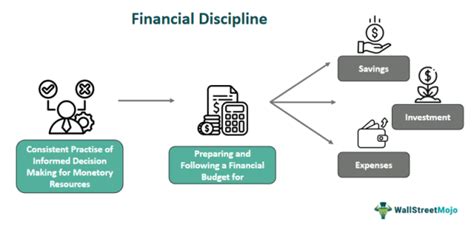

In the intricate dance of human connection, we often speak of “investing” in relationships – pouring time, emotion, and effort into fostering deeper bonds. While this metaphor is widely understood, applying the structured principles of financial discipline can offer a surprisingly powerful framework for building truly resilient and thriving connections. Just as a sound financial strategy ensures long-term wealth, a disciplined approach to our relational investments can yield immense emotional dividends and stronger, more fulfilling relationships.

Understanding “Relationship Investments”

What does it truly mean to invest in a relationship? It’s not about monetary exchange, but rather the allocation of invaluable resources: time, attention, empathy, trust, and shared experiences. Every conversation, every act of support, every compromise, and every shared laugh is a deposit into your relationship’s emotional bank account. Conversely, neglect, misunderstanding, or a lack of effort can lead to withdrawals, depleting the bond over time. Recognizing these “investments” as precious and finite resources is the first step toward disciplined management.

Principles of Financial Discipline Applied

Budgeting Time and Attention

Just as you budget your income, allocate your most precious non-renewable asset – time – with intention. Prioritize quality time, even if brief, over sporadic, unfocused interaction. This means actively scheduling dates, dedicating distraction-free moments for conversation, or simply being present when you are together. Understand where your time is being spent and consciously reallocate it towards your most valued relationships.

Investing Emotional Capital Wisely

Emotional capital includes empathy, active listening, vulnerability, and forgiveness. These are not infinite resources; they can be depleted by constant demands without replenishment. Learn to invest your emotional energy where it yields genuine connection and growth, rather than dissipating it on unproductive conflicts or emotional labor for those who don’t reciprocate. This doesn’t mean withholding, but rather ensuring your emotional “expenditures” are purposeful and respected.

Avoiding “Relationship Debt”

Relationship debt accumulates when promises are broken, apologies are withheld, or needs go consistently unmet. Each instance creates a deficit of trust and goodwill. Like financial debt, it can compound, making it harder to recover without significant, conscious effort. Proactive communication, prompt conflict resolution, and consistent follow-through are essential to prevent this kind of emotional burden from taking hold. Addressing small issues before they snowball is key.

Diversifying Your Portfolio

Relying solely on one type of interaction or shared activity can make a relationship stagnant. Diversify your “relationship portfolio” by exploring new experiences together, engaging in different types of conversations, supporting individual passions, and connecting with diverse groups. This adds resilience and keeps the relationship dynamic and exciting.

Regular “Financial” Reviews: Open Communication

Just as businesses conduct regular financial reviews, healthy relationships require consistent check-ins. This means open, honest conversations about feelings, needs, expectations, and any growing concerns. Schedule time to discuss the “state of the union,” offering feedback, expressing appreciation, and realigning goals. This transparent communication acts as an early warning system and a mechanism for continuous improvement, preventing small issues from becoming major crises.

Practical Steps to Implement

- Conduct a Relationship Audit: Reflect on where your time and emotional energy currently go. Are these allocations aligned with your relational values?

- Set “Relationship Budgets”: Intentionally allocate specific time slots for key relationships. This isn’t about rigid scheduling but ensuring presence and prioritization.

- Invest in “High-Yield” Activities: Identify shared activities or quality time that genuinely strengthen your bond and make those a priority.

- Practice Active Listening: Treat conversations as opportunities to truly understand and deposit empathy, rather than just waiting to speak.

- Address “Debts” Promptly: When conflicts arise or mistakes are made, address them quickly and sincerely to prevent resentment from building.

- Celebrate Small Wins: Acknowledge and appreciate the daily efforts and positive contributions within your relationships. These are your “returns on investment.”

Conclusion

Applying financial discipline to your relationship “investments” isn’t about turning love into a cold transaction; it’s about valuing your connections enough to approach them with intention, wisdom, and foresight. By budgeting your time and emotional capital, avoiding debt, diversifying experiences, and conducting regular reviews, you can cultivate bonds that are not only stronger and more resilient but also profoundly richer and more satisfying in the long run. Just like a well-managed financial portfolio, well-nurtured relationships offer security, growth, and immeasurable returns throughout life.