The Dual Challenge: Security and Growth

For men navigating today’s financial landscape, the quest for security often clashes with the ambition for growth. Building a robust emergency fund is a non-negotiable step towards financial resilience, yet the desire to invest for long-term goals – be it retirement, a down payment, or a business venture – is equally powerful. The good news is that these two critical objectives are not mutually exclusive. With a strategic approach, men can effectively manage both, ensuring a safety net for life’s unexpected turns while steadily building wealth for the future.

Why a Robust Emergency Fund Isn’t Just ‘Nice to Have’

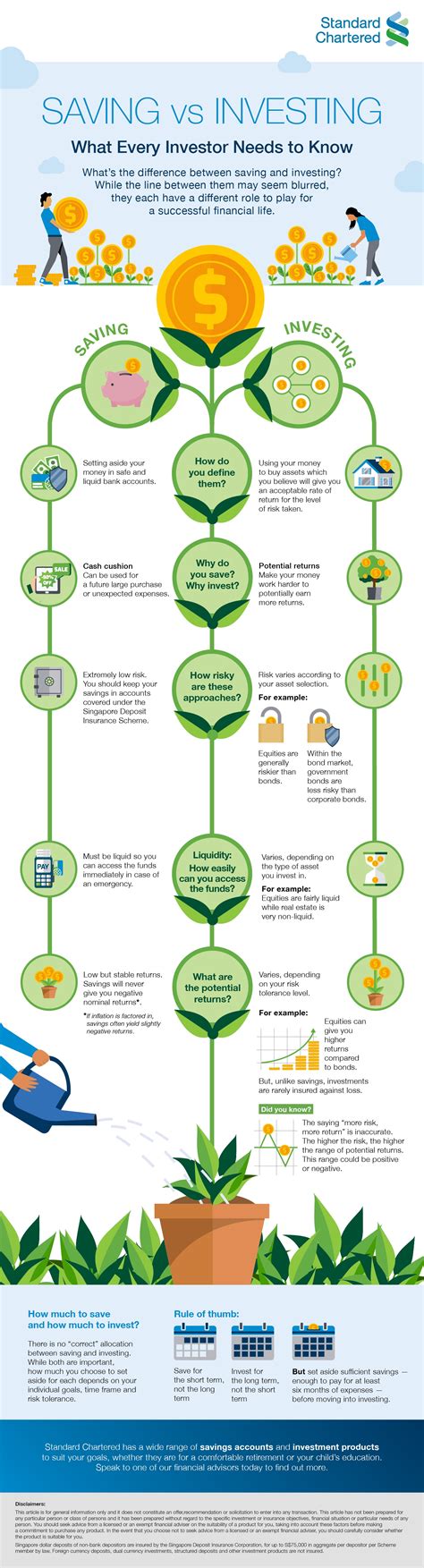

An emergency fund acts as your personal financial shock absorber. It’s a dedicated pool of easily accessible cash designed to cover essential living expenses in the event of job loss, medical emergencies, unexpected home repairs, or other unforeseen circumstances. Without it, such events can force you into high-interest debt, derail investment plans, or even lead to asset liquidation – undoing years of hard work.

The Foundation of Financial Stability

For men, who often carry significant financial responsibilities for families or businesses, this fund is paramount. It provides peace of mind, reduces stress, and allows you to make rational decisions during crises, rather than desperate ones. It’s the bedrock upon which all other financial goals are built.

How Much is Enough? Tailoring Your Emergency Cushion

The standard recommendation is to save 3-6 months’ worth of essential living expenses. However, this figure can vary based on individual circumstances:

- Job Security: If your job is stable and in high demand, 3 months might suffice. If it’s volatile or contract-based, aim for 6-12 months.

- Dependents: With a family, a larger fund offers more protection.

- Health: If you or your family have ongoing health issues, a larger buffer for medical expenses is wise.

- Other Debts: If you have significant non-mortgage debt, a larger emergency fund can prevent you from accumulating more.

Calculate your monthly essential expenses (rent/mortgage, utilities, groceries, transportation, insurance, minimum debt payments) and multiply by your target number of months.

Building Your Emergency Fund: Practical Steps

1. Automate Your Savings

The easiest way to build your fund is to make it automatic. Set up a recurring transfer from your checking account to a separate, high-yield savings account (one that’s not linked to your daily spending) on payday. Treat this transfer like a non-negotiable bill.

2. Trim the Fat: Expense Reduction

Review your budget and identify areas where you can cut back, even temporarily. Can you reduce subscriptions, dine out less, or find cheaper alternatives for services? Redirect these saved funds directly to your emergency account.

3. Boost Your Income

Consider a side hustle, freelance work, or selling unused items. Dedicate all extra income generated from these activities solely to your emergency fund until it reaches your target.

The Art of Balancing: Emergency Fund vs. Investing

Once you’ve made progress on your emergency fund, the balancing act truly begins. The key is to allocate new money efficiently.

1. The “Pay Yourself First” Principle

Before any other expenses, allocate a portion of your income to your emergency fund (if not yet complete) and another portion to your investments. A common guideline is the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment. You can adapt this, perhaps dedicating the ‘savings’ portion initially heavily to the emergency fund, and then shifting more to investments once the fund is robust.

2. Prioritize High-Interest Debt

While building an emergency fund is critical, aggressively paying down high-interest debt (like credit card debt) can be more financially beneficial than investing, especially if the interest rate on the debt exceeds your potential investment returns. A common strategy is to build a smaller, foundational emergency fund (e.g., $1,000-$2,000), then attack high-interest debt, and then resume building the full emergency fund while also investing.

Smart Investing for Future Growth

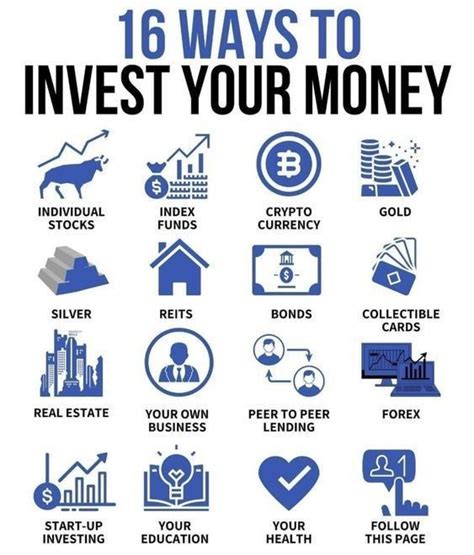

With your emergency fund established, you can confidently direct more capital towards investment vehicles that align with your long-term goals and risk tolerance.

1. Utilize Tax-Advantaged Accounts

Maximize contributions to accounts like 401(k)s, IRAs (Roth or Traditional), and HSAs. These offer significant tax benefits that can accelerate your wealth growth.

2. Diversification and Risk Management

Invest in a diversified portfolio of stocks, bonds, and potentially real estate or other assets. Don’t put all your eggs in one basket. Adjust your asset allocation based on your age, risk tolerance, and time horizon.

3. Long-Term Vision

Investing is a marathon, not a sprint. Avoid reacting to short-term market fluctuations. Stay consistent with your contributions and stick to your long-term plan. Compounding interest is your most powerful ally.

Maintaining Momentum and Reviewing Your Progress

Financial planning isn’t a one-time event. Regularly review your emergency fund balance to ensure it still meets your needs (especially if your expenses or responsibilities change). Rebalance your investment portfolio periodically to maintain your desired risk level. As your income grows, consider increasing both your emergency fund contributions and your investment allocations.

Conclusion: A Path to Financial Resilience

Building a robust emergency fund while simultaneously investing for future goals requires discipline, strategy, and patience. By prioritizing your emergency savings as the foundation, strategically balancing new funds, and committing to long-term investment, men can achieve both immediate financial security and substantial wealth growth. This dual approach not only fortifies your financial position against life’s uncertainties but also empowers you to confidently pursue your most ambitious future aspirations.