For many men, the journey to financial stability and prosperity can feel like an uphill battle. With societal pressures, career demands, and the desire to provide, it’s easy to fall into debt or miss opportunities for wealth creation. However, with a smart, structured approach to finance, men can not only crush existing debt but also build substantial, lasting wealth. This guide will outline actionable strategies to empower you on your financial journey.

Mastering Your Money: The First Steps

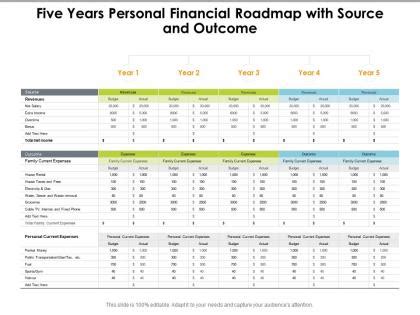

Before you can tackle debt or invest, you need a clear picture of your current financial situation. This foundational step is often overlooked but is crucial for effective planning.

- Create a Detailed Budget: Track every dollar coming in and going out. Use apps, spreadsheets, or even pen and paper. Categorize your expenses to identify areas where you can cut back. The goal isn’t deprivation, but conscious spending aligned with your values.

- Understand Your Net Worth: Calculate your assets (savings, investments, property value) minus your liabilities (debts). This number provides a snapshot of your financial health and a benchmark for growth. Regular net worth checks motivate progress.

- Automate Savings: Set up automatic transfers from your checking to your savings or investment accounts each payday. Even small, consistent contributions add up significantly over time. Pay yourself first.

Strategic Debt Elimination: Your Path to Freedom

Debt can feel like a heavy anchor, preventing you from moving forward. A strategic approach is key to eliminating it efficiently.

- Prioritize High-Interest Debt: Focus on debts with the highest interest rates first (credit cards, personal loans). The ‘debt avalanche’ method saves you the most money in interest over time.

- Consider the Debt Snowball: If motivation is an issue, the ‘debt snowball’ method can be powerful. Pay off your smallest debt first for a quick win, then roll that payment into the next smallest. This builds momentum and keeps you engaged.

- Explore Consolidation/Refinancing: For high-interest debts, look into consolidating them into a single loan with a lower interest rate, or refinancing personal loans/mortgages if beneficial. Be cautious not to extend the repayment period unnecessarily.

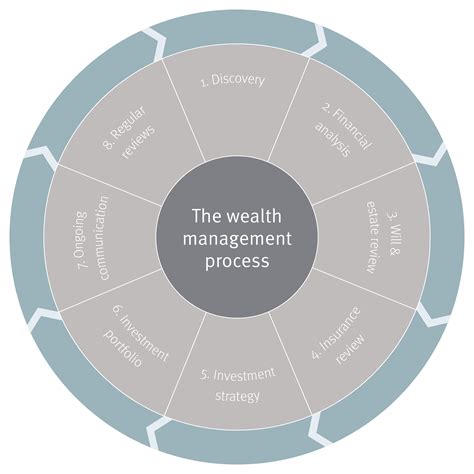

Building a Fortress: Growing Lasting Wealth

Once debt is under control, the focus shifts to building assets that work for you.

1. The Emergency Fund: Your Financial Shield

Before investing, establish an emergency fund with 3-6 months’ worth of essential living expenses in an easily accessible, high-yield savings account. This fund protects you from unexpected job loss, medical emergencies, or car repairs without derailing your financial progress.

2. Retirement Accounts: Long-Term Growth

Take advantage of tax-advantaged retirement accounts. If your employer offers a 401(k) or similar plan, contribute at least enough to get the full company match – it’s free money! Supplement this with a Roth IRA or Traditional IRA, depending on your income and tax situation.

3. Diversified Investments: Spreading Your Bets

Beyond retirement, invest in a diversified portfolio. This typically includes a mix of stocks (through low-cost index funds or ETFs), bonds, and potentially real estate. Diversification minimizes risk and maximizes long-term returns. Consider working with a fee-only financial advisor if you need personalized guidance.

4. Real Estate and Side Hustles: Accelerating Wealth

For those looking to accelerate wealth, consider real estate investing (rental properties, REITs) or starting a profitable side hustle. These avenues can provide additional income streams and build equity outside of traditional investments.

Cultivating the Right Mindset: Discipline and Vision

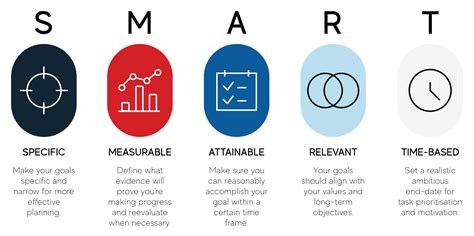

Smart finance isn’t just about numbers; it’s about habits and mindset. Cultivate financial discipline and maintain a long-term vision.

- Avoid Lifestyle Inflation: As your income grows, resist the urge to immediately increase your spending. Instead, direct a significant portion of raises and bonuses towards savings and investments.

- Continuous Learning: The financial landscape is always evolving. Stay informed about personal finance, investing, and economic trends. Read books, listen to podcasts, and follow reputable financial news sources.

- Stay Patient and Consistent: Building wealth is a marathon, not a sprint. There will be market fluctuations and unexpected challenges. Stick to your plan, stay consistent with your contributions, and trust the process of compounding.

Conclusion: Your Journey to Financial Empowerment

Effectively using smart finance to crush debt and grow lasting wealth is an achievable goal for any man committed to the process. It requires a combination of strategic planning, disciplined execution, and a forward-thinking mindset. By mastering your budget, aggressively tackling debt, and consistently investing in your future, you can build a robust financial foundation that provides security, freedom, and the ability to achieve your biggest life goals. Start today, stay consistent, and watch your financial future transform.