.

2. Embrace Small, Consistent Steps

Overwhelming goals often lead to paralysis. Break down your grand aspirations into tiny, actionable steps. Instead of “workout every day,” try “walk for 15 minutes three times a week.” For finance, instead of “save $10,000,” try “automate a $50 transfer to savings each week.” Consistency in small actions builds momentum and habit, making discipline feel less like a struggle and more like a routine.

This principle is often referred to as habit stacking or micro-habits, where you attach a new desired behavior to an existing one. For instance, after brushing your teeth, do 10 push-ups, or after getting your paycheck, immediately transfer a set amount to your savings before anything else.

3. Cultivate Delayed Gratification

Both fitness and finance require sacrificing immediate pleasure for future gain. Choosing a healthy meal over fast food, or saving money instead of buying a new gadget, are acts of delayed gratification. Train your mind to appreciate the long-term rewards. Remind yourself that the future you will thank the present you for making the harder, more beneficial choice.

4. View Discomfort as Growth

Discipline often means pushing through discomfort – whether it’s the burn of a workout or the pang of resisting an impulse purchase. Shift your perspective: view discomfort not as a deterrent, but as a signal of growth and progress. The more you step outside your comfort zone, the more resilient and disciplined your mindset becomes.

5. Implement Accountability and Systems

Discipline doesn’t have to be a lonely journey. Find an accountability partner, join a fitness group, or work with a financial advisor. Create systems that support your goals: set up automatic transfers for savings, lay out your workout clothes the night before, meal prep. These external structures reduce the reliance on sheer willpower and make disciplined choices easier.

Applying Discipline to Fitness

In fitness, unwavering discipline manifests as consistent workouts, mindful nutrition, adequate rest, and resisting unhealthy cravings. It’s about showing up even when you don’t feel like it, choosing whole foods over processed ones, and prioritizing sleep. This consistent effort, fueled by a disciplined mindset, compounds over time into significant health improvements.

Applying Discipline to Finance

Financially, discipline means adhering to a budget, saving consistently, investing wisely for the long term, and avoiding impulsive spending that derails your goals. It’s about making conscious decisions with every dollar, understanding the difference between needs and wants, and staying the course through market fluctuations or economic uncertainties. A disciplined financial mindset builds wealth and security gradually but surely.

Sustaining Your Disciplined Mindset

Discipline isn’t a destination; it’s an ongoing practice. There will be days when you falter. The key is not to dwell on perfection but to practice self-compassion and quickly get back on track. Learn from your slip-ups, adjust your strategy if necessary, and reinforce your commitment to your long-term vision. Celebrate small victories to keep motivation high, and regularly revisit your ‘why’ to rekindle your purpose.

Conclusion

Cultivating an unwavering disciplined mindset in fitness and finance is perhaps the most powerful personal development journey you can embark on. It transforms abstract goals into concrete realities, building not just a healthier body and a stronger bank account, but also incredible self-reliance and confidence. By focusing on clear vision, consistent small steps, delayed gratification, embracing discomfort, and building supportive systems, you can forge the mental fortitude required to achieve lasting success in every facet of your life.