For many men, credit card debt isn’t just a financial burden; it’s a silent stressor that impacts everything from relationships to career focus. The dream of financial freedom – having choices, security, and peace of mind – often feels miles away when high-interest balances loom. But it doesn’t have to be. Crushing credit card debt and accelerating your path to financial freedom is entirely achievable with the right strategy, discipline, and a clear understanding of the game plan.

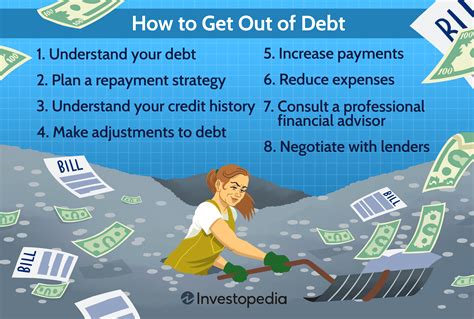

Understand the Enemy: Your Credit Card Debt

Before you can defeat credit card debt, you need to understand its nature. High interest rates are the primary culprit, causing your minimum payments to barely chip away at the principal. This perpetuates a cycle where you’re constantly paying for past purchases, limiting your ability to save, invest, or spend on things that truly matter today. Recognizing this compounding effect is the first step towards breaking free.

Start by compiling a complete list of all your credit cards, their outstanding balances, interest rates (APR), and minimum payments. This inventory gives you a clear picture of the battlefield.

Forge Your Financial Budgeting Shield

A robust budget is your most powerful tool. Many men shy away from budgeting, perceiving it as restrictive, but it’s actually empowering. It gives you control, shows you exactly where your money is going, and highlights areas where you can trim expenses to free up cash for debt repayment.

Categorize every dollar you spend for a month or two. Use apps, spreadsheets, or even a simple notebook. Identify essential expenses (housing, food, utilities) versus discretionary ones (eating out, entertainment, subscriptions). Be honest with yourself about what can be reduced or eliminated entirely, even temporarily, to funnel more money towards debt.

Implement a Strategic Debt Attack Plan

With your budget in hand, it’s time to choose your offensive strategy against debt. Two popular and effective methods are the Debt Avalanche and the Debt Snowball:

- Debt Avalanche: Focus on paying off the credit card with the highest interest rate first, while making minimum payments on all others. Once that card is paid off, take the money you were paying on it and apply it to the next highest interest rate card. This method saves you the most money in interest over time.

- Debt Snowball: Prioritize paying off the credit card with the smallest balance first, regardless of interest rate. Once that card is clear, take the money you were paying on it and add it to the payment for the next smallest balance. This method provides psychological wins and momentum, which can be crucial for staying motivated.

Consider balance transfers to 0% APR cards if you have good credit. This can give you a window of 12-18 months to pay down a significant portion of your debt without incurring interest, but be wary of transfer fees and ensure you can pay it off before the introductory period ends.

Amplify Your Income & Automate Your Future

While cutting expenses is vital, increasing your income accelerates the process significantly. Look for opportunities:

- Side Hustles: Whether it’s freelancing, driving for a ride-share, delivering food, or selling items online, extra income directly applied to debt makes a huge difference.

- Negotiate Your Salary: If you’re due for a review, prepare to negotiate for a raise.

- Sell Unused Assets: Declutter your home and sell items you no longer need – old electronics, furniture, tools.

Once you have a plan, automate your payments. Set up automatic transfers from your checking account to your credit card payments (beyond the minimum). This ensures consistency and reduces the chance of missing payments, which incur fees and hurt your credit score.

Build an Emergency Fund & Rebuild Credit

Even while aggressively paying off debt, building a small emergency fund (e.g., $1,000) is critical. This acts as a buffer against unexpected expenses, preventing you from piling new debt onto your cleared cards if an emergency arises. Once debt is gone, expand this fund to 3-6 months of living expenses.

As you pay down debt, your credit score will naturally improve. Continue to use credit responsibly – make small purchases and pay them off in full each month – to maintain a positive payment history and low credit utilization, further enhancing your score.

Master Your Mindset: Consistency and Long-Term Vision

Achieving financial freedom isn’t just about numbers; it’s about developing a resilient mindset. Set clear, measurable goals. Track your progress weekly or monthly to see the impact of your efforts. Celebrate small victories to maintain momentum. Understand that setbacks may occur, but they are not reasons to give up.

Surround yourself with positive influences and consider seeking advice from a financial advisor for personalized strategies. The journey to financial freedom is a marathon, not a sprint, but every consistent step forward brings you closer to a life of options, security, and true independence.

Crushing credit card debt and building a foundation for financial freedom requires commitment, strategy, and consistent action. By understanding your debt, budgeting rigorously, implementing a strategic repayment plan, boosting your income, and fostering a strong financial mindset, you can accelerate your journey. Take control today, and unlock the doors to a financially free future.