The Urgency of Financial Freedom for Men

In a world often defined by traditional roles and expectations, the pursuit of financial freedom holds significant weight for men. It’s not just about accumulating wealth; it’s about gaining control, securing peace of mind, and creating a legacy. The journey to early financial freedom for men typically involves two critical phases: aggressive debt elimination and strategic, consistent investing. This guide will walk you through practical steps to achieve both, helping you take charge of your financial destiny.

Accelerating Your Debt Repayment Journey

Before you can truly build wealth, shedding the burden of debt is paramount. High-interest debt, especially, acts like an anchor, dragging down your financial progress. Here’s how men can tackle debt head-on and pay it off fast.

1. Create a Bulletproof Budget

The first step is always understanding where your money goes. Track every dollar for a month or two. Identify all fixed and variable expenses. Be ruthless in cutting unnecessary costs. Differentiating between ‘needs’ and ‘wants’ is crucial here. Can you cut down on subscriptions, dining out, or expensive hobbies temporarily? Every dollar saved is a dollar that can go towards debt.

2. Choose Your Debt Payoff Strategy: Snowball or Avalanche

- Debt Snowball: Pay off your smallest debt first, then roll that payment into the next smallest. This method provides psychological wins, keeping you motivated.

- Debt Avalanche: Focus on paying off the debt with the highest interest rate first. This method saves you the most money on interest in the long run. Choose the method that best suits your personality and keeps you committed.

3. Boost Your Income

Sometimes, cutting expenses isn’t enough. Explore avenues to increase your income. This could involve taking on a side hustle (freelancing, gig work, consulting), negotiating a raise at your current job, or even pursuing further education or certifications that lead to higher-paying opportunities. Every extra dollar earned should be directly applied to your debt.

Building Wealth: Your Path to Early Financial Freedom

Once significant debt is under control, the focus shifts to building your investment portfolio. Early financial freedom is achieved not just by saving, but by making your money work for you through smart investments.

1. Start Early and Embrace Compound Interest

Time is your most powerful ally in investing. The earlier you start, the more time your money has to grow through the magic of compound interest. Even small, consistent contributions made early can snowball into substantial wealth over decades. Don’t wait until you feel ‘rich enough’ to invest; start now, even if it’s just a small amount.

2. Automate Your Investments

Set up automatic transfers from your checking account to your investment accounts. Treat investing like a non-negotiable bill. This removes the temptation to spend the money and ensures consistent contributions, building discipline and wealth effortlessly over time.

3. Leverage Tax-Advantaged Accounts

Take full advantage of retirement accounts like a 401(k) (especially if your employer offers a match, which is free money!), a Roth IRA, or a Traditional IRA. These accounts offer significant tax benefits that can accelerate your wealth growth. Beyond retirement accounts, consider a Health Savings Account (HSA) if you’re eligible, as it offers a triple tax advantage.

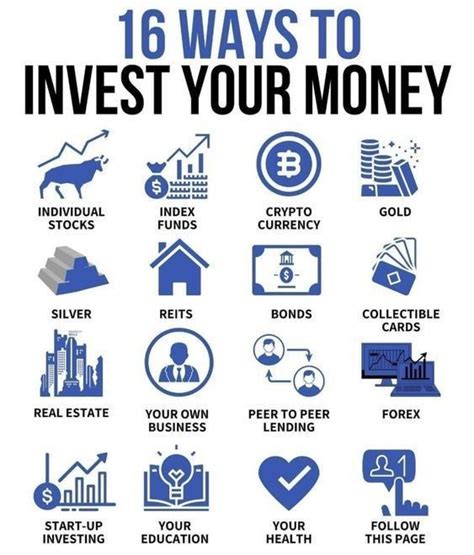

4. Invest in Broad-Market Index Funds or ETFs

For most men, especially those new to investing, low-cost index funds or Exchange Traded Funds (ETFs) that track broad market indices (like the S&P 500) are excellent choices. They offer diversification across many companies, reducing risk, and historically provide solid returns with minimal effort. Avoid trying to pick individual stocks unless you’re willing to dedicate significant time to research and understand the associated higher risks.

5. Diversify and Rebalance

While index funds offer diversification, ensure your overall portfolio is diversified across different asset classes (e.g., stocks, bonds, real estate) appropriate for your age and risk tolerance. Periodically rebalance your portfolio to maintain your desired asset allocation, selling off winners and buying more of those that have lagged to keep your risk profile in check.

The Mindset for Sustainable Financial Success

Achieving financial freedom is as much about mindset as it is about strategies. Cultivating the right attitude is crucial for long-term success.

1. Embrace Discipline and Patience

There will be ups and downs in your financial journey. Market fluctuations are normal, and debt payoff can feel slow at times. Discipline to stick to your plan and patience to let your investments grow are indispensable virtues. Don’t chase get-rich-quick schemes; focus on consistent, disciplined action.

2. Continuous Financial Education

The financial landscape evolves, and your knowledge should too. Continuously educate yourself about personal finance, investing, and wealth management. Read books, listen to podcasts, and follow reputable financial experts. The more you understand, the more confident and effective you’ll be in your decisions.

3. Avoid Lifestyle Inflation

As your income grows, it’s tempting to increase your spending proportionally. This phenomenon, known as lifestyle inflation, can sabotage your financial freedom goals. Resist the urge to constantly upgrade your lifestyle. Instead, funnel increased income towards investments and debt reduction.

Your Journey to Financial Empowerment

Paying off debt fast and investing for early financial freedom is an ambitious but entirely achievable goal for men. It requires discipline, strategic planning, and a long-term perspective. By diligently tackling debt, consistently investing in diversified, low-cost assets, and cultivating a resilient financial mindset, you can build a future where you dictate your terms, enjoy true freedom, and leave a lasting legacy. Start today, stay consistent, and watch your financial future transform.