High-interest debt can feel like a heavy anchor, dragging down your financial aspirations and preventing you from building wealth. Whether it’s credit card balances, personal loans, or other costly borrowing, these debts often come with crippling interest rates that make repayment a daunting uphill battle. But the good news is, with a strategic approach and unwavering discipline, you can not only tackle but “crush” this debt, paving your way to true financial freedom.

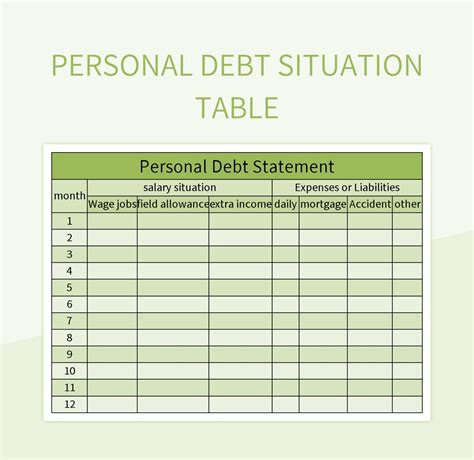

Understanding Your High-Interest Burden

Before you can effectively combat high-interest debt, you need to fully understand its scope. Gather all your debt statements and make a comprehensive list. For each debt, note:

- The creditor (e.g., credit card company, bank)

- The outstanding balance

- The interest rate (APR)

- The minimum monthly payment

This “debt inventory” is your battle plan. It allows you to see exactly what you’re up against and identify the most expensive debts that demand immediate attention.

Choosing Your Debt-Crushing Strategy: Avalanche or Snowball

There are two primary, highly effective methods for accelerated debt repayment:

The Debt Avalanche Method

This strategy prioritizes paying off debts with the highest interest rates first, regardless of the balance. You make minimum payments on all other debts and direct any extra money towards the debt with the highest APR. Once that debt is paid off, you roll the money you were paying on it into the next highest interest rate debt. This method saves you the most money in interest over time.

The Debt Snowball Method

In contrast, the debt snowball focuses on paying off the smallest balance debt first, while making minimum payments on all others. Once the smallest debt is gone, you take the money you were paying on it and add it to the payment of the next smallest debt. This method provides psychological wins early on, keeping motivation high, even if it might cost a bit more in interest over the long run.

Choose the method that best aligns with your personality and financial discipline. Both are powerful tools for accelerating repayment.

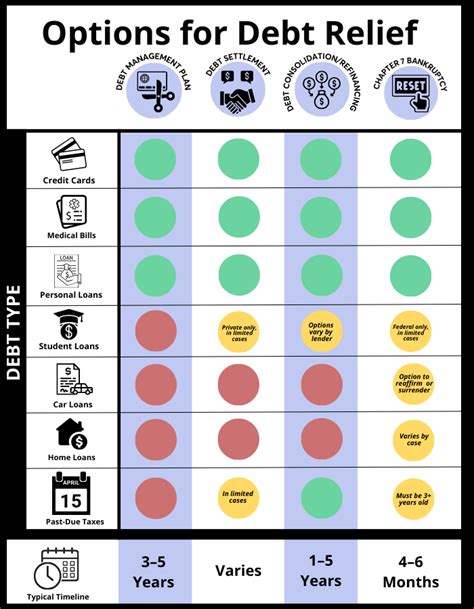

Explore Refinancing and Consolidation Options

Sometimes, restructuring your debt can give you a significant advantage, especially with high-interest balances.

Balance Transfer Credit Cards

If you have good credit, you might qualify for a balance transfer credit card that offers an introductory 0% APR period (typically 12-21 months). This allows you to transfer high-interest balances from existing cards to the new one and pay down the principal without accruing interest for a limited time. Be mindful of transfer fees (usually 3-5%) and ensure you can pay off the balance before the promotional period ends.

Debt Consolidation Loans

A personal loan can be used to consolidate multiple high-interest debts into a single, lower-interest monthly payment. This simplifies your payments and can reduce the overall interest paid, especially if your credit score has improved since you took on the original debts.

Supercharge Your Budget and Boost Income

To truly crush debt fast, you need to create “extra” money to throw at it.

Aggressive Budgeting and Expense Cutting

Go through your budget with a fine-tooth comb. Identify all non-essential expenses and look for areas to cut back drastically. This might mean temporarily reducing entertainment, dining out, subscriptions, or other discretionary spending. Every dollar saved is a dollar that can go towards your debt.

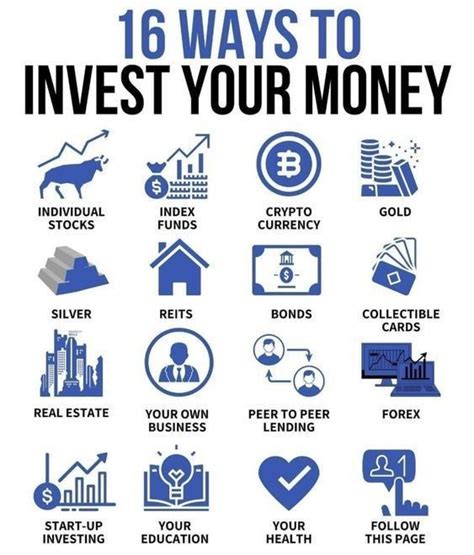

Increase Your Income

Consider ways to bring in more money. This could involve:

- Taking on a part-time job or side hustle

- Selling unused items around your home

- Asking for a raise at your current job

- Freelancing in your area of expertise

The more money you can dedicate to debt repayment, the faster you’ll reach your goal.

Maintain Momentum and Stay Disciplined

Debt repayment is a marathon, not a sprint. Consistency and discipline are crucial.

- Automate Payments: Set up automatic payments to ensure you never miss a deadline and always pay at least the minimum, if not more.

- Track Your Progress: Seeing your balances shrink can be incredibly motivating. Use spreadsheets, apps, or even a visual thermometer to track your journey.

- Avoid New Debt: During your debt-crushing phase, make a strict commitment to not take on any new debt. Cut up credit cards if necessary, or freeze them.

- Build an Emergency Fund: Once you’ve made significant progress, start building a small emergency fund (e.g., $1,000) to prevent new debt from arising due to unexpected expenses.

Conclusion

Crushing high-interest debt quickly requires a clear plan, commitment, and consistent effort. By understanding your debt, employing strategic repayment methods, exploring consolidation options, optimizing your budget, and increasing your income, you can accelerate your journey. Embrace the process, celebrate your milestones, and soon you’ll experience the profound relief and power of true financial freedom.