For many men, the concept of budgeting can feel restrictive, overly complicated, or even unnecessary. Yet, mastering your money is not about deprivation; it’s about gaining control, building a robust financial future, and ultimately, achieving financial independence. This isn’t just about saving for retirement; it’s about creating a life where you have choices, freedom, and the ability to pursue your passions without financial constraint. The good news? Budgeting doesn’t have to be complex. By adopting a simplified, aggressive approach, men can significantly accelerate their journey towards wealth and financial freedom.

The Core Principle: The 50/30/20 Rule (Simplified)

Forget intricate spreadsheets and tracking every single coffee. A highly effective and simple budgeting framework is the 50/30/20 rule. This allocates your after-tax income into three main categories:

- 50% for Needs: This includes essential expenses like housing (rent/mortgage), utilities, groceries, transportation, insurance, and minimum loan payments. These are the costs you absolutely cannot live without.

- 30% for Wants: This category covers discretionary spending – dining out, entertainment, hobbies, new gadgets, vacations, and subscription services. These are the things that improve your quality of life but aren’t strictly necessary.

- 20% for Savings & Debt Repayment: This is where aggressive wealth building happens. This portion goes towards your emergency fund, retirement accounts (401k, IRA), brokerage accounts, and paying down high-interest debt beyond the minimums (e.g., credit card debt).

This rule provides a clear, high-level guide. If your ‘needs’ are pushing past 50%, it’s a signal to evaluate big expenses like housing or vehicle costs. If your ‘wants’ are eating into your savings, you know where to trim.

Automate Everything for Effortless Progress

One of the most powerful strategies for simplifying finances and building wealth is automation. Make your financial progress automatic, so you don’t have to rely on discipline alone. Set up automatic transfers for the following:

- Savings: Schedule a portion of your paycheck to automatically transfer to a high-yield savings account or an emergency fund immediately after you get paid.

- Investments: Automate contributions to your 401k, IRA, or brokerage account. If your employer offers a 401k match, contribute at least enough to get the full match – it’s free money!

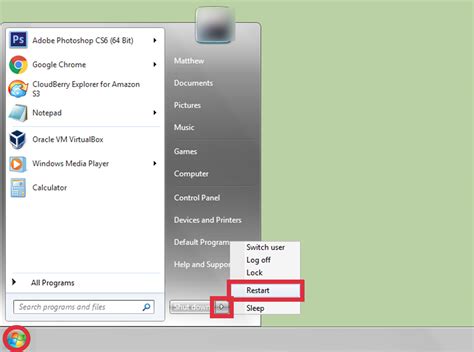

- Bill Payments: Set up auto-pay for all your regular bills (utilities, rent/mortgage, insurance, loan payments) to avoid late fees and missed payments.

By automating, you adopt the ‘pay yourself first’ principle. Your savings and investments are taken care of before you even see the money in your checking account, dramatically increasing your chances of reaching your financial goals.

Track Your Spending, But Keep It Simple

While the 50/30/20 rule provides a framework, you still need to know where your money is actually going. This doesn’t mean meticulously logging every single expense. Instead, focus on simplicity and identifying major spending patterns.

Here are simplified tracking methods:

- Banking App Review: Most banking apps categorize your spending automatically. Spend 15-30 minutes once a week or month reviewing your transactions. Look for large expenses or recurring subscriptions that might be draining your funds unnoticed.

- Credit Card Statements: Similarly, credit card statements offer a summary of your spending. Identify areas where you consistently overspend in your ‘wants’ category.

- Dedicated Budgeting Apps: If you prefer more detail without manual input, apps like Mint, YNAB, or Personal Capital link to your accounts and categorize expenses for you, giving you an overview without the fuss.

The goal isn’t to judge yourself, but to gain awareness. Once you see where your money truly goes, you can make informed decisions about where to cut back to free up more funds for savings and investments.

Optimize High-Impact Areas

Aggressive wealth building often involves finding significant savings, not just cutting out lattes. Focus on optimizing the largest categories of your spending, as these offer the most substantial returns.

- Housing: Is your rent or mortgage payment disproportionately high? Consider if you can downsize, find a roommate, or negotiate a better rate if you’re renting.

- Transportation: Vehicle payments, insurance, and fuel can be major expenses. Could you opt for a less expensive car, utilize public transport, bike, or carpool? Regularly shop around for better insurance rates.

- Food: Eating out frequently adds up fast. Plan meals, cook at home more often, and pack lunches. When you do dine out, be mindful of costs.

- Subscriptions & Services: Regularly review all your recurring subscriptions (streaming, gym memberships, software). Cancel those you don’t use or consolidate where possible.

Making conscious choices in these areas can free up hundreds, if not thousands, of dollars per month to redirect towards your wealth-building goals.

Accelerate Wealth Building: Invest Early and Often

Budgeting is the foundation, but investing is how you aggressively build wealth and reach financial independence. The earlier you start, the more powerful compound interest becomes.

- Maximize Retirement Accounts: Contribute as much as you can to tax-advantaged accounts like a 401k (especially if there’s an employer match) and an IRA. These accounts offer significant tax benefits that supercharge your returns.

- Diversify with Low-Cost Index Funds: For most men, a simple, effective investment strategy is to invest in broad market index funds or ETFs. These passively managed funds offer diversification across hundreds or thousands of companies at a very low cost, historically outperforming most actively managed funds.

- Consistency is Key: Regular contributions, even small ones, over a long period are far more effective than trying to time the market or making sporadic large investments. Set up automated investments so you ‘set it and forget it.’

- Understand Your Risk Tolerance: As you educate yourself, you can adjust your portfolio. For younger men, a higher allocation to stocks is generally advisable due to a longer time horizon, allowing them to ride out market fluctuations.

By consistently allocating a significant portion of your income to these simple, proven investment vehicles, you’re not just saving; you’re putting your money to work, actively building a future of financial independence.

Conclusion

Simplifying budgeting for men isn’t about rigid rules or constant deprivation; it’s about creating an efficient system that fuels aggressive wealth building and leads to financial independence. By embracing a clear framework like the 50/30/20 rule, automating your savings and investments, simply tracking your spending, and optimizing major expense categories, you can transform your financial trajectory. Remember, the goal is freedom – the freedom to live life on your terms, unburdened by financial worries. Start today, stay consistent, and watch your financial independence become a tangible reality.