The pursuit of excellence in both physical health and financial stability often feels like an uphill battle, especially when consistency falters. For men aiming to master both domains, the secret ingredient isn’t brute strength or raw intelligence, but rather an unyielding commitment to consistent discipline. This article delves into the shared principles and specific strategies that empower men to build lasting discipline for concurrent success in fitness and finance.

The Interconnectedness of Discipline

Discipline isn’t compartmentalized; the mental fortitude required to hit the gym consistently often echoes the resolve needed to stick to a budget. At its core, discipline is about making choices now that benefit your future self, even when those choices are difficult or inconvenient. Understanding this synergy is the first step towards building a holistic framework for success.

1. Define Clear, Attainable Goals

Vague aspirations lead to vague efforts. Whether it’s shedding 15 pounds, running a marathon, saving for a down payment, or investing a specific amount monthly, clarity is paramount. Break down large goals into smaller, manageable steps. For fitness, this might mean weekly workout targets; for finance, it could be daily spending limits or automated savings transfers.

2. Cultivate Non-Negotiable Habits

Discipline thrives on habit. The less you have to “decide” whether to exercise or save, the more likely you are to do it. Establish routines that become second nature. Wake up and go for a run, pack your lunch instead of buying it, review your budget every Sunday – these small, repeatable actions build momentum.

Strategies for Fitness Discipline

Achieving a strong physique and robust health demands more than just occasional effort. It requires a disciplined approach to training, nutrition, and recovery.

Structured Training Regimen

Design a workout schedule that fits your life and commit to it. Whether it’s weightlifting, cardio, or a combination, consistency is king. Don’t chase fleeting trends; find what works for your body and your goals, and stick to it for the long haul. Track your progress to stay motivated and make adjustments as needed.

Mastering Nutritional Discipline

Your fitness journey is significantly influenced by what you eat. Developing discipline in nutrition means planning meals, prepping food, making healthy choices, and avoiding impulsive unhealthy snacks. This isn’t about deprivation but about mindful eating that fuels your body for optimal performance and recovery.

Strategies for Financial Discipline

Building wealth and securing financial independence also hinges on disciplined choices and consistent actions, often over many years.

Budgeting and Conscious Spending

A budget is your financial roadmap. It helps you understand where your money is going and empowers you to allocate funds strategically towards savings, investments, and necessary expenses. Discipline here means regularly tracking expenses and making conscious decisions to align spending with your financial goals, not just your immediate desires.

Automate Savings and Investments

The easiest way to be consistent with saving and investing is to automate it. Set up automatic transfers from your checking to savings or investment accounts immediately after payday. This “pay yourself first” strategy removes the temptation to spend the money before it reaches your long-term goals.

Continuous Financial Education

The financial landscape is ever-evolving. Disciplined men continuously educate themselves about personal finance, investment strategies, and economic trends. This ongoing learning helps make informed decisions, avoid costly mistakes, and optimize their financial trajectory.

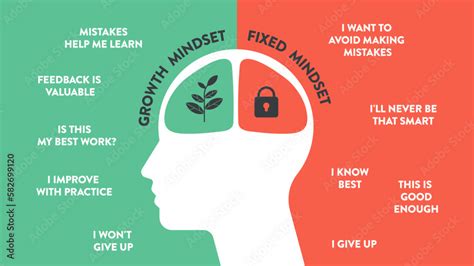

The Power of Accountability and Mindset

While individual discipline is crucial, external accountability can provide an extra push. Share your fitness goals with a workout buddy or a coach. Discuss your financial aspirations with a trusted mentor or partner. A strong, growth-oriented mindset, viewing setbacks as learning opportunities rather than failures, is fundamental to sustaining discipline over time. Resilience in the face of challenges is a hallmark of truly disciplined individuals.

Conclusion

Building consistent discipline for both fitness and financial success isn’t about innate talent; it’s a learned skill, honed through intentional effort and unwavering commitment. By setting clear goals, establishing strong habits, embracing delayed gratification, and leveraging strategic planning in both domains, men can forge a powerful synergy that propels them towards a healthier, wealthier, and more fulfilling life. The journey begins with a single disciplined choice, repeated consistently.