In a world of increasing expenses and often stagnant wages, many men find themselves caught in a cycle of living paycheck to paycheck. The idea of building a robust emergency fund or investing for long-term wealth can feel like a distant dream, especially when money is tight. However, financial security isn’t exclusive to the affluent. With strategic planning, discipline, and a few smart adjustments, every man can lay a solid foundation for financial resilience and growth, regardless of his current income level.

Why Financial Security is a Must-Have, Not a Nice-to-Have

Life is unpredictable. A sudden job loss, unexpected medical bill, or car repair can quickly derail financial stability, pushing individuals into debt. For men, who often shoulder significant family responsibilities or aspire to future independence, having a safety net and a path to wealth building isn’t just about personal comfort—it’s about providing security and opportunities. Proactive financial management reduces stress, offers freedom, and opens doors to future aspirations, from homeownership to early retirement.

Step 1: The Non-Negotiable Emergency Fund

Before any investment, an emergency fund is paramount. Think of it as your financial shock absorber. This fund should ideally cover 3 to 6 months of essential living expenses. For those on a tight budget, even starting with $1,000 is a significant first step, often referred to as a “starter” or “mini” emergency fund. The goal is to separate these funds from your everyday spending, placing them in an easily accessible, high-yield savings account where they can grow slightly without risk.

Strategies for Building Your Emergency Fund:

- Automate Savings: Set up an automatic transfer of a small amount (e.g., $25-$50) from your checking account to your emergency fund every payday. You won’t miss what you don’t see.

- Cut Unnecessary Expenses: Review your budget meticulously. Can you trim subscriptions, eat out less, or find cheaper alternatives for daily necessities? Every dollar saved is a dollar earned for your fund.

- Windfalls Go Towards Savings: Any unexpected income, like a bonus, tax refund, or gift, should be largely directed towards your emergency fund until it reaches its target.

- Side Hustles: Even a few hours a week on a side gig can significantly accelerate your emergency fund accumulation.

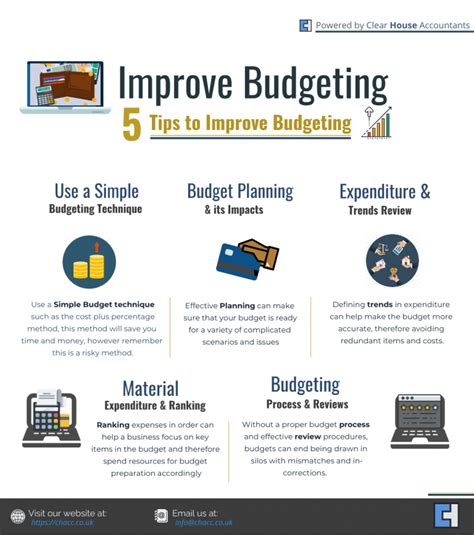

Step 2: Master Your Budget – Finding Hidden Cash

A budget isn’t about restriction; it’s about control and awareness. Many people believe they don’t have enough money to save or invest, but often, a detailed look at their spending habits reveals opportunities. Budgeting helps you understand where every dollar goes and empowers you to redirect funds towards your financial goals.

Practical Budgeting Tips:

- Track Everything: For a month, track every single expense. Use an app, a spreadsheet, or a notebook. This step is eye-opening.

- Categorize and Analyze: Group your expenses (housing, food, transport, entertainment). Where can you realistically cut back without sacrificing your quality of life too much?

- The 50/30/20 Rule: A popular guideline suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. Adjust this as necessary for your situation.

- Meal Prep & DIY: Cooking at home, making your coffee, and tackling small repairs yourself can save hundreds monthly.

Step 3: Investing for Wealth, Even with Pennies

Once your emergency fund has a decent buffer, it’s time to start investing. The biggest misconception is that you need a lot of money to begin. The truth is, the earlier you start, the more powerful compound interest becomes.

Smart Investing Strategies for Tight Budgets:

- Start Small with Micro-Investing Apps: Apps like Acorns, Robinhood, or Fidelity Go allow you to invest small amounts, often as little as $5, or round up your spare change from purchases.

- Fractional Shares: Many brokerages now allow you to buy fractions of expensive stocks, meaning you can own a piece of a high-value company without buying a full share.

- Low-Cost Index Funds & ETFs: These are ideal for beginners. They offer diversification across many companies with a single investment and typically have very low fees. Vanguard and Fidelity offer excellent options.

- Employer-Sponsored Retirement Plans (401k/403b): If your employer offers a match, contribute at least enough to get the full match. It’s essentially free money and an immediate 100% return on your investment.

- Roth IRA: Contribute what you can, even if it’s just $50 a month. Your contributions grow tax-free, and qualified withdrawals in retirement are also tax-free.

Step 4: Consistency, Patience, and Continuous Learning

Building wealth is a marathon, not a sprint. There will be market fluctuations, and some months might be harder than others to stick to your plan. The key is consistency and patience.

- Automate Investments: Just like savings, set up automatic transfers to your investment accounts. “Set it and forget it” for long-term growth.

- Regular Reviews: Annually, review your budget, emergency fund status, and investment portfolio. Adjust as your income or life circumstances change.

- Educate Yourself: Continuously learn about personal finance and investing. The more you understand, the more confident you’ll become in making informed decisions.

- Avoid Lifestyle Creep: As your income potentially grows, resist the urge to immediately upgrade your lifestyle proportionally. Instead, increase your savings and investments.

Building an emergency fund and investing for wealth, even on a tight budget, is entirely achievable. It requires discipline, a willingness to make smart choices, and a long-term perspective. By prioritizing your emergency fund, mastering your budget, and starting to invest small amounts consistently, you can transform your financial future from a struggle into a journey of security and prosperity. Your future self will thank you for taking these crucial steps today.