The Dual Challenge: Fitness Aspirations Meets Financial Security

Many men juggle the desire for peak physical condition with the critical need to build a stable financial future. Balancing gym memberships, healthy eating, and potential investment opportunities can feel overwhelming. This guide offers practical strategies to smartly budget, enabling you to crush your fitness goals without compromising your long-term financial security.

Laying the Financial Foundation

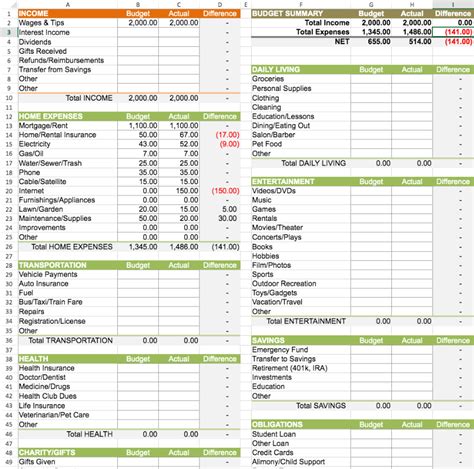

The first step toward achieving any financial goal is understanding your current financial landscape. This means knowing exactly where your money comes from and, more importantly, where it goes. Start by tracking all your income and expenses for a month or two. Use an app, a spreadsheet, or even a simple notebook to categorize your spending into areas like housing, transport, food, entertainment, and, of course, fitness.

Once you have a clear picture, you can create a realistic budget. Allocate specific amounts to each category, ensuring you’re prioritizing your needs over wants. The goal isn’t to restrict yourself entirely, but to gain control and make conscious decisions about your spending.

Equally important is setting clear, SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals for both your fitness journey and your financial future. Do you want to save for a home gym by next year? Or contribute an extra $100 to your retirement fund monthly? Having defined targets makes budgeting more purposeful.

Optimizing Your Fitness Budget

Fitness doesn’t have to break the bank. Many men fall into the trap of believing that expensive gym memberships, personal trainers, or a plethora of supplements are essential. While these can be beneficial, there are numerous cost-effective ways to stay in shape.

Consider alternatives: outdoor activities like running, cycling, or hiking require minimal investment. Bodyweight exercises at home, using free online resources, can be incredibly effective. If you prefer a gym, look for off-peak membership deals, consider local community centers, or investigate used equipment for a home setup. Prioritize which fitness expenses are truly essential for your goals and which are luxuries.

Nutritional spending is another significant area. Meal prepping is a game-changer for saving money and eating healthier. Buying in bulk, focusing on seasonal produce, and planning your meals in advance can drastically reduce your grocery bill while providing the fuel your body needs to perform.

Investing in Your Future Self

While funding your fitness goals is important, neglecting your long-term financial security is a critical mistake. Start by building an emergency fund, ideally 3-6 months’ worth of living expenses, in an easily accessible savings account. This acts as a financial safety net for unexpected events, preventing you from derailing your other goals or going into debt.

Next, tackle any high-interest debt aggressively. Credit card debt, for example, can quickly erode your financial progress. Focus on paying it down using strategies like the debt snowball or avalanche method, freeing up more of your income for savings and investments.

Then, turn your attention to investments. For most men, this means maximizing contributions to retirement accounts like a 401(k) or IRA, especially if your employer offers a matching program – that’s free money you don’t want to miss. Diversify your investments to mitigate risk, and consider consulting a financial advisor to create a plan tailored to your age, risk tolerance, and long-term aspirations. The power of compound interest means that starting early, even with small amounts, can lead to substantial wealth over time.

The Interconnected Path to Success

It’s crucial to recognize that physical health and financial health are deeply interconnected. A healthy lifestyle can lead to fewer medical expenses, increased energy for productivity at work, and potentially a longer, more fulfilling life during which you can enjoy the fruits of your financial planning. Similarly, financial stability reduces stress, which positively impacts your mental and physical well-being.

The discipline required to stick to a fitness regimen – consistency, goal-setting, and delayed gratification – can be directly applied to your financial habits. Viewing your financial future as another muscle to train, requiring regular effort and smart choices, can be a powerful motivator. Regularly review and adjust both your fitness and financial plans as your life circumstances and goals evolve.

Conclusion

Funding your fitness goals while securing your financial future isn’t a zero-sum game. By adopting smart budgeting strategies, prioritizing expenses, and making consistent, informed decisions, men can achieve both physical prowess and financial peace of mind. Start small, stay consistent, and remember that every wise financial choice you make today contributes to a stronger, healthier, and wealthier you tomorrow.