A bulletproof budget isn’t about deprivation; it’s about empowerment. It’s your most potent tool for taking control of your money, eliminating debt, and systematically building wealth. This guide will walk you through creating a financial blueprint that truly works for you, transforming your financial outlook.

Grasp Your Financial Reality

The first step to building an effective budget is to gain a clear, honest understanding of where your money currently goes. This involves meticulously tracking both your income and your expenses for at least one month.

- Identify All Income Sources: List every dollar coming in – salary, side hustles, dividends, etc.

- Track Every Expense: From your rent and utilities to your daily coffee and streaming subscriptions, categorize every outgoing payment. Use bank statements, credit card statements, or a dedicated tracking app. Don’t overlook small, recurring expenses that add up.

Articulate Your Financial Goals

A budget without a purpose is just a spreadsheet. What are you trying to achieve? Whether it’s paying off credit card debt, saving for a down payment, or building an emergency fund, define your goals clearly. Use the SMART framework:

- Specific: “Pay off $5,000 in credit card debt” is better than “pay off debt.”

- Measurable: You can track progress.

- Achievable: Set realistic targets based on your income and expenses.

- Relevant: Align with your broader financial aspirations.

- Time-bound: Set a deadline (e.g., “within 12 months”).

Select Your Budgeting System

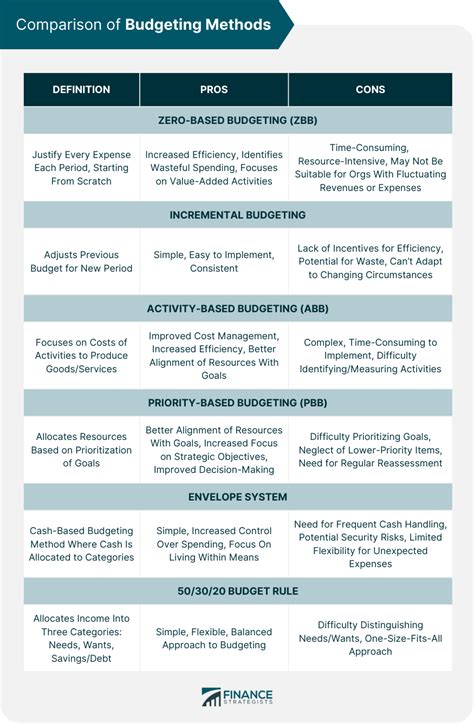

There’s no one-size-fits-all budget, so find a method that aligns with your personality and financial complexity. Popular options include:

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Simple and effective for many.

- Zero-Based Budgeting: Every dollar has a job. You assign all your income to expenses, savings, or debt payments until your balance is zero. This requires more diligence but offers immense control.

- Envelope System: Great for cash spenders, you physically allocate cash into envelopes for different categories (e.g., groceries, entertainment).

- Budgeting Apps/Software: Tools like Mint, YNAB (You Need A Budget), or Personal Capital can automate tracking and provide insights.

Optimize Spending and Eliminate Waste

Once you have a clear picture of your spending and a system in place, it’s time to find areas to cut. Review your “wants” categories first. Are there subscriptions you don’t use? Can you cook at home more often? Look for significant expenses you can reduce:

- Negotiate Bills: Call your internet, cable, or insurance providers to see if you can get a better rate.

- Reduce Discretionary Spending: Dining out, entertainment, and impulse purchases are often the easiest places to find extra cash.

- Shop Smart: Compare prices, use coupons, and plan your grocery list.

Automate Your Financial Progress

The easiest way to stick to a budget and achieve your goals is to remove human error and temptation. Set up automatic transfers for savings and debt payments.

- Automate Savings: Have a portion of each paycheck automatically transferred to your savings account, retirement fund, or investment portfolio. “Pay yourself first.”

- Automate Debt Payments: Set up automatic payments for your credit cards, loans, or mortgage. If you’re tackling high-interest debt, consider an aggressive payment plan where extra money automatically goes towards the principal.

Regular Review and Adaptation

A bulletproof budget isn’t set and forget. Life changes, and so should your budget. Make it a habit to review your budget at least monthly, or quarterly. This allows you to:

- Track Progress: See how close you are to your goals.

- Identify Overspending: Pinpoint categories where you consistently exceed your limits.

- Adjust for Life Changes: A new job, a raise, a new family member, or unexpected expenses all warrant budget modifications. Flexibility is key to longevity.

Creating a bulletproof budget is an ongoing journey of awareness, discipline, and adjustment. It’s a powerful habit that transforms your financial outlook, empowering you to crush debt, build substantial wealth, and achieve true financial freedom. Start today, stay consistent, and watch your financial future unfold.