The Imperative of Intentional Spending for Financial Domination

For men aiming for aggressive financial growth, passive saving isn’t enough. It requires a proactive, almost militant approach to spending optimization. This isn’t about deprivation; it’s about reallocating resources from things that offer fleeting satisfaction to investments that build lasting wealth and freedom. The goal is to maximize every dollar’s potential, ensuring it serves your long-term financial objectives rather than succumbing to consumerist whims.

Laying the Groundwork: The Power of a Purposeful Budget

Aggressive financial growth begins with absolute clarity on where your money goes. A budget isn’t a restrictive cage; it’s a strategic blueprint. Start by meticulously tracking all income and expenses for at least a month. Categorize everything, from housing and utilities to entertainment and dining out. Tools, apps, or even a simple spreadsheet can help illuminate your spending patterns. This diagnostic phase reveals hidden money leaks and areas ripe for optimization.

Once you have a clear picture, create a forward-looking budget. Allocate specific amounts to essential categories and, crucially, to savings and investments. The ‘pay yourself first’ mantra is paramount here; treat your future self as your most important creditor. For aggressive growth, aim to push your savings rate as high as possible, ideally beyond the typical 10-15% mark, perhaps into the 30-50% range by making strategic cuts elsewhere.

Ruthless Expense Elimination: Cutting the Fat for Faster Growth

With your budget in hand, it’s time to identify and eliminate non-essential spending. This often requires a critical look at lifestyle choices. Are there subscriptions you don’t use? Can you reduce dining out frequency? Explore cheaper alternatives for daily coffees, lunches, or even entertainment. Consider renegotiating recurring bills like insurance, internet, or phone plans. Even small, consistent savings accumulate rapidly when redirected towards high-growth investments.

Question every discretionary expense: Does this purchase genuinely align with my long-term financial goals, or is it merely instant gratification? This mindset shift transforms spending from an automatic habit into a conscious decision, empowering you to divert more capital towards wealth-building assets.

Strategic Debt Annihilation: Freeing Capital for Investment

High-interest debt (like credit card balances or personal loans) is a growth killer. The interest payments erode your ability to save and invest effectively. For aggressive financial growth, prioritizing the elimination of consumer debt is non-negotiable. Employ strategies like the debt snowball or debt avalanche method to systematically pay off balances. The money freed up from debt payments can then be immediately redirected into your investment portfolio, acting as an accelerant for your growth.

Consider consolidating debt to lower interest rates if appropriate, but always with a clear plan for rapid repayment. The psychological and financial liberation from debt provides a powerful boost to your overall financial momentum.

Automate Savings and Aggressive Investing: Your Growth Engine

Once you’ve optimized spending and managed debt, the real work of aggressive growth begins: consistently saving and investing. Automate your savings by setting up regular transfers from your checking to your savings and investment accounts immediately after payday. This removes the temptation to spend the money.

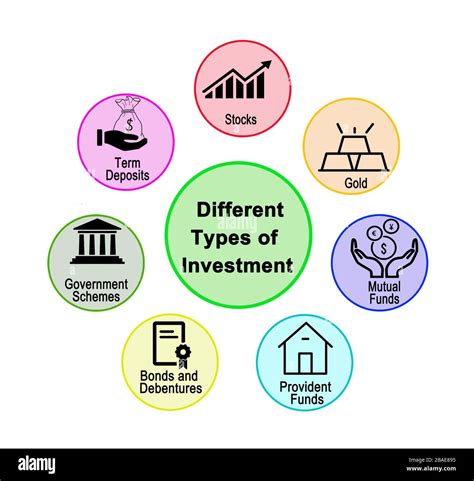

Focus on aggressive investment strategies that align with your risk tolerance and time horizon. This might include diversified portfolios of stocks, index funds, ETFs, or real estate. Learn about dollar-cost averaging and consistently contribute, regardless of market fluctuations. The power of compound interest is your greatest ally; the more you save and invest early, the more time your money has to grow exponentially.

Mastering Lifestyle Inflation: Staying Lean for Long-Term Gains

As your income grows, it’s natural for lifestyle costs to creep up. This phenomenon, known as lifestyle inflation, is a silent killer of aggressive financial growth. To counteract it, commit to maintaining a relatively lean lifestyle even as your earnings increase. Instead of upgrading every aspect of your life proportionally to your raises, divert a significant portion (e.g., 50-70%) of any new income towards savings and investments.

Celebrate successes, but do so wisely. A conscious effort to avoid keeping up with the Joneses and focusing on experiences over material possessions can significantly enhance your ability to accumulate wealth rapidly. This disciplined approach ensures that your financial growth outpaces your lifestyle expenses, creating a widening gap that fuels your investment goals.

Conclusion: Your Path to Financial Domination

Optimizing spending for aggressive financial growth for men is a journey of discipline, intentionality, and strategic execution. It demands a clear understanding of your current financial state, a ruthless commitment to eliminating wasteful expenses, a focused effort to annihilate debt, and a consistent habit of aggressive saving and investing. By mastering these principles and actively resisting lifestyle creep, you can transform your financial trajectory from gradual progress to rapid, substantial wealth accumulation, ultimately achieving true financial independence and freedom.