Navigating the financial landscape as a man often involves a delicate balancing act: building a safety net for the unexpected while simultaneously shedding the burden of debt. Both are crucial for long-term financial security and peace of mind, yet they often feel like competing priorities. The good news is that with a strategic approach, it’s entirely possible to make significant progress on both fronts, setting yourself up for a stronger financial future.

The Dual Challenge: Why Both Matter

An emergency fund acts as your financial shield, protecting you from life’s curveballs – a sudden job loss, unexpected medical expenses, or a major car repair. Without it, these events often lead to more debt. Debt, on the other hand, can be a heavy anchor, limiting your financial freedom and costing you significant interest over time. The goal isn’t to choose one over the other, but to integrate them into a cohesive financial strategy.

Prioritizing Your First Steps: The Mini-Fund

The conventional wisdom often suggests building a small “starter” emergency fund (e.g., $1,000-$2,000) before aggressively tackling high-interest debt. This mini-fund provides immediate psychological relief and a buffer against minor emergencies, preventing new debt from forming. Once this initial cushion is in place, you can then pivot your focus more intensely towards debt repayment.

Crafting Your Financial Blueprint: A Step-by-Step Guide

Achieving your dual goals requires a clear, actionable plan. Here’s how to build that blueprint:

1. Audit Your Finances Ruthlessly

Before you can make changes, you need to understand where every dollar goes. Track all your income and expenses for at least a month. Use budgeting apps, spreadsheets, or even a pen and paper. Identify non-essential spending that can be cut or reduced. This audit is the foundation for freeing up cash.

2. Establish Your Mini Emergency Fund

Prioritize saving your initial $1,000 to $2,000. Treat this as non-negotiable. Cut back on discretionary spending, eat out less, cancel unused subscriptions, or pick up extra shifts. This money should be easily accessible but separate from your checking account, ideally in a high-yield savings account.

3. Attack High-Interest Debt Aggressively

Once your mini-fund is secure, shift your focus. High-interest debt (like credit card debt or personal loans) is the most destructive. Consider these strategies:

- Debt Avalanche: Pay off debts with the highest interest rates first, while making minimum payments on others. This saves you the most money in the long run.

- Debt Snowball: Pay off the smallest debt first to gain psychological momentum, then roll that payment into the next smallest debt. This can be highly motivating.

Allocate any extra funds you find from budgeting or increased income towards this debt. Every extra dollar paid reduces your principal and saves on future interest.

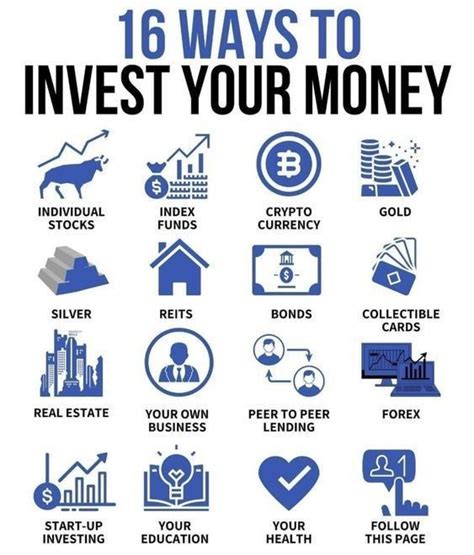

4. Boost Your Income and Cut Expenses Further

To accelerate your progress, look beyond just cutting current spending. Can you:

- Take on a side hustle (freelancing, gig work, consulting)?

- Negotiate a raise at your current job?

- Sell unused items around your house?

- Refinance high-interest debt to a lower rate (if your credit score allows)?

- Drastically reduce housing or transportation costs?

Every additional dollar earned or saved is a dollar that can go towards your emergency fund or debt repayment.

5. Automate for Success

Set up automatic transfers from your checking account to your emergency fund and automatic payments for your debts. This removes the temptation to spend the money and ensures consistent progress. “Set it and forget it” allows you to build habits without constant manual effort.

Maintaining Momentum and Mindset

This journey isn’t a sprint; it’s a marathon. Stay motivated by tracking your progress regularly. Celebrate milestones, no matter how small – paying off a credit card, reaching your mini-fund goal, or hitting a certain debt-free percentage. Educate yourself continuously on personal finance to make informed decisions. Surround yourself with a supportive community or accountability partner if possible.

Building a strong emergency fund and aggressively paying down debt simultaneously is a testament to discipline and strategic planning. By prioritizing a foundational safety net, systematically attacking high-interest obligations, and maximizing your financial resources, you can quickly move towards a more secure and prosperous future. The effort you put in today will pay dividends for years to come, offering unparalleled financial freedom and peace of mind.