Why an Emergency Fund is Non-Negotiable

Life is full of uncertainties. From unexpected job loss to a sudden medical emergency or a car repair, these unforeseen events can quickly derail your financial stability. This is where an emergency fund steps in – a crucial safety net designed to protect you from accumulating debt or depleting your long-term savings when life throws a curveball. The general wisdom often suggests having 3-6 months’ worth of essential living expenses saved, but how do you figure out your specific number?

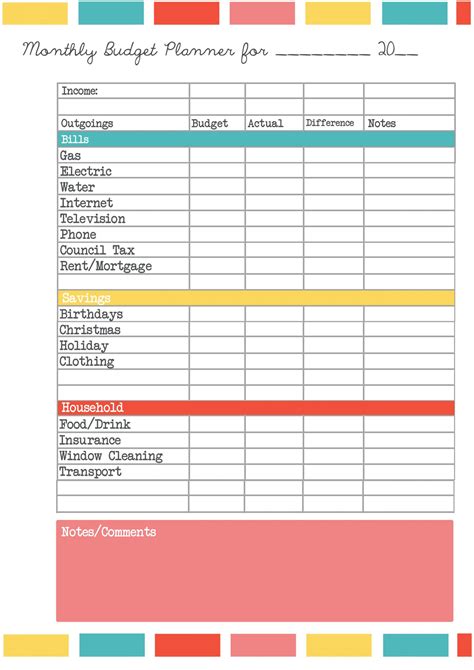

Step 1: Calculate Your True Monthly Expenses

The first and most critical step is to understand exactly how much money you need to live each month. This isn’t about your total income, but rather your essential outgoings. Start by tracking your spending for a month or two, or review your bank and credit card statements. Categorize your expenses into two groups: needs and wants.

- Needs: These are non-negotiable costs like housing (rent/mortgage), utilities (electricity, water, gas, internet), groceries, transportation, insurance premiums, essential medications, and minimum debt payments.

- Wants: These are discretionary expenses you could cut back on or eliminate in an emergency, such as dining out, entertainment, subscriptions (beyond basic internet), new clothes, and vacations.

For your emergency fund calculation, focus exclusively on your ‘needs’. Sum these up to get your core monthly essential expenses. Be realistic and thorough; missing a key expense can leave you short when you need it most.

Step 2: Determine Your Ideal Fund Duration (3 to 6 Months)

While 3-6 months is a common guideline, the exact duration depends on several personal factors:

- Job Security: If your job is highly stable or you work in a high-demand field, 3 months might suffice. If your industry is volatile, you’re self-employed, or your job security is lower, aim for 6 months or more.

- Number of Dependents: If you have a spouse, children, or other dependents relying on your income, a larger fund provides greater security for the whole family.

- Health Conditions: Individuals with pre-existing health conditions or frequent medical needs might benefit from a larger buffer to cover unexpected medical bills or time off work.

- Income Stability: If your income is variable (e.g., commissions, freelance work), a larger fund provides a cushion during leaner months.

- Access to Other Resources: Do you have other readily accessible assets (e.g., a line of credit, family support) that could bridge a gap? While an emergency fund is ideal, these can influence your comfort level.

Once you’ve calculated your essential monthly expenses, multiply that number by your chosen duration (3, 4, 5, or 6 months). For example, if your essential monthly expenses are $2,500, a 3-month fund would be $7,500, and a 6-month fund would be $15,000.

Step 3: Building Your Emergency Fund

Setting the goal is just the beginning; the real work is saving the money. Here are practical strategies:

- Set a Realistic Goal: Break down your total target into smaller, manageable weekly or monthly savings goals.

- Automate Your Savings: Set up an automatic transfer from your checking account to a dedicated savings account each payday. Treat this transfer as a non-negotiable bill.

- Cut Unnecessary Expenses: Review your ‘wants’ category and identify areas where you can temporarily reduce spending to accelerate your savings.

- Boost Your Income: Consider a side hustle, selling unused items, or taking on extra shifts to inject more cash into your fund.

- Windfalls: Direct any unexpected money, like tax refunds, bonuses, or gifts, straight into your emergency fund.

Where to Keep Your Emergency Fund

The ideal place for your emergency fund is an account that offers both liquidity and safety. High-yield savings accounts are often recommended because they:

- Are Separate: Keeping it separate from your everyday checking account reduces the temptation to spend it.

- Offer Interest: While not a primary goal, earning some interest helps your money grow slightly.

- Are Easily Accessible: You can typically access funds quickly without penalties, unlike CDs or investment accounts.

- Are FDIC Insured: Your money is protected by the government up to certain limits, making it a safe place.

Avoid keeping your emergency fund in investments like stocks, as their value can fluctuate, potentially leaving you short during a market downturn when you need the money most.

Conclusion: Peace of Mind is Priceless

Building an emergency fund takes discipline and time, but the peace of mind it provides is invaluable. It protects your other financial goals, prevents you from going into debt, and allows you to face life’s unexpected challenges with confidence. Start today by calculating your needs, setting a target, and consistently contributing to your financial safety net. Your future self will thank you.