Why Financial Stability is Your Ultimate Goal

In a world full of unpredictable events, financial stability isn’t just a luxury; it’s a necessity. It’s the bedrock upon which you build a secure future, allowing you to weather life’s storms without derailing your long-term goals. The path to this stability often involves two critical components: establishing a solid emergency fund and strategically crushing your debt.

Many people feel overwhelmed by the thought of managing their finances, but breaking it down into actionable steps can make the journey feel much more manageable. Let’s explore how to tackle both an emergency fund and debt simultaneously, or in a smart sequence, to achieve lasting peace of mind.

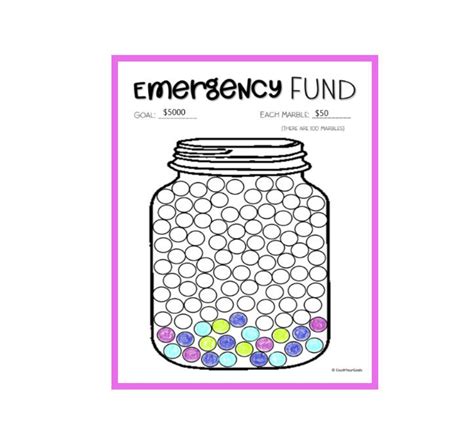

Building Your Financial Safety Net: The Emergency Fund

An emergency fund is a stash of readily accessible cash specifically for unexpected expenses. Think job loss, medical emergencies, major car repairs, or sudden home repairs. It acts as a buffer, preventing you from going into debt (or deeper into debt) when life throws a curveball.

How Much Should You Save?

The general recommendation is to save at least three to six months’ worth of essential living expenses. For those with less stable income, dependents, or single-income households, aiming for closer to six to twelve months might be a wiser choice. Start small if you must, even with $500 or $1,000, and build from there. The key is to start.

Where to Keep Your Emergency Fund

This money needs to be liquid and safe. A high-yield savings account separate from your everyday checking account is ideal. Avoid investing this money in the stock market, as its value can fluctuate, and you might need it quickly. The goal isn’t growth; it’s accessibility and security.

Conquering Debt: Your Path to Financial Freedom

While an emergency fund protects you from future financial crises, tackling existing debt frees up your current income and reduces the burden of interest payments. High-interest debt, like credit card balances, can be a massive drain on your resources, making it harder to save and invest.

Strategizing Your Debt Attack

Two popular methods for debt reduction are the Debt Snowball and Debt Avalanche. The Debt Snowball method involves paying off your smallest debt first, regardless of interest rate, to gain psychological momentum. Once that’s paid, you roll the payment amount into the next smallest debt. The Debt Avalanche method, on the other hand, prioritizes paying off debts with the highest interest rates first, which saves you the most money in the long run.

Both methods are effective; choose the one that best fits your personality and motivation. The most important thing is consistency.

Tactics to Accelerate Debt Payoff

- Create a Detailed Budget: Identify where your money is going and find areas to cut back to free up more cash for debt payments.

- Increase Income: Consider a side hustle, freelance work, or asking for a raise to create additional funds specifically for debt.

- Avoid New Debt: During your debt payoff journey, be vigilant about not taking on any new debt.

- Negotiate Interest Rates: Call your credit card companies and ask if they can lower your interest rates.

- Debt Consolidation: For high-interest debts, consider a personal loan with a lower, fixed interest rate to consolidate multiple payments into one. Be cautious and ensure the new loan doesn’t extend your repayment period unnecessarily or come with hidden fees.

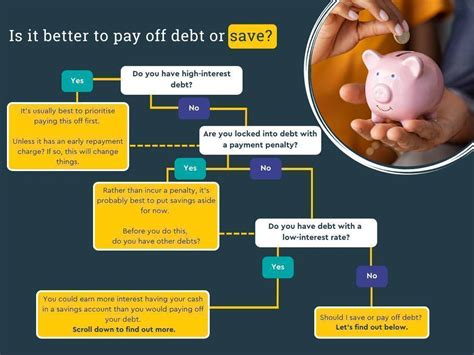

The Synergy: Emergency Fund First or Debt First?

This is a common dilemma. A widely recommended approach is a hybrid strategy:

- Build a Mini-Emergency Fund (e.g., $1,000): This provides immediate protection against small emergencies, preventing new debt.

- Attack High-Interest Debt Aggressively: Once your mini-fund is in place, focus all extra income on paying down credit cards or personal loans with high interest rates.

- Fully Fund Your Emergency Fund: After significant progress on high-interest debt, pivot back to building your emergency fund to the full three to six (or more) months of expenses.

- Continue Debt Payoff & Investing: With a fully funded emergency fund, you can then focus on paying off lower-interest debts (like student loans or mortgages if desired) and simultaneously increasing investments for long-term wealth building.

This phased approach allows you to build a safety net while also making significant headway on your debt, creating a strong foundation for future financial growth.

Your Path to Lasting Financial Stability

Building an emergency fund and crushing debt are not just about numbers; they’re about gaining control and reducing stress. It’s a journey that requires discipline, patience, and consistency, but the rewards are immense: genuine financial stability, freedom, and the ability to pursue your financial goals without the constant weight of worry. Start today, take one step at a time, and watch your financial landscape transform.