The Essential Question: Crafting a Secure Retirement for Men

Planning for retirement is one of the most significant financial endeavors in a man’s life. The question of “how much should I save monthly?” is complex, without a one-size-fits-all answer. It depends heavily on individual circumstances, aspirations, and financial realities. However, by understanding key factors and applying proven strategies, men can build a robust savings plan to ensure a comfortable and financially secure future.

Key Factors Influencing Your Retirement Savings Goal

Several variables play a critical role in determining your ideal monthly savings contribution. These include your current age, your desired retirement age, your expected lifespan, and the lifestyle you envision in retirement. A younger man has the benefit of time, allowing compound interest to work its magic, potentially requiring a lower monthly contribution initially compared to someone starting later in life.

Your current income and expenses are also paramount. A higher income often allows for greater savings, but it’s equally important to manage lifestyle creep. Additionally, inflation is a silent wealth killer; what seems like enough today may be insufficient in 20 or 30 years. Factoring in future healthcare costs, which tend to rise significantly with age, is another crucial consideration that often gets overlooked.

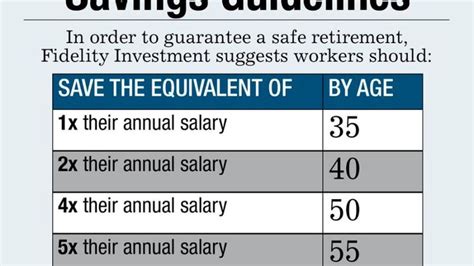

Common Benchmarks and Rules of Thumb

While personalized plans are best, financial experts offer general guidelines that can serve as a starting point. A widely cited rule suggests saving 10-15% of your gross income for retirement throughout your working life. If you start saving later, this percentage may need to increase significantly, potentially to 20% or even 25%.

Another popular benchmark involves having certain multiples of your salary saved by specific ages. For instance, some suggest having 1x your salary saved by age 30, 3x by 40, 6x by 50, and 8-10x by retirement age. These benchmarks provide a useful framework for tracking your progress and making adjustments as needed. For withdrawals during retirement, the “4% rule” is a common guideline, suggesting you can safely withdraw 4% of your starting retirement portfolio balance each year, adjusted for inflation, without running out of money.

Personalizing Your Savings Plan

To move beyond general rules, it’s essential to perform a more personalized calculation. Start by estimating your annual expenses in retirement. Will you downsize? Travel more? Consider potential sources of retirement income, such as Social Security benefits, pensions, or rental income, and subtract these from your estimated expenses to determine your annual income gap.

Once you have this gap, you can use online retirement calculators to project how much you need to save monthly to accumulate the necessary nest egg. These tools allow you to input variables like your current savings, investment growth rate, and inflation to give you a more precise savings target. Remember to revisit these calculations periodically, especially after significant life events or changes in financial markets.

Strategies to Boost Your Monthly Contributions

If your personalized calculation indicates you need to save more, don’t despair. There are several effective strategies to increase your monthly contributions. Automating your savings is one of the most powerful tools; set up automatic transfers from your checking account to your retirement accounts (401k, IRA, etc.) on payday. This removes the temptation to spend the money and ensures consistent contributions.

Look for ways to reduce unnecessary expenses in your budget. Even small cuts can add up over time. Consider increasing your contributions whenever you receive a raise or bonus – aim to save at least half of any new income. Exploring side hustles or additional income streams can also significantly accelerate your savings efforts. Finally, ensure your investments are aligned with your risk tolerance and long-term goals, maximizing growth potential while managing risk appropriately.

The Power of Consistency and Regular Review

The most important aspect of retirement savings is consistency. Small, regular contributions made over decades will almost always outperform sporadic, larger contributions made later in life. Time is your greatest asset in compounding wealth. Furthermore, your financial situation and life goals will evolve, making regular reviews of your retirement plan essential. Aim to review your progress at least once a year, or whenever you experience a major life change like marriage, divorce, a new child, or a job change.

Don’t hesitate to seek advice from a qualified financial advisor. They can provide personalized guidance, help you create a comprehensive plan, and ensure you’re on track to meet your retirement goals. A professional can also help navigate complex investment strategies and tax implications, optimizing your savings potential.

Ultimately, determining how much men should save monthly for retirement is a personal journey. By understanding the influencing factors, leveraging common benchmarks, personalizing your plan, and implementing smart saving strategies, you can confidently build the financial foundation for a comfortable and enjoyable retirement.