Navigating the Financial Crossroads: Debt vs. Investment

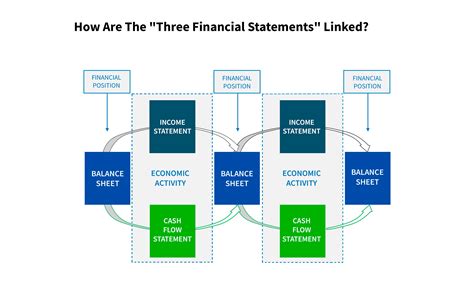

For many men, the path to financial security is paved with a fundamental question: should I funnel my extra cash into paying down debt, or should I invest it to grow my wealth? This isn’t a simple either/or proposition, but rather a nuanced decision influenced by individual circumstances, financial goals, and risk tolerance. Understanding the merits of each approach is crucial for making informed choices that align with your long-term aspirations.

The Case for Aggressive Debt Repayment

Prioritizing debt repayment, especially high-interest debt, offers a guaranteed return on investment equal to the interest rate you avoid. Credit card debt, for instance, often carries interest rates upwards of 15-20% annually. Paying off a $5,000 credit card balance at 20% interest is equivalent to earning a risk-free 20% return on your money – a return rarely matched consistently in the investment world.

Beyond the raw numbers, eliminating debt provides immense psychological benefits. The freedom from monthly payments, the reduction of financial stress, and the clear path to allocating future income towards savings and investments can be incredibly empowering. For some, the peace of mind derived from a debt-free existence outweighs the potential for higher investment returns, especially if they are risk-averse or burdened by significant liabilities like personal loans or car payments with high rates.

The Power of Investing for Wealth Growth

On the flip side, investing is the engine of long-term wealth creation. The magic of compounding returns allows your money to grow exponentially over time. Historically, the stock market has provided average annual returns of around 7-10% (adjusted for inflation) over long periods. Delaying investment means missing out on valuable time for your money to grow, especially for younger men who have decades ahead for their investments to mature.

Investing isn’t just about stocks; it includes retirement accounts like 401(k)s and IRAs, which often come with tax advantages and, in the case of 401(k)s, potential employer matching contributions. Missing out on an employer match is essentially leaving free money on the table, a guaranteed 50% or 100% return on your contribution, which almost always trumps paying down even high-interest debt.

Striking a Balance: A Hybrid Approach

For most men, the optimal strategy isn’t an all-or-nothing approach but a balanced hybrid. Here’s a common framework:

- Build an Emergency Fund: Start by squirreling away 3-6 months’ worth of living expenses in a readily accessible savings account. This safety net prevents future debt accumulation in case of unforeseen circumstances.

- Capture Employer Match: If your employer offers a 401(k) match, contribute at least enough to get the full match. This is immediate, free money for your retirement.

- Attack High-Interest Debt: Aggressively pay down any debt with an interest rate above 7-8%. This includes credit cards, payday loans, and high-interest personal loans. The guaranteed return from avoiding these high-interest payments is hard to beat.

- Simultaneous Investing for Lower-Interest Debt: Once high-interest debt is managed, compare the interest rate on your remaining debt (e.g., student loans, mortgages below 5-6%) with the expected long-term returns from investing. Many financial advisors suggest that if your debt interest rate is lower than the historical average market return, you might be better off investing.

Key Factors to Consider

- Age and Time Horizon: Younger men have more time for investments to compound, making early investing very powerful. Older men closer to retirement might prioritize debt elimination for security.

- Risk Tolerance: If the thought of market fluctuations keeps you up at night, aggressively paying down debt offers a tangible, risk-free return and peace of mind.

- Current Debt Load: A man with overwhelming credit card debt will have a different priority than one with only a low-interest mortgage.

- Financial Goals: Are you saving for a down payment on a house, early retirement, or just general financial security? Your goals will dictate the best strategy.

Making the Right Choice for Your Future

There’s no single right answer to the debt vs. investment dilemma. It requires an honest assessment of your current financial situation, your comfort level with risk, and your long-term aspirations. By understanding the principles behind each strategy and considering the key factors at play, men can confidently develop a personalized financial plan that systematically reduces debt while building a robust foundation for wealth growth. Regularly review your plan, adjust as life changes, and seek advice from a financial professional if needed to ensure you’re always on the optimal path.