The Silent Siphon: Why High-Interest Debt is a Freedom Killer

High-interest credit card debt can feel like a relentless burden, silently siphoning away your hard-earned money and restricting your financial choices. It’s a common trap, but escaping it is not just possible—it’s a critical step towards achieving genuine financial freedom. This article will guide you through actionable strategies to dismantle that debt and empower your financial future.

The insidious nature of high-interest debt lies in its ability to make minimum payments feel like a bottomless pit. A significant portion of your payment goes straight to interest, barely touching the principal, and keeping you in a cycle of indebtedness. Recognizing this cycle is the first step towards breaking free.

Step 1: Get Real & Get Organized

Before you can crush your debt, you need to understand its full scope. Gather all your credit card statements and list every card, its current balance, interest rate (APR), and minimum payment due. This comprehensive overview will be your battle plan’s foundation. Knowing which cards carry the highest interest rates is crucial for prioritizing your attack.

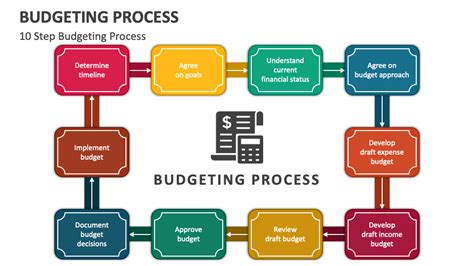

Step 2: Forge a Debt-Crushing Budget

A budget isn’t about deprivation; it’s about control. Create a realistic budget that tracks every dollar coming in and going out. Identify areas where you can cut back, even temporarily, to free up extra cash for debt repayment. Look for “budgeting blind spots” like subscriptions you don’t use, daily coffees, or excessive entertainment expenses. Every extra dollar directed towards your principal makes a difference.

Step 3: Choose Your Debt Repayment Strategy

Two popular and effective methods stand out for tackling multiple debts:

- The Debt Snowball Method: List your debts from smallest balance to largest. Pay the minimum on all cards except the smallest one, on which you throw every extra dollar you can find. Once the smallest is paid off, take the money you were paying on it and add it to the payment for the next smallest debt. This method builds psychological momentum as you quickly pay off smaller debts, providing motivation to continue.

- The Debt Avalanche Method: List your debts from highest interest rate to lowest. Pay the minimum on all cards except the one with the highest interest rate, on which you focus all your extra payments. Once that’s paid off, move to the next highest interest rate. This method saves you the most money on interest over time, making it financially efficient.

Choose the method that best suits your personality. If you need quick wins for motivation, go with the snowball. If you’re disciplined and want to save the most money, the avalanche is for you.

Step 4: Explore Debt Optimization Tools

Sometimes, external tools can accelerate your journey:

- Balance Transfers: If you have good credit, you might qualify for a 0% APR balance transfer credit card. This allows you to move high-interest balances to a new card with no interest for an introductory period (often 12-18 months). Use this window to aggressively pay down the principal, but be wary of transfer fees and ensure you can pay off the balance before the promotional period ends and high interest kicks in.

- Debt Consolidation Loans: A personal loan can consolidate multiple high-interest credit card debts into one single payment with a lower, fixed interest rate. This simplifies your payments and can significantly reduce the total interest paid. Ensure the interest rate on the consolidation loan is genuinely lower than your average credit card APRs.

Step 5: Boost Your Income & Embrace Frugality

Accelerating debt repayment often requires a dual approach: cutting expenses AND increasing income. Consider side hustles, selling unused items, or asking for a raise. Every additional dollar you can direct towards your principal balance will shorten your debt-free timeline. Review your spending habits regularly and challenge yourself to find creative ways to save money without sacrificing essential quality of life.

Step 6: Build a Robust Emergency Fund

Once you’ve made significant progress on your debt, or even while you’re attacking it, start building a small emergency fund (e.g., $1,000). This acts as a buffer against unexpected expenses, preventing you from relying on credit cards again and derailing your progress. Once the high-interest debt is gone, you can focus on building a larger emergency fund of 3-6 months’ worth of living expenses.

Step 7: Foster Healthy Financial Habits for Life

Crushing debt is a monumental achievement, but maintaining financial freedom requires ongoing discipline. Pay your credit card statements in full every month. Review your budget regularly. Continue to save and invest for your future. Understand your credit score and how to maintain a good one. These habits will ensure you never fall back into the high-interest trap.

Embrace Your Financial Freedom

The journey to crush high-interest credit card debt might be challenging, but the destination—financial freedom—is well worth the effort. Imagine a life where your money works for you, not against you; where stress over debt payments is a distant memory, and you have the power to pursue your financial goals with confidence. By systematically applying these strategies, you’re not just paying off debt; you’re investing in a more secure, empowered, and free future.