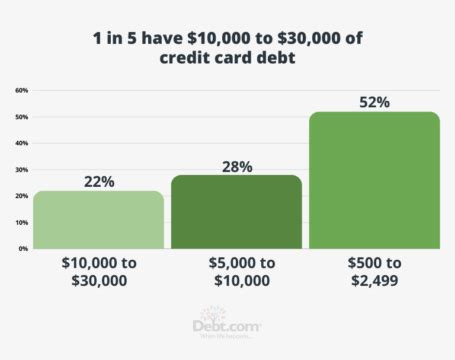

Understanding the Urgency of High-Interest Debt

High-interest credit card debt can feel like an insurmountable mountain, eroding your financial health and making it difficult to achieve other goals. The longer you carry these balances, the more you pay in interest, trapping you in a cycle that can be hard to break. Taking proactive steps to accelerate your payoff is not just about saving money; it’s about regaining control of your financial future and reducing stress.

1. Get a Clear Picture of Your Debt

Before you can tackle the problem, you need to understand its full scope. List all your credit cards, their current balances, interest rates (APR), and minimum payments. Prioritize them by interest rate, from highest to lowest. This overview will be crucial for choosing the most effective payoff strategy.

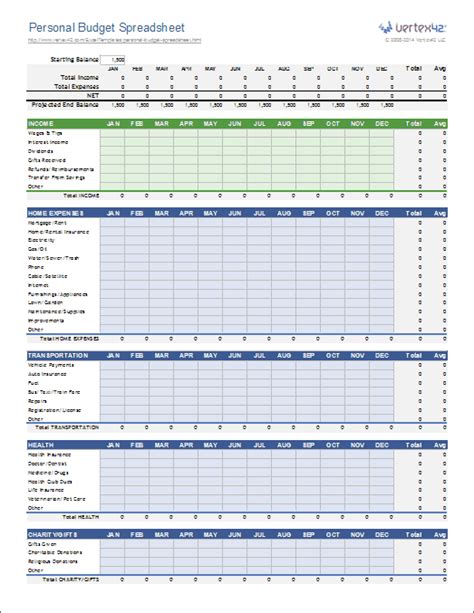

2. Create a Strict Budget and Cut Expenses

One of the most powerful tools in your debt reduction arsenal is a well-crafted budget. Track every dollar you spend for a month to identify where your money is truly going. Look for areas where you can significantly cut back—dining out, entertainment, subscriptions, or impulse purchases. Redirecting these savings directly towards your credit card payments will dramatically speed up the payoff process.

3. Choose a Debt Payoff Strategy: Snowball or Avalanche

There are two popular and effective methods for paying down multiple debts:

- Debt Avalanche Method: This strategy focuses on paying off the credit card with the highest interest rate first, while making minimum payments on all others. Once the highest-interest card is paid off, you take the money you were paying on it and add it to the payment of the next highest-interest card. This method saves you the most money in interest over time.

- Debt Snowball Method: With this method, you focus on paying off the smallest balance first, regardless of the interest rate, while making minimum payments on the rest. Once the smallest debt is gone, you roll that payment amount into the next smallest debt. This method provides psychological wins that can keep you motivated, even if it costs slightly more in interest in the long run.

4. Consider Balance Transfers and Debt Consolidation

For those with good credit, a balance transfer credit card can be a game-changer. These cards offer an introductory 0% APR for a period (e.g., 12-18 months), allowing you to transfer high-interest balances and pay them down without incurring new interest charges during the promotional period. Be aware of balance transfer fees (typically 3-5%) and ensure you can pay off the transferred amount before the promotional period ends.

Alternatively, a debt consolidation loan can simplify your payments and potentially lower your overall interest rate. You take out a new loan at a lower interest rate to pay off all your credit card debts, leaving you with just one fixed monthly payment.

5. Boost Your Income and Stay Consistent

If possible, look for ways to increase your income, whether through a side hustle, overtime, or selling unused items. Every extra dollar you can dedicate to your credit card debt will accelerate your payoff. Consistency is key; stick to your budget, make your payments on time, and regularly review your progress to stay motivated.

Conclusion

Accelerating high-interest credit card payoff requires discipline and a strategic approach, but the financial freedom it brings is invaluable. By understanding your debt, budgeting rigorously, choosing an effective payoff strategy, and exploring consolidation options, you can break free from the cycle of debt faster than you might think. Start today, and pave your way to a healthier financial future.