The Silent Saboteur: How Procrastination Hinders Your Aspirations

Procrastination is a universal foe, a cunning adversary that whispers sweet nothings of “later” while silently eroding our progress towards crucial life goals. It’s particularly insidious when it comes to areas requiring consistent effort and discipline, such as managing finances and maintaining physical fitness. Both domains demand proactive engagement, yet both often fall victim to the ‘I’ll start tomorrow’ syndrome. Understanding this pervasive habit and developing robust strategies to overcome it is not just about ticking off tasks; it’s about reclaiming control over your financial destiny and physical well-being.

Unmasking the Roots of Procrastination

Before we can conquer procrastination, we must first understand its origins. It’s rarely about laziness; more often, it stems from fear – fear of failure, fear of success, fear of the unknown, or even fear of discomfort. Tasks related to finances, like budgeting or investment planning, can feel overwhelming due to their perceived complexity or the weight of potential consequences. Similarly, fitness goals, such as starting a new workout routine or adhering to a strict diet, often come with the discomfort of physical exertion and lifestyle changes. This emotional avoidance mechanism is what truly drives procrastination.

Turbocharging Your Financial Progress

When it comes to your finances, procrastination can manifest as delaying bill payments, avoiding budget creation, or putting off crucial investment decisions. Here’s how to shift from paralysis to progress:

- Break It Down: Large financial goals, like saving for retirement or a house, can seem daunting. Break them into smaller, manageable steps. Instead of “create a budget,” aim for “list monthly income,” then “list fixed expenses,” and so on.

- Automate Everything Possible: Set up automatic transfers for savings, investments, and even bill payments. This removes the decision-making process, making it harder to procrastinate.

- Schedule Financial Check-ins: Treat your financial reviews like important appointments. Block out time weekly or monthly to review spending, track progress, and adjust your budget.

- Visualize Success: Regularly imagine the positive outcomes of your financial discipline – the security, the freedom, the achievement of your dreams. This can be a powerful motivator.

Igniting Your Fitness Journey

Fitness goals are notorious for being put off until “tomorrow.” The initial discomfort, the time commitment, and the perceived lack of immediate results can all contribute to procrastination. Here’s how to get moving:

- Start Ridiculously Small: If a 30-minute workout feels overwhelming, commit to just 5 minutes. The goal is to build consistency and create a habit, not to achieve peak performance immediately. Once you start, you often find yourself continuing.

- Schedule and Protect Your Time: Just like financial check-ins, schedule your workouts. Write them in your planner or add them to your digital calendar. Treat them as non-negotiable appointments with yourself.

- Find Your Enjoyment: If you dread the gym, explore other activities. Dancing, hiking, cycling, or team sports can make fitness feel less like a chore and more like a pastime.

- Focus on How You Feel: Shift your focus from external metrics (weight, reps) to internal feelings (energy levels, mood, strength). Recognizing immediate positive impacts can reinforce the habit.

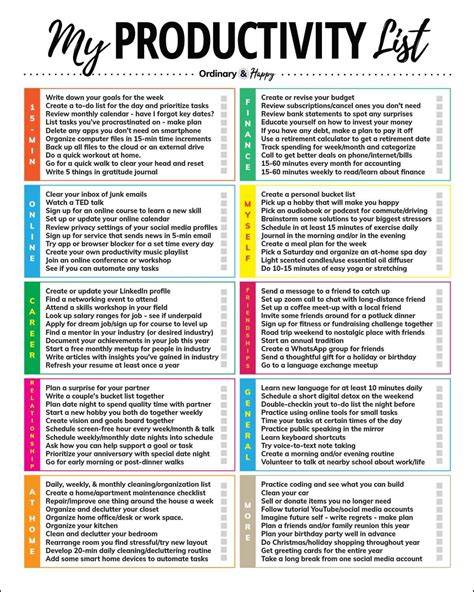

Universal Strategies to Beat the Procrastination Monster

Beyond domain-specific tactics, several general strategies can help you combat procrastination across the board:

- The Pomodoro Technique: Work for 25 minutes, then take a 5-minute break. Repeat. This breaks down large tasks and prevents burnout.

- “Eat the Frog”: Tackle your most challenging or dreaded task first thing in the morning. Once it’s done, the rest of your day feels lighter and more productive.

- Set Up Rewards: Promise yourself a small, non-detrimental reward for completing a procrastinated task. This creates positive reinforcement.

- Cultivate Self-Compassion: Don’t beat yourself up for past procrastination. Acknowledge the habit, forgive yourself, and focus on the present moment and what you can do now.

The Mindset Shift: Action Over Perfection

The core of conquering procrastination lies in a fundamental mindset shift: prioritizing action over perfection. Waiting for the “perfect” time or the “perfect” plan is often just another form of delay. Imperfect action taken consistently will always yield better results than perfect inaction. Recognize that every small step, every budget reviewed, every minute of exercise, compounds over time into significant financial stability and improved physical health.

Conclusion: The Power of Now

Conquering procrastination in your financial and fitness endeavors is not about finding a magic bullet, but about consistently applying practical strategies and cultivating a proactive mindset. By breaking down tasks, automating where possible, scheduling commitments, and focusing on small, consistent actions, you can dismantle the barriers that hold you back. Embrace the power of “now” and start building the financial security and vibrant health you deserve, one intentional step at a time.