Navigating the Dual Challenge: Debt Reduction and Wealth Creation

For many men, the journey to financial freedom often presents a formidable dual challenge: aggressively tackling high-interest debt while simultaneously building a robust foundation for future wealth. It’s a balancing act that requires strategic thinking, discipline, and a clear understanding of financial principles. The good news is that these two goals are not mutually exclusive; with the right approach, men can make significant progress on both fronts.

The allure of immediate gratification or the pressure of societal expectations can sometimes lead to accumulating debt that carries a high cost, such as credit card balances or personal loans. Ignoring these debts can erode financial progress, making it harder to save and invest. This article will outline a strategic framework designed specifically for men to navigate this complex financial landscape, ensuring both debt elimination and wealth accumulation are prioritized.

Prioritizing the High-Interest Debt Attack

The first and most critical step is to understand the corrosive power of high-interest debt. The interest rates on credit cards can easily negate any returns you might see from investments, making debt reduction an effective, guaranteed return on investment. Imagine earning 7% on an investment while paying 18% on a credit card; you’re effectively losing 11% annually. Therefore, the initial focus must be a concerted assault on these high-cost obligations.

Developing a Debt Reduction Strategy

- Debt Avalanche vs. Debt Snowball: Choose a method that suits your psychological makeup. The debt avalanche prioritizes paying off debts with the highest interest rates first, saving the most money over time. The debt snowball focuses on paying off the smallest debts first to build momentum. Both are effective; consistency is key.

- Budgeting & Expense Tracking: Create a detailed budget to identify where your money is going. Cut unnecessary expenses to free up more cash for debt payments. Every extra dollar directed towards high-interest debt is a dollar saved in future interest.

- Income Generation: Look for opportunities to increase your income. This could involve side hustles, overtime at work, or negotiating a raise. More income means more firepower for debt reduction.

Simultaneously Laying the Wealth Building Foundation

While aggressively attacking debt, it’s crucial not to neglect the foundational elements of wealth building. These steps are often less glamorous but provide the essential structure for long-term financial security and growth.

The Essential Wealth Building Pillars

- Emergency Fund: Before significant investing, aim to build an emergency fund covering 3-6 months of living expenses. This fund acts as a financial safety net, preventing new debt accumulation when unexpected life events occur.

- Employer-Sponsored Retirement Plans (401k/403b Match): If your employer offers a matching contribution, contribute at least enough to get the full match. This is free money and an immediate 100% return on your investment – something you won’t find anywhere else.

- Roth IRA/Traditional IRA: Once you’ve secured your employer match, consider contributing to an Individual Retirement Account (IRA). These offer tax advantages and allow for further diversification of your investments.

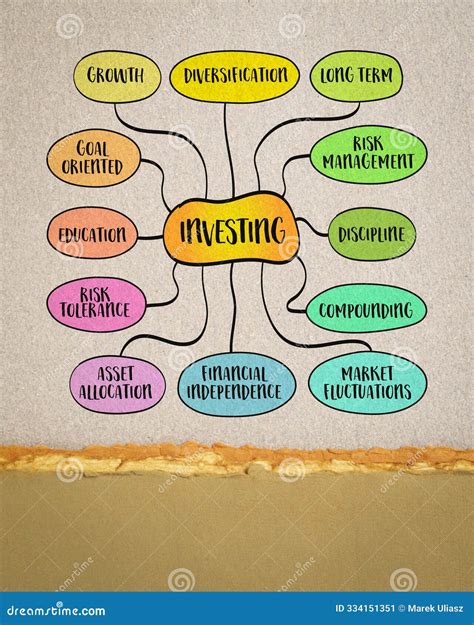

Strategic Asset Allocation and Investment Diversification

As debt diminishes and your wealth-building capacity grows, focus on smart investment strategies. Diversification across various asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk and optimize returns over the long term. Educate yourself on different investment vehicles, understand your risk tolerance, and consider consulting a financial advisor for personalized guidance.

The Power of Consistency and Delayed Gratification

Building wealth and eliminating debt are marathon, not a sprint. Consistency in your financial habits – sticking to your budget, making regular debt payments, and consistently contributing to investments – is paramount. Practicing delayed gratification, choosing long-term financial gains over immediate splurges, is a superpower in this journey. Regularly review your progress, celebrate milestones, and adjust your plan as life circumstances evolve.

Conclusion: A Path to Financial Empowerment

Tackling high-interest debt while building wealth is an achievable goal for men willing to embrace a strategic, disciplined approach. By prioritizing the elimination of high-cost debt, establishing a robust emergency fund, and consistently investing in tax-advantaged accounts, men can effectively navigate their financial landscape. This dual-track strategy not only liberates you from the burden of debt but also empowers you to build a secure and prosperous financial future for yourself and your loved ones. The time to act is now; your future self will thank you for the financial discipline you cultivate today.