Navigating the Path to Financial Prosperity for Men

In today’s dynamic economic landscape, taking proactive steps to enhance career earnings and optimize investment strategies is crucial for men aiming to build substantial wealth. This guide explores practical approaches to accelerate your professional growth and make your money work harder for you, ensuring a robust financial future.

Boosting Your Career Salary: A Strategic Approach

Your career is arguably your most significant asset. Maximizing its earning potential requires a blend of skill development, strategic networking, and assertive negotiation.

1. Continuous Skill Enhancement and Education

The professional world evolves rapidly. Invest in acquiring new, in-demand skills and staying abreast of industry trends. This could involve certifications, advanced degrees, workshops, or even self-taught expertise in emerging technologies. Demonstrating a commitment to learning makes you indispensable and justifies higher compensation.

2. Strategic Networking and Mentorship

Building a robust professional network opens doors to new opportunities, insights, and potential advancements. Seek out mentors who can guide your career path and provide valuable advice. Reciprocate by offering your expertise where possible, fostering a mutually beneficial relationship.

3. Mastering Salary and Promotion Negotiations

Many men undervalue their worth. Research industry benchmarks for your role and experience level. When negotiating salary or a promotion, articulate your value proposition clearly, highlighting achievements and contributions. Practice negotiation techniques to approach these discussions with confidence and achieve the compensation you deserve.

Optimizing Investments for Long-Term Wealth Accumulation

Earning more is only half the battle; the other half is making that money grow through smart investment choices. A well-planned investment strategy is the cornerstone of long-term wealth.

1. Establish Clear Financial Goals and a Budget

Before investing, define what you’re saving for (retirement, house, child’s education) and create a realistic budget. Understanding your cash flow allows you to identify funds available for consistent investing and ensures you live within your means.

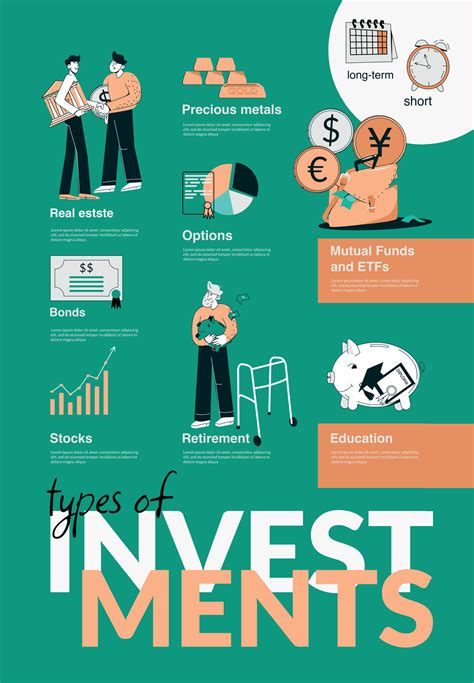

2. Diversify Your Investment Portfolio

Don’t put all your eggs in one basket. Diversification across various asset classes (stocks, bonds, real estate, commodities) and geographies is key to mitigating risk. Consider low-cost index funds or ETFs for broad market exposure and automatic diversification.

3. Leverage Compounding with Long-Term Investing

Time is an investor’s best friend. Start investing early and consistently. The power of compounding means your earnings generate further earnings, exponentially growing your wealth over decades. Resist the urge to frequently check market fluctuations and maintain a long-term perspective.

4. Prioritize Tax-Efficient Accounts

Utilize tax-advantaged accounts like 401(k)s, IRAs (Roth or Traditional), and HSAs. These vehicles offer significant tax benefits, either allowing your investments to grow tax-deferred or tax-free, substantially boosting your net returns over time. Maximize employer matching contributions—it’s essentially free money.

5. Smart Debt Management

Not all debt is bad, but high-interest consumer debt (credit cards, personal loans) can severely hamper your ability to save and invest. Prioritize paying off high-interest debts before funneling significant amounts into investments. Mortgage debt, conversely, can be a lower-interest, potentially tax-deductible investment in an appreciating asset.

Conclusion: Your Blueprint for Financial Success

Building wealth is a journey that requires continuous effort, strategic decision-making, and discipline. By actively pursuing career growth through skill development and shrewd negotiation, and by consistently implementing diversified, tax-efficient investment strategies, men can significantly boost their earning power and secure a prosperous financial future. Start today, stay informed, and commit to your financial well-being.