For many men, the dream of early retirement isn’t just about escaping the daily grind; it’s about reclaiming time for passions, family, and personal growth. Achieving this coveted financial freedom requires a strategic blend of disciplined spending and intelligent investing. This guide is tailored to help men navigate the financial landscape, optimize their resources, and build a robust pathway to an early, comfortable retirement.

Understanding Your Financial Blueprint

Before you can optimize, you need to understand. The first crucial step is to gain a clear picture of your current financial situation. This involves tracking every dollar that comes in and goes out. Many men find practical tools, from budgeting apps to simple spreadsheets, effective for this task.

- Income Assessment: Know your net income after taxes and deductions.

- Expense Tracking: Categorize all your spending – fixed costs (rent, mortgage, loans) and variable costs (food, entertainment, hobbies).

- Debt Analysis: Understand all outstanding debts, especially high-interest consumer debt like credit cards. Prioritizing the elimination of this “bad” debt is often a powerful early step towards financial liberation.

Optimizing Spending: More Than Just Cutting Costs

Optimized spending isn’t about deprivation; it’s about intentionality. For men, this often means re-evaluating traditional “man-cave” spending habits – be it on gadgets, subscriptions, vehicles, or social outings – to ensure they align with long-term goals.

Strategic Budgeting for Men

- The “Why”: Connect your budget to your early retirement goal. Visualizing the freedom helps maintain discipline.

- Identify “Value” Spending: Discern between spending that genuinely adds value or enjoyment and habitual spending that doesn’t. Perhaps that expensive golf club membership could be scaled back, or a less frequent upgrade of tech gadgets could free up significant capital.

- Automate Savings: Set up automatic transfers from your checking to savings or investment accounts immediately after payday. “Pay yourself first” is a cornerstone of financial success.

- Bulk Buying & Meal Prep: Men often appreciate efficiency. Buying in bulk for household staples or committing to weekly meal prep can significantly reduce food costs and impulse purchases.

Investing Smart: Accelerating Your Retirement Timeline

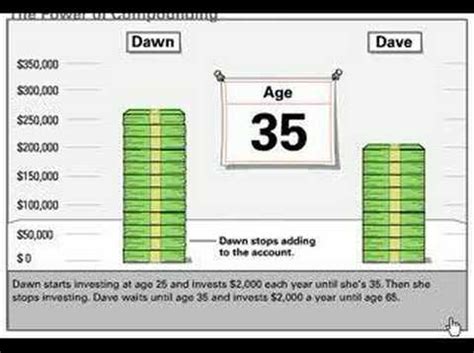

Once spending is optimized and savings begin to accumulate, the next critical step is smart investing. This is where your money starts working for you, leveraging the power of compounding to accelerate your journey to early retirement.

Understanding Risk and Diversification

Every investment carries some level of risk. Understanding your personal risk tolerance is paramount. A diversified portfolio, spread across various asset classes, is key to mitigating risk while maximizing potential returns.

- Stocks: Offer potential for high growth but come with volatility. Consider index funds or ETFs for broad market exposure without picking individual stocks.

- Bonds: Generally less volatile than stocks, providing stability and income. They balance out a portfolio.

- Real Estate: Can offer appreciation and rental income, but requires significant capital and often active management.

- Alternative Investments: Depending on your risk profile, you might explore commodities, private equity, or even cryptocurrencies (with extreme caution and thorough research).

Leveraging Retirement Accounts

These tax-advantaged accounts are specifically designed to help you save for retirement.

- 401(k) / 403(b): If offered by your employer, contribute at least enough to get the full company match – it’s free money! Maxing out these contributions can significantly reduce your taxable income.

- IRA / Roth IRA: These individual retirement accounts offer flexibility. Roth IRAs are particularly attractive for early retirees as qualified withdrawals in retirement are tax-free.

- HSA (Health Savings Account): Often overlooked, an HSA is a triple-tax-advantaged account (tax-deductible contributions, tax-free growth, tax-free withdrawals for qualified medical expenses). For those aiming for early retirement, it can serve as a supplemental investment vehicle, especially if health costs are a concern in later years.

Mindset, Discipline, and Professional Guidance

Financial success, especially for early retirement, isn’t just about numbers; it’s about consistent discipline and a long-term vision. Avoid lifestyle creep – where increasing income leads to increasing expenses, negating savings efforts. Regularly review your financial plan, making adjustments as life circumstances change.

While self-education is crucial, consider consulting a fee-only financial advisor. They can provide personalized strategies, identify blind spots, and help you navigate complex investment decisions, ensuring your plan is robust and aligned with your early retirement aspirations.

Conclusion: Your Path to Financial Freedom

Optimizing spending and investing smart for early retirement is a journey, not a destination. It requires dedication, informed decisions, and a clear vision of the future you want to create. By taking control of your finances, eliminating unnecessary expenses, and strategically investing in a diversified portfolio, men can significantly accelerate their path to financial independence and enjoy the fruits of their labor much sooner. Start today, stay disciplined, and watch your early retirement dreams become a reality.