Achieving early financial freedom is a goal many aspire to, offering the liberation to pursue passions, spend more time with loved ones, or simply have control over one’s time. For men, this journey often involves a dual focus: aggressively optimizing income and intelligently deploying capital through wise investments. This comprehensive guide outlines the pathways to building significant wealth and securing an early exit from the traditional work grind.

Strategies for Optimizing Income

The first pillar of early financial freedom is a robust income stream. Merely working harder isn’t enough; working smarter and strategically increasing your earning potential is key. This involves a multi-faceted approach to maximizing your current and future income.

Skill Development and Career Advancement: Invest in yourself by acquiring high-demand skills. This could mean pursuing further education, certifications, or specialized training relevant to your industry or a new, more lucrative field. Regularly assess market trends to ensure your skills remain valuable. Proactively seek out opportunities for promotion within your current role, demonstrating leadership and a clear impact on the company’s bottom line. Don’t shy away from negotiating your salary and benefits aggressively, armed with data about your market value.

Building Multiple Income Streams: Relying solely on a single paycheck can be precarious. Explore side hustles that leverage your existing skills or develop new ones. This could range from freelancing, consulting, or starting a small online business to investing in passive income generators like rental properties or dividend stocks. Diversifying your income sources not only boosts your overall earnings but also provides a safety net against job loss or economic downturns.

Mastering Wise Investment Strategies

Optimizing income is only half the battle; the other half is making your money work for you. Smart investing is the engine that drives your wealth accumulation, transforming your savings into significant assets over time.

Budgeting, Saving, and Debt Management: Before investing, ensure your financial foundation is solid. Create a detailed budget to track where your money goes and identify areas for saving. Prioritize building an emergency fund covering 3-6 months of living expenses. Aggressively pay down high-interest debt, such as credit card balances, as the interest rates often outweigh potential investment returns. A clear financial picture allows you to allocate more funds towards investments.

Understanding Risk Tolerance and Diversification: Your investment strategy should align with your risk tolerance and time horizon. Younger investors with a longer time horizon might opt for more aggressive growth investments (e.g., stocks, index funds), while those closer to their goal might prefer a more balanced approach. Diversification across different asset classes (stocks, bonds, real estate, commodities) and geographies is crucial to mitigate risk. Never put all your eggs in one basket.

Long-Term Growth Vehicles: Focus on investments that offer compound interest, where your earnings also start earning returns. Historically, the stock market, particularly through low-cost index funds and ETFs, has provided robust long-term growth. Consider real estate for potential appreciation and rental income. Utilize tax-advantaged accounts like 401(k)s, IRAs, and HSAs to maximize your investment growth by reducing your tax burden.

Accelerating Towards Early Financial Freedom

With optimized income and wise investments in play, the final push involves specific actions to speed up your journey to early financial independence.

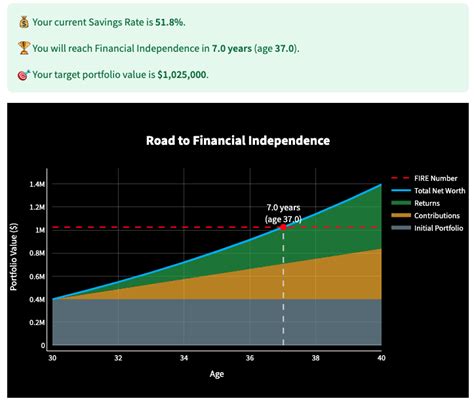

Maintaining a High Savings Rate: The most powerful lever for early financial freedom is your savings rate. Aim to save and invest a significant portion of your income—ideally 25% or more. The higher your savings rate, the faster your investment portfolio will grow to cover your living expenses, enabling you to become financially independent sooner.

Continuous Financial Education: The financial landscape is constantly evolving. Commit to lifelong learning about personal finance, investment strategies, and economic trends. Read books, follow reputable financial advisors, and stay informed. Understanding market dynamics and tax laws can help you make more informed decisions and adapt your strategy as needed.

Mindset and Discipline: Achieving early financial freedom requires immense discipline, patience, and a strong mindset. There will be market fluctuations, temptations to spend, and moments of doubt. Staying committed to your long-term goals, avoiding lifestyle inflation, and maintaining a positive outlook are essential to navigating the challenges and celebrating the milestones.

Conclusion

For men aiming for early financial freedom, the path is clear: optimize your income streams through continuous self-improvement and diversification, then invest that income wisely with a long-term, diversified strategy. Combine this with a high savings rate and an unwavering commitment, and you can significantly accelerate your timeline to financial independence. It’s not just about accumulating wealth; it’s about gaining the freedom to live life on your own terms, pursue your deepest desires, and build a legacy.