In a world brimming with instant gratification, the pursuit of consistent fitness and sound financial habits often feels like an uphill battle. Both demand a similar, often elusive, quality: mental fortitude. This isn’t about being born with iron-clad willpower; it’s about cultivating a specific mindset and implementing strategies that fortify your resolve, turning aspirations into sustainable achievements.

The Interconnectedness of Mind and Habits

While one domain focuses on physical well-being and the other on economic security, the underlying psychological mechanisms for success are remarkably similar. Both fitness and finance require deferred gratification, the ability to make difficult choices today for a better tomorrow, and resilience in the face of setbacks. The mental muscles you build in one area often strengthen the other, creating a powerful synergy.

The challenge isn’t usually a lack of knowledge, but a lack of consistent action. We know we should exercise, eat well, save, and invest. The gap lies in transforming that knowledge into unwavering daily habits, even when motivation wanes. This is where mental fortitude becomes your most valuable asset.

Unearthing Your Core Motivation

Before you can build discipline, you must understand your ‘why.’ Why do you want to be fit? Why do you want financial security? Surface-level answers like ‘to look good’ or ‘to have more money’ are often insufficient to sustain long-term effort. Dig deeper. Is it for longevity to enjoy your grandchildren? To create freedom from debt? To build a legacy? A profound ‘why’ acts as an anchor when the tides of motivation shift.

Take time to journal or reflect on your deepest values and aspirations. Connect your fitness goals to your health, vitality, and quality of life. Link your financial goals to your security, freedom, and ability to pursue your passions. This clarity of purpose is the bedrock upon which true mental fortitude is built, providing the internal compass for consistent decision-making.

Cultivating Self-Discipline Through Small Wins

Discipline isn’t a switch you flip; it’s a muscle you develop. Trying to overhaul your entire life overnight is a recipe for burnout. Instead, focus on small, manageable victories. If your goal is to exercise daily, start with a 15-minute walk. If it’s to save, begin by putting aside a small, consistent amount each week.

These ‘small wins’ build momentum and self-efficacy. Each time you adhere to your mini-commitment, you reinforce the belief in your ability to follow through. Habit stacking – adding a new desired behavior immediately after an existing one (e.g., ‘after I brush my teeth, I’ll do 10 push-ups’) – can be incredibly effective. Consistency, not intensity, is the key in the initial stages.

Embracing Discomfort and Building Resilience

Growth rarely happens in comfort. Whether it’s the burn of the last rep, the discomfort of saying ‘no’ to an impulse purchase, or the discipline of reviewing your budget, embracing discomfort is central to developing fortitude. Reframe discomfort not as a sign to stop, but as a signal of progress – you’re pushing boundaries and getting stronger.

Resilience is the ability to bounce back from setbacks. You will miss workouts, you will overspend occasionally, and you will face unexpected financial challenges. True mental fortitude isn’t about avoiding these instances, but about how you respond to them. Instead of self-recrimination, acknowledge the misstep, learn from it, and get back on track immediately. One missed day does not erase weeks of effort; it’s merely a data point.

Strategic Tools for Lasting Change

Beyond mindset, practical tools are essential. Set SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) for both your fitness and financial objectives. Instead of ‘get fit,’ try ‘run a 5K in 12 weeks.’ Instead of ‘save money,’ aim for ‘save $500 per month for a down payment in 12 months.’

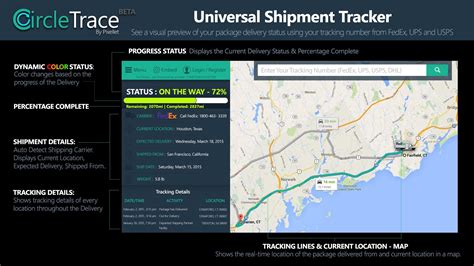

Track your progress religiously. For fitness, this might involve logging workouts, monitoring sleep, or tracking nutrition. For finance, it means budgeting, tracking expenses, and reviewing your net worth. Seeing tangible evidence of your efforts is a powerful motivator. Finally, consider an accountability partner or system. Sharing your goals with a trusted friend, family member, or coach can provide an extra layer of commitment and support.

Sustaining Momentum and Preventing Burnout

Mental fortitude isn’t about being relentlessly hard on yourself; it’s about sustainable effort. Integrate rest and recovery into your fitness regimen and allow for planned indulgences in your financial plan. Just as muscles need time to repair and grow, your willpower reservoir needs replenishment. Periodically review your goals and celebrate milestones, no matter how small. This positive reinforcement prevents burnout and reinforces the intrinsic reward of your efforts.

Cultivate a growth mindset, believing that your abilities can be developed through dedication and hard work. See challenges as opportunities to learn and adapt, rather than insurmountable obstacles. This perspective is vital for navigating the inevitable plateaus and setbacks that occur on any long-term journey.

Building mental fortitude for consistent fitness and financial discipline is not a destination but a continuous journey of self-improvement. By understanding your deep motivations, starting with small, consistent actions, embracing discomfort, learning from setbacks, and utilizing strategic tools, you can cultivate an unbreakable resolve. The discipline you forge in one area will inevitably spill over into the other, creating a ripple effect of empowerment and lasting positive change across your life.