The Cornerstone of Success: Why Discipline Matters

In a world brimming with fleeting motivation, unshakeable discipline stands as the bedrock for achieving significant, lasting success in both personal fitness and financial well-being. It’s the silent force that propels you forward when motivation wanes, ensuring consistent action towards your most ambitious goals. While often perceived as restrictive, true discipline is liberating – it frees you from the whims of instant gratification and aligns your daily actions with your deepest aspirations. Building this inner fortitude isn’t about brute force; it’s about strategic habit formation, mental resilience, and a clear understanding of your long-term vision.

Understanding the Nature of Discipline

Discipline is not merely doing what you don’t want to do; it’s about making conscious choices today that benefit your future self. It’s the ability to forgo immediate pleasure for greater long-term satisfaction. For fitness, this might mean choosing a workout over an extra hour of sleep. For finance, it could be saving a portion of your income instead of buying a new gadget. The key is recognizing that these are not sacrifices, but investments in your desired future.

It’s Not About Motivation, It’s About Habit

Motivation is an emotion; it fluctuates. Discipline, however, is a skill honed through consistent practice and the establishment of strong habits. Relying solely on motivation is like building a house on sand. Habits are the concrete foundation, ensuring your actions continue even when your enthusiasm dips.

Phase 1: Laying the Foundation – Clarity and Commitment

Define Your “Why” with Precision

Before you can build discipline, you must understand its purpose. Why do you want to achieve your fitness goals? Is it for better health, more energy, or to be a role model? For finance, is it for early retirement, a down payment on a home, or financial freedom? A clear, emotionally compelling “why” acts as your internal compass, guiding you through difficult moments and reinforcing your commitment.

Set SMART Goals

Vague goals lead to vague efforts. Ensure your fitness and finance goals are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of “I want to get fit,” try “I will run a 5k in 12 weeks.” Instead of “I want to save money,” aim for “I will save $500 per month for the next year for a down payment.” This clarity provides a roadmap and allows you to track progress effectively.

Phase 2: Building Blocks – Habits and Routines

Start Small and Be Consistent

The biggest mistake people make is trying to change too much too soon. Instead of aiming for an hour-long gym session daily, start with 15 minutes three times a week. Rather than cutting all discretionary spending, begin by reviewing your budget and finding one small area to reduce. Consistency, no matter how small the action, builds momentum and makes the new behavior feel natural over time. Focus on showing up, not on perfection.

Automate Your Decisions

Reduce the mental energy required for disciplined actions by automating them. For fitness, lay out your workout clothes the night before, or schedule your gym sessions like non-negotiable appointments. For finance, set up automatic transfers to your savings or investment accounts immediately after payday. The less you have to think about doing it, the more likely you are to do it.

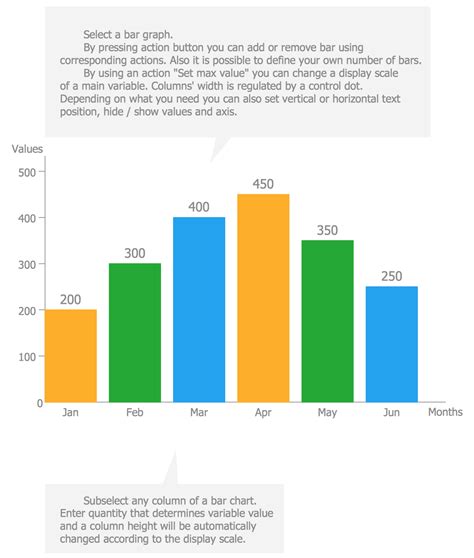

Track Your Progress Relentlessly

Seeing how far you’ve come is a powerful motivator and reinforces discipline. Use a fitness tracker, a journal, a budgeting app, or even a simple spreadsheet to log your workouts, meals, spending, and savings. Visualizing your progress, no matter how incremental, creates a positive feedback loop that strengthens your resolve and reminds you of the tangible results of your discipline.

Phase 3: Overcoming Obstacles – Resilience and Adaptability

Embrace Failure as Feedback

You will stumble. You will miss a workout, or overspend one month. The disciplined individual doesn’t view these as reasons to quit, but as opportunities to learn and adjust. Analyze what went wrong, adapt your strategy, and get back on track immediately. Discipline isn’t about never falling; it’s about getting back up every single time.

Cultivate a Growth Mindset

Believe in your capacity to grow and improve. Understand that your abilities are not fixed, and that challenges are opportunities for development. This mindset fosters persistence and resilience, crucial components for sustaining discipline through inevitable setbacks.

Seek Accountability and Support

Share your goals with a trusted friend, family member, or join a community of like-minded individuals. Having someone to check in with, or even just knowing someone is aware of your commitments, can provide an extra layer of motivation and help keep you on track. A personal trainer for fitness or a financial advisor for finance can also offer expert guidance and accountability.

Conclusion: The Empowering Path of Discipline

Building unshakeable discipline for your fitness and finance goals is a journey, not a destination. It requires patience, persistence, and a willingness to learn from every step. By defining your “why,” setting SMART goals, building small consistent habits, automating processes, tracking progress, and embracing setbacks as learning opportunities, you can forge an inner strength that will transform your aspirations into tangible realities. Discipline isn’t about punishment; it’s about empowerment – giving yourself the power to shape the future you truly desire.